What Is The Difference Between A 401k And Ira

Differences Between An Ira And 401k A Simple Guide Learn how 401 (k) plans and iras differ in contribution limits, investment options, tax benefits, and employer matching. compare the pros and cons of each account and find out which one suits your retirement goals. Learn the differences and similarities between iras and 401 (k)s, two common retirement savings plans. compare tax benefits, contribution limits, withdrawal rules and more.

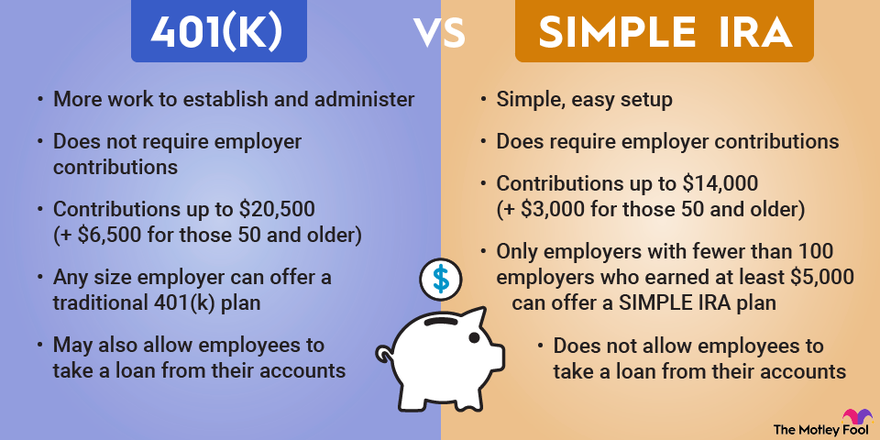

401 K Vs Simple Ira What S The Difference The Motley Fool Learn how to choose between 2 retirement savings options: iras and 401 (k)s. compare their tax advantages, contribution limits, investment options, and employer match. Learn the key differences between 401 (k)s and iras, such as contribution limits, eligibility rules, investment options, and withdrawal rules. find out how to choose the best retirement account for your situation and goals. The 401 (k) is simply objectively better. the employer sponsored plan allows you to add much more to your retirement savings than an ira – $23,000 compared to $7,000 in 2024. plus, if you’re. Learn the differences and benefits of 401 (k)s and iras, and how to use both to maximize your retirement savings. compare contribution limits, tax advantages, investment options, and eligibility requirements for each account type.

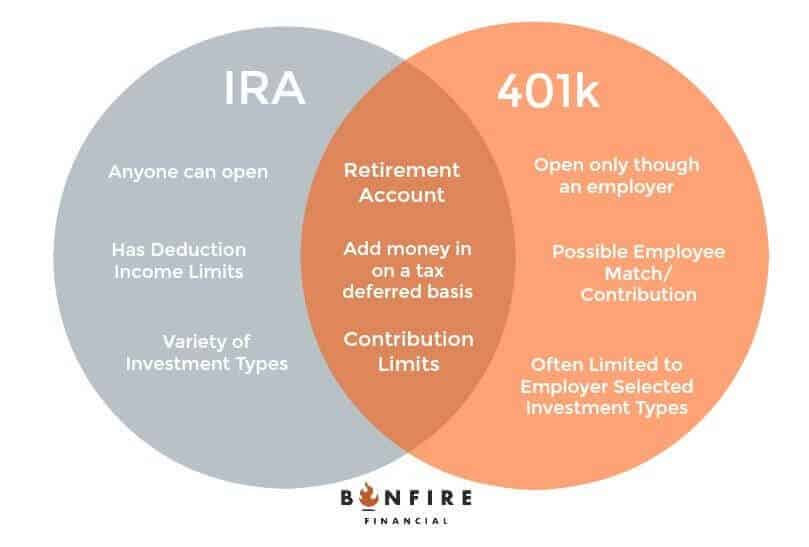

Difference Between Ira And 401k Compare The Difference Between The 401 (k) is simply objectively better. the employer sponsored plan allows you to add much more to your retirement savings than an ira – $23,000 compared to $7,000 in 2024. plus, if you’re. Learn the differences and benefits of 401 (k)s and iras, and how to use both to maximize your retirement savings. compare contribution limits, tax advantages, investment options, and eligibility requirements for each account type. Ira vs. 401 (k) the main difference between 401 (k)s and iras is that 401 (k)s are offered through employers, whereas iras are opened by individuals through a broker or a bank. iras typically. A 401 (k) and ira are both great tax advantaged retirement savings options, and many people use both. a 401 (k) is a better option than an ira if you're looking for the convenience of automatic.

The Beginnerтащs Guide To Retirement 401 K юааiraюаб Ira vs. 401 (k) the main difference between 401 (k)s and iras is that 401 (k)s are offered through employers, whereas iras are opened by individuals through a broker or a bank. iras typically. A 401 (k) and ira are both great tax advantaged retirement savings options, and many people use both. a 401 (k) is a better option than an ira if you're looking for the convenience of automatic.

What Is The Difference Between An Ira A 401k Iwa Blog

Comments are closed.