What Potential Whistleblowers Need To Know About The Dodd Frank Act

What Potential Whistleblowers Need To Know About The Dodd Frank Act Protections from retaliation. the dodd frank act prohibits employers from retaliating against whistleblowers, whether by terminating, demoting, suspending, threatening, or otherwise discriminating against the whistleblower. dodd frank protects whistleblowers even if the employer had no knowledge that the employee was the reporting party. Whistleblower program. background: section 922 of the dodd frank wall street reform and consumer protection act provides that the commission shall pay awards to eligible whistleblowers who voluntarily provides the sec with original information that leads to a successful enforcement action yielding monetary sanctions of over $1 million. the.

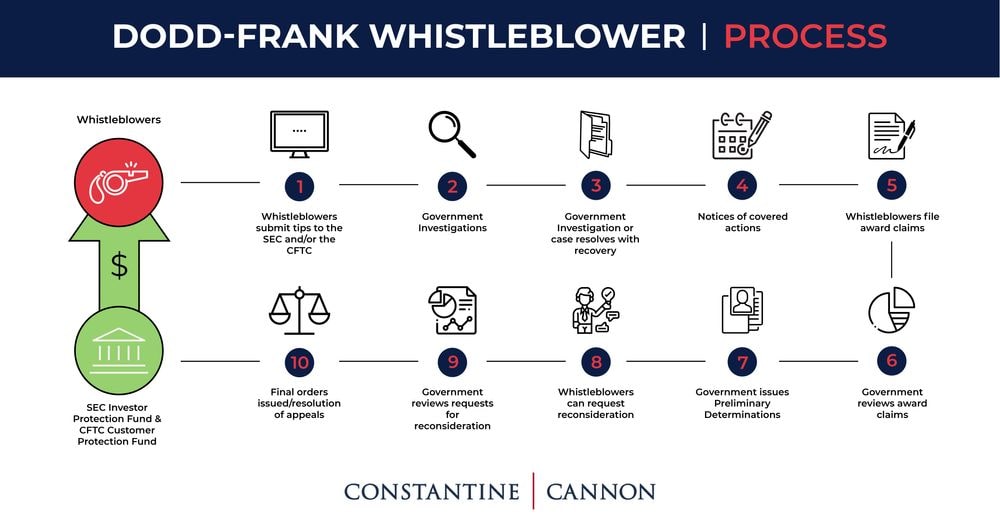

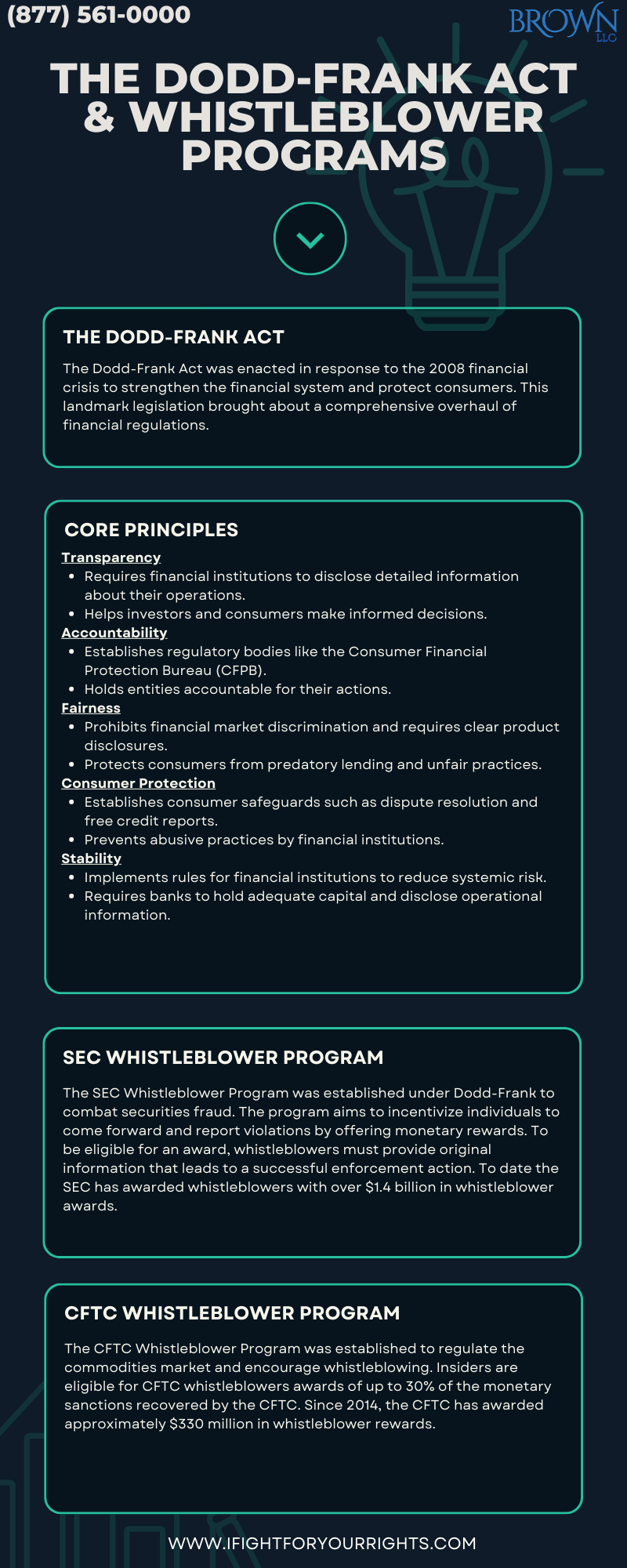

Learn The Dodd Frank Act Sec Cftc Whistleblowers Further, a whistleblower may satisfy independent analysis where: the whistleblower’s conclusion of possible securities violations derives from multiple sources, including sources that, although publicly available, are not readily identified and accessed by a member of the public without specialized knowledge, unusual effort, or substantial. Under the dodd frank act, the sec implemented rules that enabled the agency to take legal action against employers who have retaliated against whistleblowers. additional resources the whistleblower program's statutes and regulations as well as other information a potential whistleblower may need to know. 15 u.s.c. § 78u 6 (b) (1) of the dodd frank act gives the sec the power to give whistleblowers who provide original information that leads to a successful sec enforcement 10% to 30% of the monetary sanctions over $1 million. if the sec sanctions a company individual at least $1 million, the “related action” provisions of the law kick in. Frequently asked questions. the cftc's whistleblower program – which was created by the dodd frank act – allows for the payment of monetary awards to eligible whistleblowers, and provides anti retaliation protections for whistleblowers.*. click on any of the boxes below for answers to frequently asked questions.

