What Is Portfolio Management Services Types Of Portfolio Management

Portfolio Manager Competencies Responsibilities Types Portfolio management is the process of creating and maintaining a well diversified collection of investments that align with an individual's financial goals and risk tolerance. these include monitoring performances, setting goals, analyzing risk factors, and devising investment strategies. there are four main portfolio management types: active. Portfolio management is a critical investment practice used by two types of entities: individual and institutional investors. these categories have distinct strategies, goals, and resources.

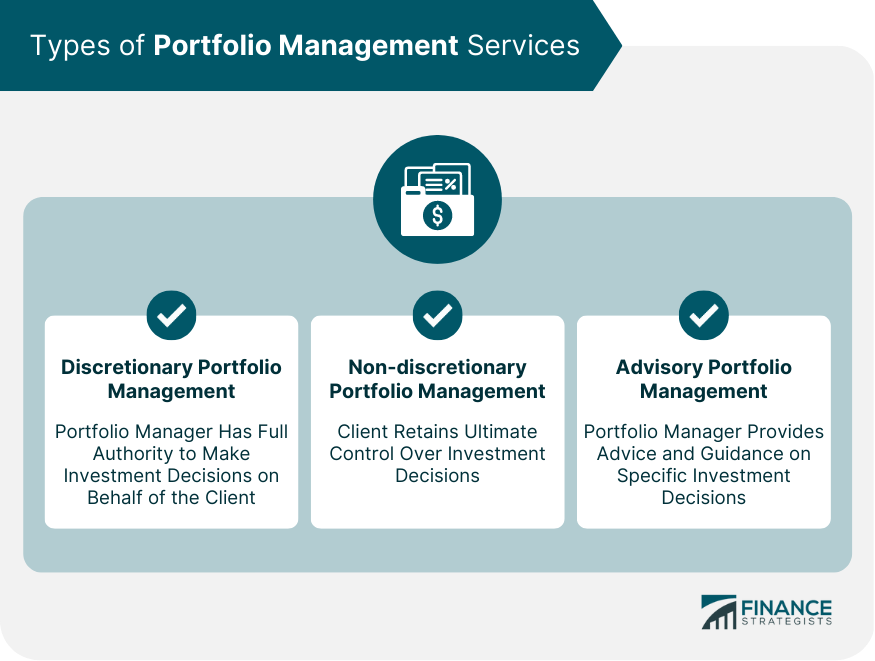

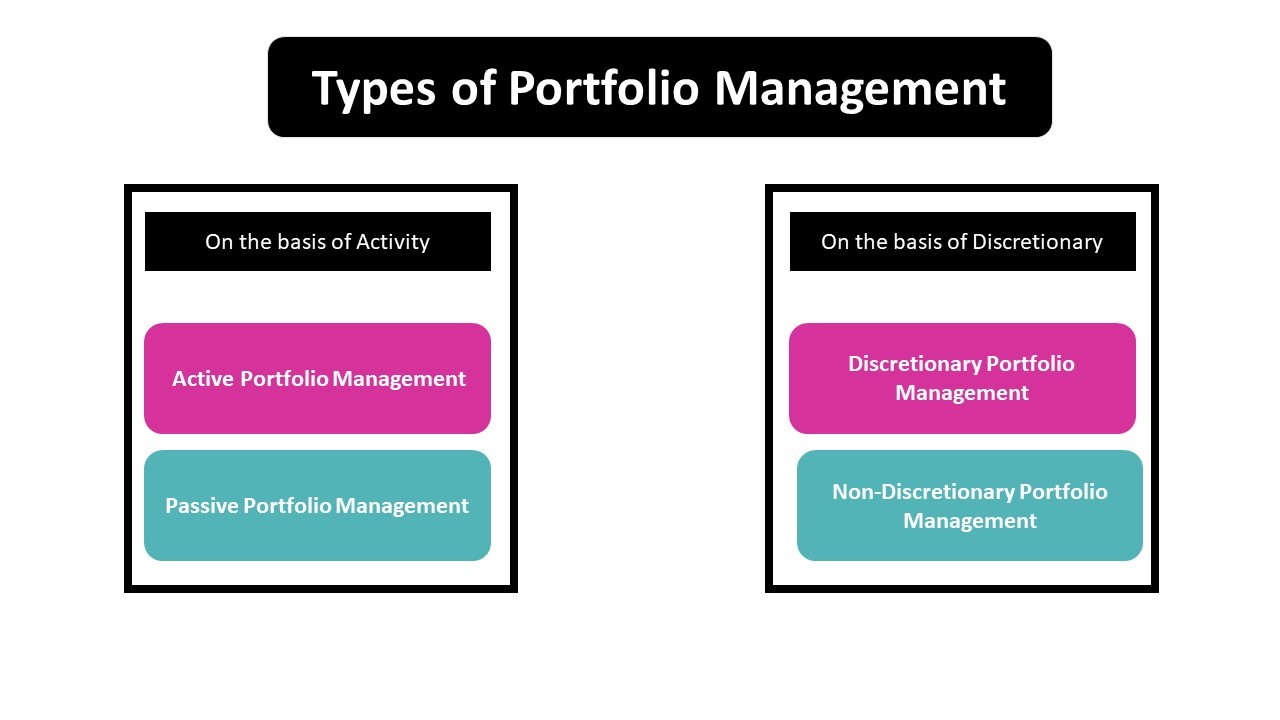

Portfolio Management Meaning Objectives Process Types Portfolio management involves deciding which investments to buy and making decisions on what to do with the assets. some people manage their own portfolios and do their own research when buying. What are the types of portfolio management services? there are four popular types of pms which are explained in this section. active portfolio management: the portfolio manager's primary goal is to maximise returns. in the active portfolio management method, the portfolio manager attempts to reduce the risk of your investments by diversifying. Portfolio management services, often abbreviated as pms, refer to the professional management of an individual’s or entity’s investment portfolio. these services are designed to optimize returns while considering the client’s risk tolerance, financial goals, and time horizon. a dedicated portfolio manager handles the portfolio, making. Types of portfolio management services (pms) 1. discretionary portfolio management: with discretionary portfolio management services, all control over the portfolio and associated decisions is handed to the portfolio managers. it is up to them to devise the effective strategy in line with the investor’s requirements.

