What Is The Amortization Of Intangibles Youtube

2013 9 Amortization Of Intangibles Youtube In this video, we cover how to amortize intangible assets. we begin by defining intangible assets and discuss when to amortize. we place amortization expense. Are you studying for the cpa exam? would you say you’re more of a visual learner that would find video explanations on every single multiple choice question.

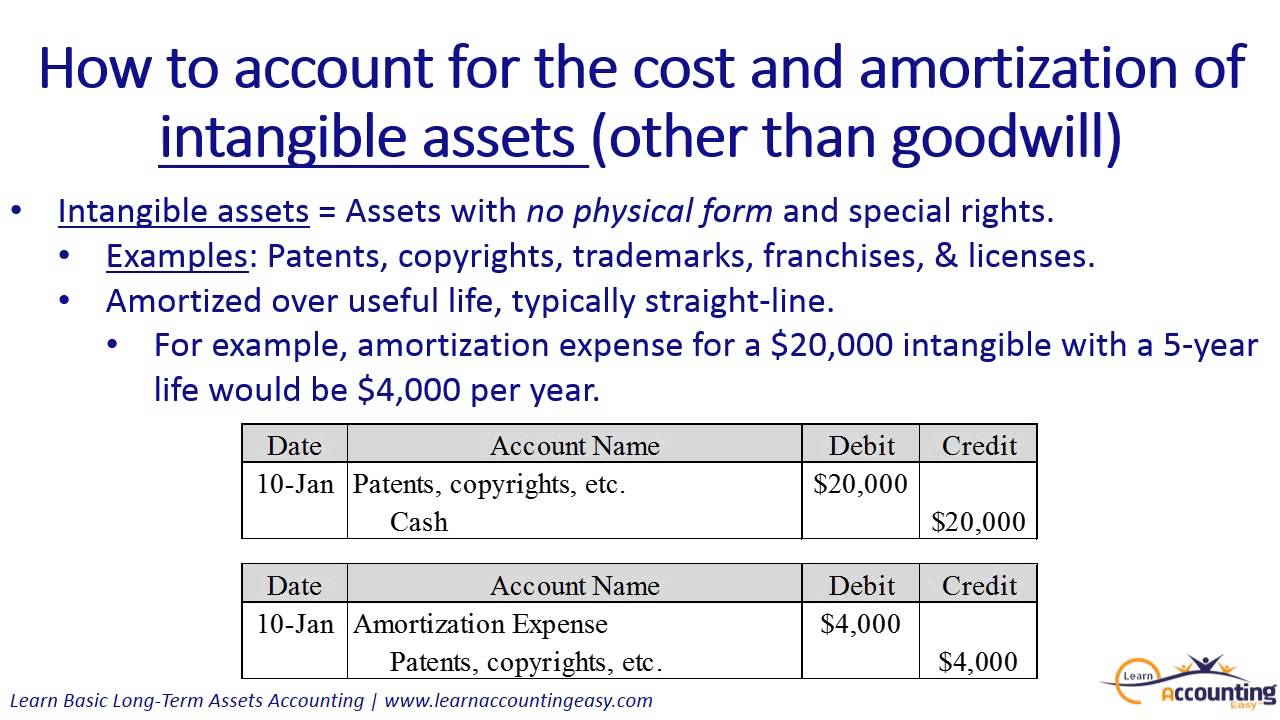

What Is The Amortization Of Intangibles Youtube Intangible assets: amortization and goodwill impairment intermediate accounting chapter 12visit finally learn: finallylearn welcome intermediate. Intangible assets are assets a company owns but that have no physical form. they can’t be touched but they are of value to the business. they can increase a business' profit because they can be written off as an expense over a period of years through a process called “amortization.”. Amortization of intangibles, also simply known as amortization, is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or accounting purposes. The straight line method amortizes the intangible asset at a constant rate over its useful life. we assume that the organization is deriving equally distributed benefits over each year of consumption. the amortization amount is equal each year, making this the simplest method for accounting for the asset's consumption.

Amortization Of Intangibles Youtube Amortization of intangibles, also simply known as amortization, is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or accounting purposes. The straight line method amortizes the intangible asset at a constant rate over its useful life. we assume that the organization is deriving equally distributed benefits over each year of consumption. the amortization amount is equal each year, making this the simplest method for accounting for the asset's consumption. The company will use the straight line method to report the amortization of the software. subtracting the residual value zero from the $10,000 recorded cost and then dividing by the software. Intangible assets refer to assets of a company that are not physical in nature. they include trademarks, customer lists, goodwill, etc. intangible assets are classified into two different categories: definite life and indefinite life. definite life intangible assets are typically subject to amortization, whereas indefinite life intangible.

Amortization Of Intangible Assets Definition Merits Uses Youtube The company will use the straight line method to report the amortization of the software. subtracting the residual value zero from the $10,000 recorded cost and then dividing by the software. Intangible assets refer to assets of a company that are not physical in nature. they include trademarks, customer lists, goodwill, etc. intangible assets are classified into two different categories: definite life and indefinite life. definite life intangible assets are typically subject to amortization, whereas indefinite life intangible.

How To Account For Intangible Assets Including Amortization 3 Of 5

Comments are closed.