What Is Tbml Trade Based Money Laundering Explained Risk Indicators

What Is Trade Based Money Laundering Tbml Amlc Eu Download. 11 march 2021 – fatf egmont report on trade based money laundering: risk indicators. trade based money laundering is one of the most complex and widely used methods of money laundering. criminals use legitimate trade transactions or networks to disguise and move proceeds of crime around the world. in december 2020, the fatf and. Money laundering: risk indicators. by laundering indicators provided below are public and private entities to identify a sampling of the data received may be laundering. by is indicators suspicious designed of the trade based associated to enhance indicators identified of nonetheless using the be relevant when trying indicative of of a.

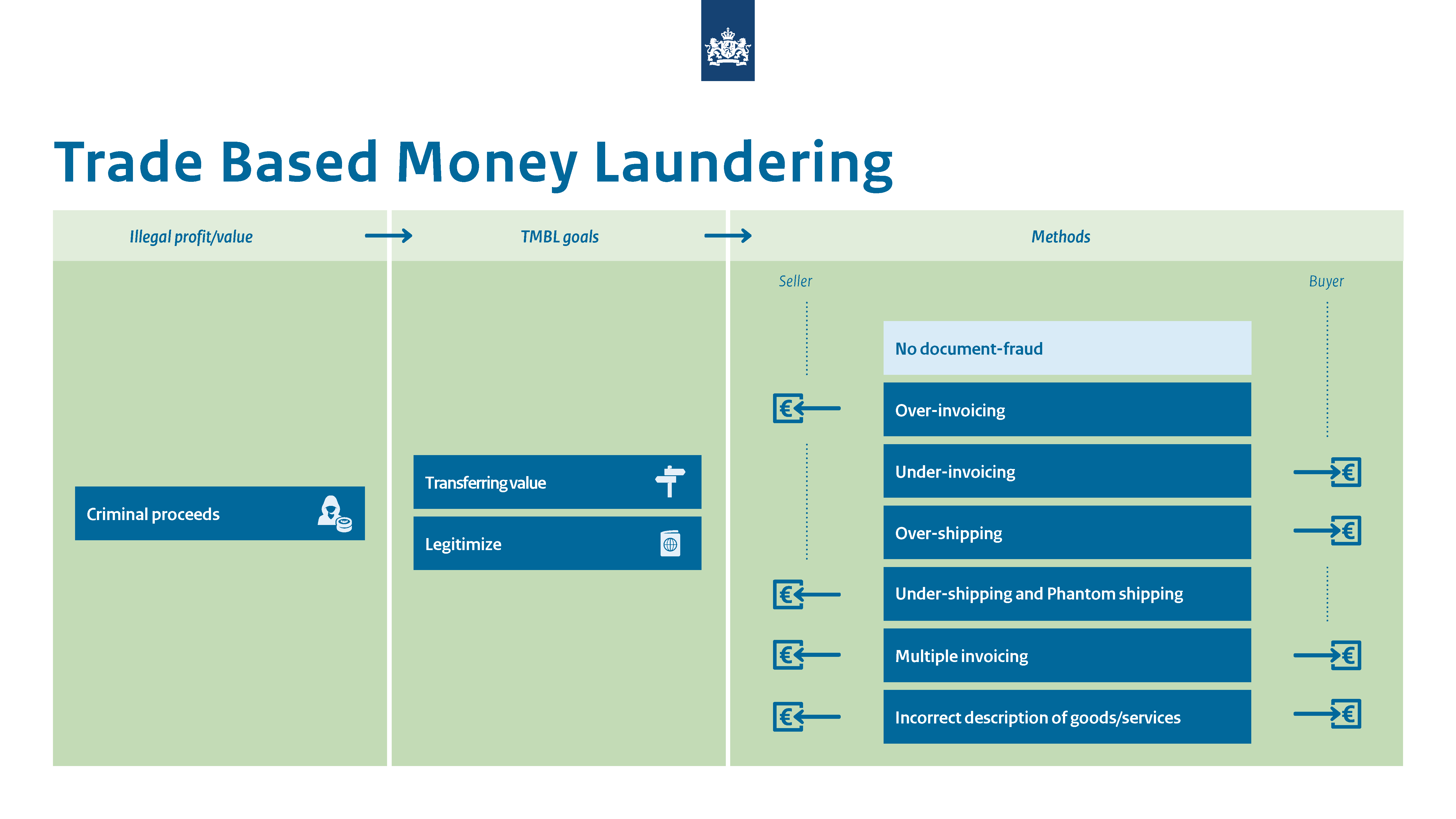

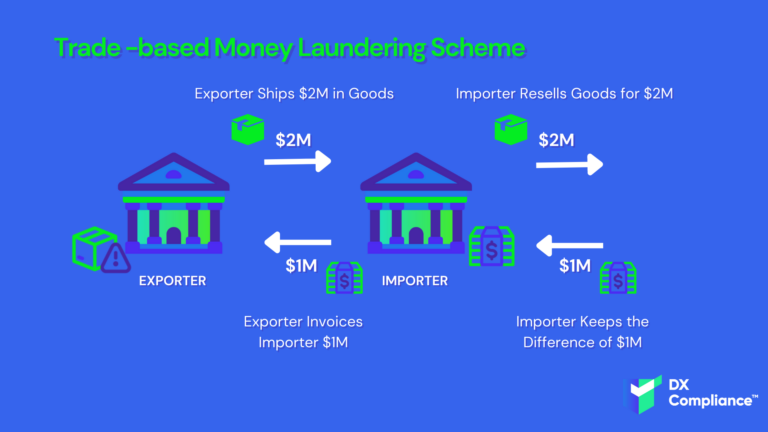

Trade Based Money Laundering Faqs Everything You Need To Know Trade based money laundering (tbml) is the process of moving illegal funds through the international trade system to legitimize them. tbml practices can include the falsification of price, quantity, and quality of the imported or exported goods. tbml takes advantage of the complex nature of trade systems, most prominently in international. Let’s look at eight common red flags that may indicate tbml. 1. invoicing and shipping discrepancies. discrepancies between goods that are shipped and the declared value, quantity, or description on the invoices could indicate attempts to manipulate trade transactions for money laundering purposes. these inconsistencies may arise from forged. Aml compliance. risk indicators for trade based money laundering. trade based money laundering (tbml) is estimated to account for $2 trillion of the annual $20 trillion in global trade. this article gives an high level overview of the nature of tbml, common techniques and risk indicators that help to detect tbml. thorsten j gorny. A red flag in trade based money laundering refers to suspicious indicators or patterns in international trade transactions that might suggest attempts to conceal illicit funds. examples include over or under invoicing, frequent changes in counterparties, unusual payment methods, and discrepancies in goods descriptions.