Pdf Enhanced Protections For Whistleblowers Under The Dodd Frank Act 15 u.s.c. § 78u 6 (b) (1) of the dodd frank act gives the sec the power to give whistleblowers who provide original information that leads to a successful sec enforcement 10% to 30% of the monetary sanctions over $1 million. if the sec sanctions a company individual at least $1 million, the “related action” provisions of the law kick in. Frequently asked questions. the cftc's whistleblower program – which was created by the dodd frank act – allows for the payment of monetary awards to eligible whistleblowers, and provides anti retaliation protections for whistleblowers.*. click on any of the boxes below for answers to frequently asked questions. That said, the dodd frank act, set up in the wake of the financial crisis of 2008, created the office of the whistleblower to reward and protect individuals who report violations of regulations governing a range of activities in the financial markets and in the activities of us companies doing business abroad. Whistleblower protections. the dodd frank act provides confidentiality protections and prohibits retaliation by employers against whistleblowers who provide the commission with information about possible violations of the commodity exchange act, including those who assist the commission in any investigation or proceeding based on such information.

Dodd Frank Act Robust Protections And Substantial Rewards For That said, the dodd frank act, set up in the wake of the financial crisis of 2008, created the office of the whistleblower to reward and protect individuals who report violations of regulations governing a range of activities in the financial markets and in the activities of us companies doing business abroad. Whistleblower protections. the dodd frank act provides confidentiality protections and prohibits retaliation by employers against whistleblowers who provide the commission with information about possible violations of the commodity exchange act, including those who assist the commission in any investigation or proceeding based on such information.

Comments are closed.