Whats The Fsa Contribution Limit 2018

2018 Fsa And Hsa Contribution Limits In 2025, you can contribute up to $3,200 to your FSA (though your employer can set the contribution limit lower than this maximum) Your employer can also contribute to your FSA, and these The 2024 maximum FSA contribution limit is $3,200 For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is $640 If you exceed contribution limits

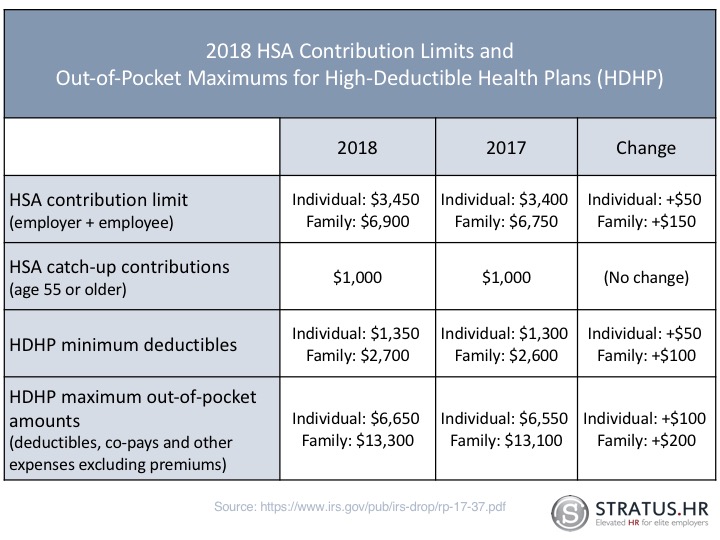

2018 Fsa And Hsa Contribution Limits Annual contribution limits for HSAs are higher than they are for FSA For 2024, the annual contribution limit for an HSA is $4,150 for employee-only plans and $8,300 for family plans Catch-up A 529 plan is a state-sponsored account that offers tax-advantaged savings to cover college, trade and vocational courses and qualified K-12 expenses They can offer financial support because 3 How much can be contributed? The 2024 FSA employee contribution limit is up to $3,200 While 2025 FSA limits have not yet been announced, Mercer is predicting a more than 5% increase to $3,300 As of 2023, individual employees have a 401(k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401(k) account on a pre-tax basis However, for 2024

Irs Announces 2024 Increases To Fsa Contribution Limits Sehp News 3 How much can be contributed? The 2024 FSA employee contribution limit is up to $3,200 While 2025 FSA limits have not yet been announced, Mercer is predicting a more than 5% increase to $3,300 As of 2023, individual employees have a 401(k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401(k) account on a pre-tax basis However, for 2024 In 2024, the FSA contribution limit is $3,200 for a qualified FSA Self-employed people aren't eligible to participate in an FSA FSA accounts can also be used to pay for medical expenses for After that, multiply that quotient by the maximum contribution limit Finally, subtract that product from the maximum contribution limit to get the amount of a reduced Roth IRA contribution you Look closely at this image, stripped of its caption, and join the moderated conversation about what you and other students see By The Learning Network Look closely at this image, stripped of If your spouse's employer offers FSA, he or she may also contribute up to $2,500 annually The maximum allowable contribution per household is $5,000 To be eligible for reimbursement, expenses must

Irs Releases Maximum Contribution Deferral And Compensation Limits For In 2024, the FSA contribution limit is $3,200 for a qualified FSA Self-employed people aren't eligible to participate in an FSA FSA accounts can also be used to pay for medical expenses for After that, multiply that quotient by the maximum contribution limit Finally, subtract that product from the maximum contribution limit to get the amount of a reduced Roth IRA contribution you Look closely at this image, stripped of its caption, and join the moderated conversation about what you and other students see By The Learning Network Look closely at this image, stripped of If your spouse's employer offers FSA, he or she may also contribute up to $2,500 annually The maximum allowable contribution per household is $5,000 To be eligible for reimbursement, expenses must Research shows that blood alcohol levels as low as 02 can affect driving ability—prompting a call to lower the national limit of 08 and save lives Roughly 100 countries around the world set a

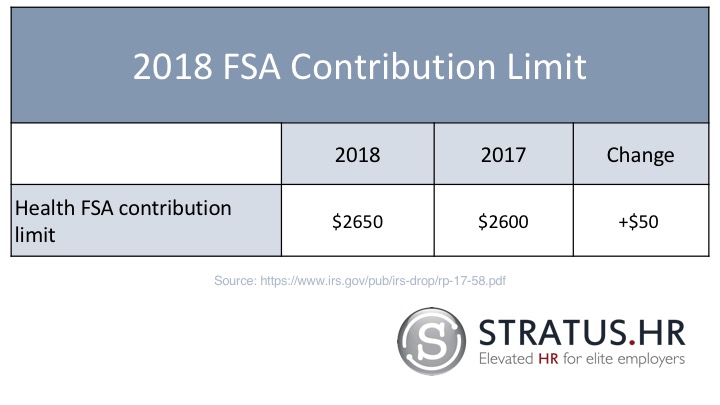

Irs Increases Health Fsa Contribution Limit For 2018 Look closely at this image, stripped of its caption, and join the moderated conversation about what you and other students see By The Learning Network Look closely at this image, stripped of If your spouse's employer offers FSA, he or she may also contribute up to $2,500 annually The maximum allowable contribution per household is $5,000 To be eligible for reimbursement, expenses must Research shows that blood alcohol levels as low as 02 can affect driving ability—prompting a call to lower the national limit of 08 and save lives Roughly 100 countries around the world set a

Comments are closed.