Trade Based Money Laundering Tbml Risk Indicators Complyad Aml compliance. risk indicators for trade based money laundering. trade based money laundering (tbml) is estimated to account for $2 trillion of the annual $20 trillion in global trade. this article gives an high level overview of the nature of tbml, common techniques and risk indicators that help to detect tbml. thorsten j gorny. A red flag in trade based money laundering refers to suspicious indicators or patterns in international trade transactions that might suggest attempts to conceal illicit funds. examples include over or under invoicing, frequent changes in counterparties, unusual payment methods, and discrepancies in goods descriptions. Trade based money laundering is the process of disguising the proceeds of crime and moving value using trade transactions to legitimize their illicit origins. trade based money laundering (tbml) is a growing risk, as seemingly legitimate transactions are exploited by criminal groups to launder funds and finance terrorist activity. Section 2. trade based money laundering risks and trends 15 risk based approach to trade based money laundering 16 economic sectors and products vulnerable to tbml activity 20 types of businesses at risk of trade based money laundering 24 common trade based money laundering techniques 26 assessment of current trade based money laundering risks 28.

What Is Tbml Trade Based Money Laundering Explained Risk Indicators Trade based money laundering is the process of disguising the proceeds of crime and moving value using trade transactions to legitimize their illicit origins. trade based money laundering (tbml) is a growing risk, as seemingly legitimate transactions are exploited by criminal groups to launder funds and finance terrorist activity. Section 2. trade based money laundering risks and trends 15 risk based approach to trade based money laundering 16 economic sectors and products vulnerable to tbml activity 20 types of businesses at risk of trade based money laundering 24 common trade based money laundering techniques 26 assessment of current trade based money laundering risks 28.

Analyzing Tbml Risk Assessment A Comprehensive Trade Based Money

Comments are closed.