What Is Regulation E

Regulation E What You Need To Know Regulation e is a federal law that protects consumers who use electronic methods to transfer money. it covers atm, debit card, and ach transactions, and outlines consumer liability, error resolution, and disclosure requirements. Regulation e, issued by the cfpb, protects consumers who use electronic funds transfers, such as debit cards, atms and direct deposits. learn how to dispute errors, limit fraud liability and protect your bank accounts under reg e.

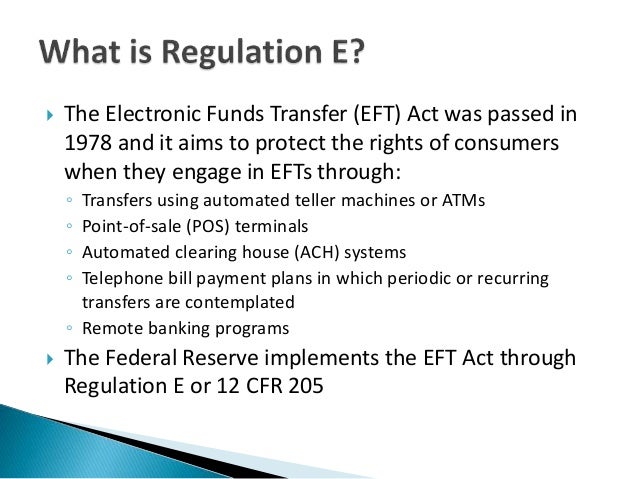

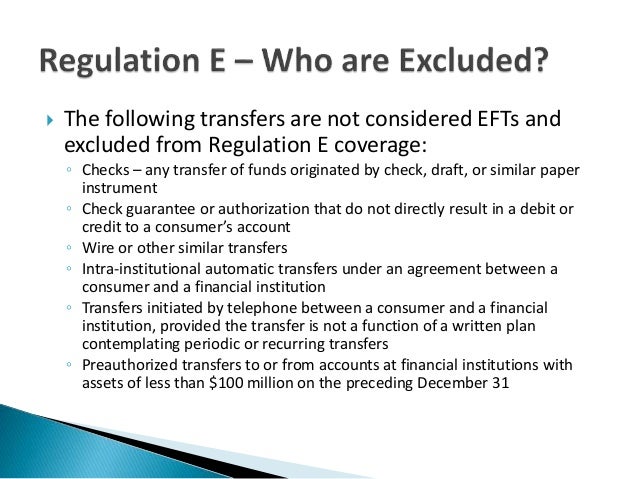

Regulation E What You Need To Know Regulation e protects consumers when they use electronic fund and remittance transfers, such as atms, direct deposit, gift cards, overdraft, and international money transfers. it covers topics such as disclosure, cancellation, error resolution, liability, and preauthorized transfers. Regulation e is a federal law that covers any transfer of funds initiated through electronic means, such as debit cards, atms, direct deposits and online payments. it gives consumers the right to dispute unauthorized or erroneous transactions and limits their liability for lost or stolen debit cards. Regulation e (reg e) is a set of rules that govern electronic fund transfers (efts) in the united states. it's part of the electronic fund transfer act (efta), which was passed in 1978. basically, reg e is designed to protect consumers when they're moving money electronically—whether that's transferring money between accounts, paying bills. The regulation in this part, known as regulation e, is issued by the bureau of consumer financial protection (bureau) pursuant to the electronic fund transfer act (15 u.s.c. 1693 et seq.). the information collection requirements have been approved by the office of management and budget under 44 u.s.c. 3501 et seq. and have been assigned omb no.

Comments are closed.