What Is The Dodd Frank Act

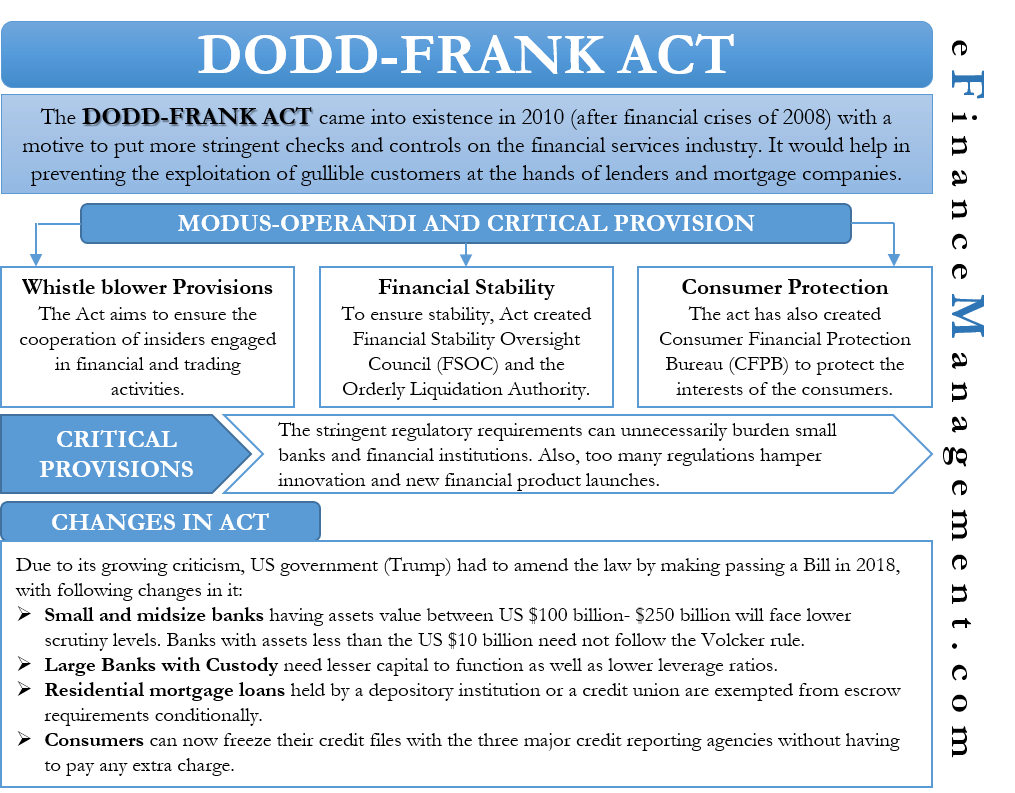

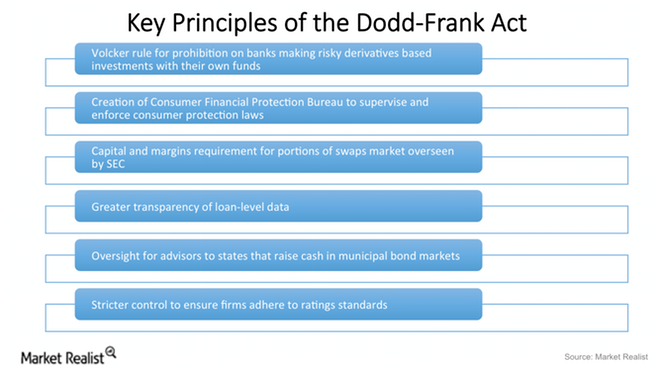

Dodd Frank Act Introduction Key Provisions Shortcomings Changes The dodd frank act is a law that regulates the u.s. financial system to prevent another crisis like the one in 2007–2008. it covers topics such as financial stability, consumer protection, derivatives, and whistleblower rewards. The dodd frank act was a response to the 2008 financial crisis that aimed to regulate and protect the financial industry and consumers. learn about its key provisions, such as the cfpb, the volcker rule, stress tests and more.

What Is The Dodd Frank Act Why Is It Important Thestreet The dodd frank act is a 2010 u.s. law that aimed to prevent another financial crisis like the one in 2008. learn about its origins, main provisions, rollbacks, and impact of the 2023 bank failures. The dodd frank act is a law that regulates the financial industry and protects consumers after the great recession. it was signed by president obama in 2010 and has faced debate and reform ever since. The dodd–frank wall street reform and consumer protection act, commonly referred to as dodd–frank, is a united states federal law that was enacted on july 21, 2010. [1] the law overhauled financial regulation in the aftermath of the great recession , and it made changes affecting all federal financial regulatory agencies and almost every part of the nation's financial services industry. The dodd frank act is a u.s. federal law that reformed the banking and financial system after the 2008 recession. it created new regulatory agencies, rules, and protections for consumers and the economy.

Dodd Frank Act What Is It Bebdata The dodd–frank wall street reform and consumer protection act, commonly referred to as dodd–frank, is a united states federal law that was enacted on july 21, 2010. [1] the law overhauled financial regulation in the aftermath of the great recession , and it made changes affecting all federal financial regulatory agencies and almost every part of the nation's financial services industry. The dodd frank act is a u.s. federal law that reformed the banking and financial system after the 2008 recession. it created new regulatory agencies, rules, and protections for consumers and the economy. The dodd frank act and swaps. in 2010, the u.s. congress passed the dodd frank wall street reform and consumer protection act, commonly known as the dodd frank act. it was designed to modernize regulation to improve financial stability following the crisis; a big part of this was regulating swaps. The dodd frank wall street reform and consumer protection act, commonly known as dodd frank, was passed in 2010 in the wake of the 2008 financial crisis. the obama era law aimed to prevent another financial meltdown. it increased regulation of the financial industry with the intent of better protecting customers of the financial industry.

What Is The Dodd Frank Act The dodd frank act and swaps. in 2010, the u.s. congress passed the dodd frank wall street reform and consumer protection act, commonly known as the dodd frank act. it was designed to modernize regulation to improve financial stability following the crisis; a big part of this was regulating swaps. The dodd frank wall street reform and consumer protection act, commonly known as dodd frank, was passed in 2010 in the wake of the 2008 financial crisis. the obama era law aimed to prevent another financial meltdown. it increased regulation of the financial industry with the intent of better protecting customers of the financial industry.

Comments are closed.