Your Guide To Credit Counseling Services вђ Forbes Advisor

Your Guide To Credit Counseling Services вђ Forbes Advisor Consumer credit counseling services are designed to help people get their debt under control. if you're having trouble making and sticking to a budget, or you need advice on how to pay off debt, a. Forbes advisor compared the top credit counseling services on the market today to find the best options for the largest number of consumers. we considered each organization’s variety of services.

How Credit Counseling Can Help You вђ Forbes Advisor Credit report reviews. credit counselors can review your credit reports to help you find errors that might be hurting your score so you can dispute them. they can help you understand what’s. Aura all in one id theft protection. learn more. on aura's website. (or call 855 459 6788 for details) $9 to $25 per month for family plans, if billed annually. 3 bureau monitoring. monthly credit. Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out. Cambridge’s initial counseling sessions are free, and dmp fees will vary based on state of residence. the maximum enrollment fee is $75, and the maximum monthly fee is $50. on average, according.

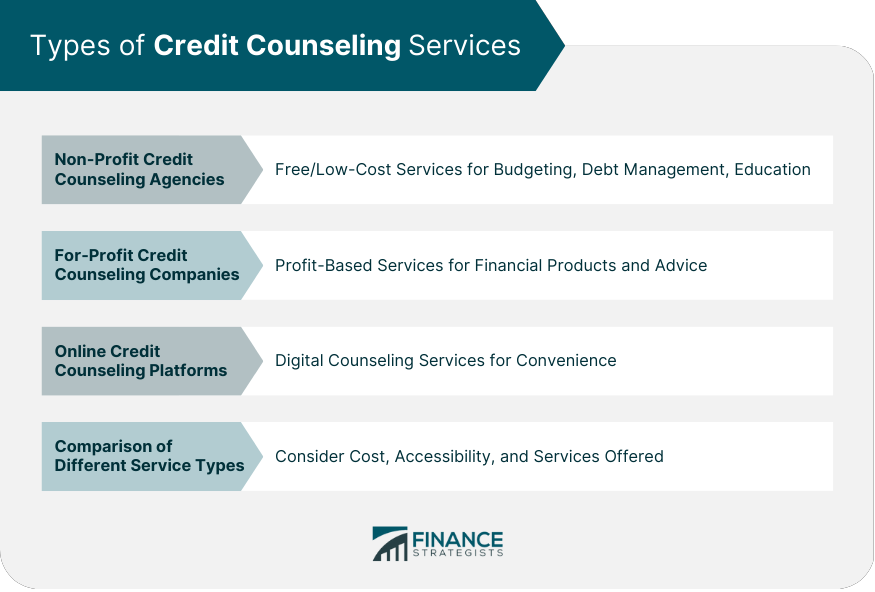

Credit Counseling Meaning Types Process Agency Selection Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out. Cambridge’s initial counseling sessions are free, and dmp fees will vary based on state of residence. the maximum enrollment fee is $75, and the maximum monthly fee is $50. on average, according. The 50 30 20 rule is such a method. the idea is to use 50% of your income for needs, 30% for wants (like dining out or travel) and 20% for savings and debt. if you’re typically paid in cash or. Here are some things to look for. make sure the credit counseling organization is accredited by the national foundation for credit counseling. check with the better business bureau and make sure the organization is in good standing. ultimately, try to find a counselor you feel comfortable with.

Comments are closed.