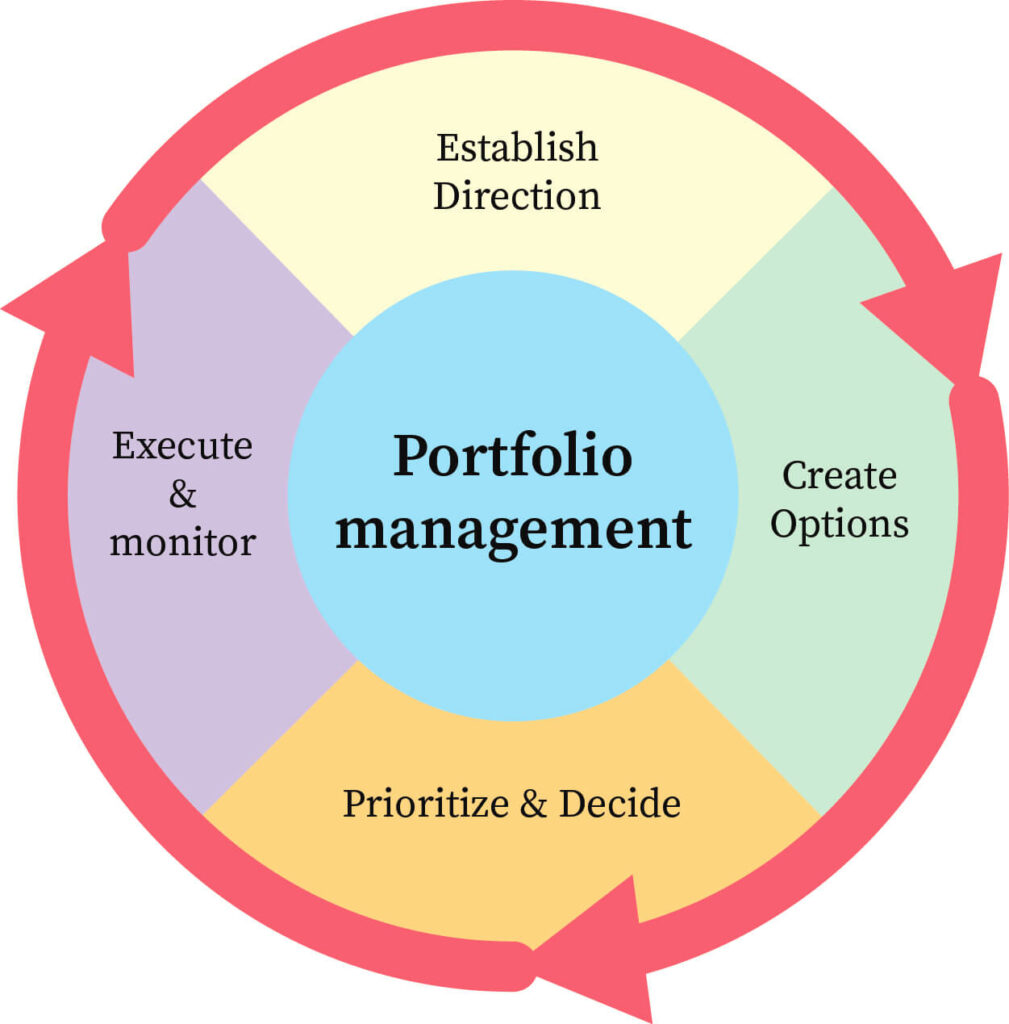

Portfolio Management 101 Definition Types Process And Approaches Portfolio management services, often abbreviated as pms, refer to the professional management of an individual’s or entity’s investment portfolio. these services are designed to optimize returns while considering the client’s risk tolerance, financial goals, and time horizon. a dedicated portfolio manager handles the portfolio, making. Types of portfolio management services (pms) 1. discretionary portfolio management: with discretionary portfolio management services, all control over the portfolio and associated decisions is handed to the portfolio managers. it is up to them to devise the effective strategy in line with the investor’s requirements. Portfolio management definition. portfolio management is a cohesive investing strategy based on your goals, timeline and risk tolerance. portfolio management involves picking investments such as. Portfolio management refers to building and supervising a group of investments, such as securities, bonds, exchange traded funds, mutual funds, cryptocurrencies, etc., either personally or professionally. it is a three step process that includes planning, implementation, and feedback, with asset allocation, diversification, rebalancing, and tax.

Portfolio Diversification Strategies For Maximizing Returns And Portfolio management definition. portfolio management is a cohesive investing strategy based on your goals, timeline and risk tolerance. portfolio management involves picking investments such as. Portfolio management refers to building and supervising a group of investments, such as securities, bonds, exchange traded funds, mutual funds, cryptocurrencies, etc., either personally or professionally. it is a three step process that includes planning, implementation, and feedback, with asset allocation, diversification, rebalancing, and tax.

Comments are closed.