What Is Fintech Intro To Financial Tech The Motley Fool 2024

What Is Fintech Intro To Financial Tech The Motley Fool 2024 Fintech, short for financial technology, are a variety of software platforms, apps, and hardware solutions that leverage tech to make financial processes easier, more efficient and more profitable. The motley fool has positions in and recommends adyen, amazon, bank of america, bitcoin, block, mercadolibre, microsoft, paypal, and uber technologies. the motley fool recommends the following.

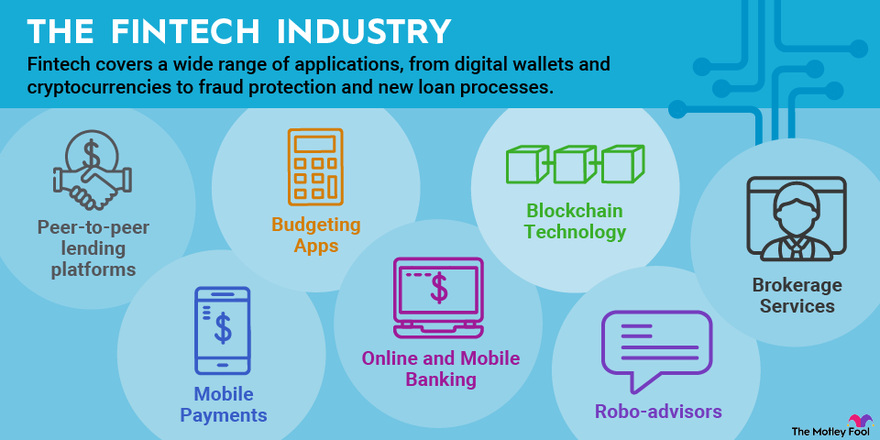

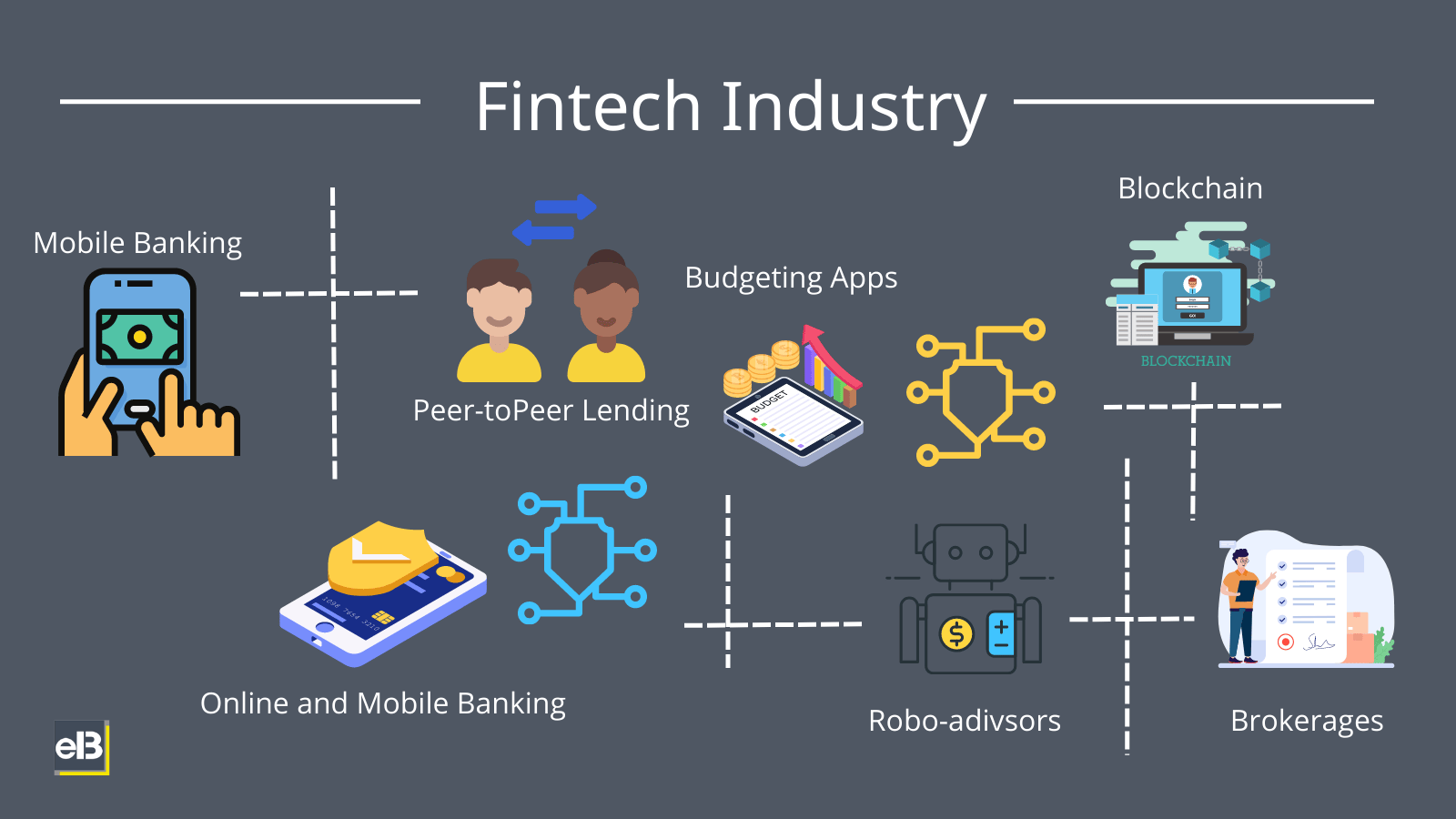

Top 10 Fintech Trends To Watch Out In 2023 2024 Market cap. $65b. today's change. ( 4.46%) $0.64. current price. $13.70. price as of september 6, 2024, 4:00 p.m. et. these fintech stocks offer a compelling combination of value and explosive. Fintechs—short for financial technology—are companies that rely primarily on technology to conduct fundamental functions provided by financial services, affecting how users store, save, borrow, invest, move, pay, and protect money. most fintechs were launched after 2000, have raised funding since 2010, and have not yet reached maturity. In 2024, open banking will reach unprecedented levels of interconnectedness as insights and solutions from traditional financial institutions, fintechs and businesses converge more seamlessly. from a provider perspective, the widespread distribution of apis is levelling the playing field, fostering increased innovation, new revenue streams and. Paypal (nasdaq:pypl), a top american fintech company, is considered the world’s leading non bank payment company. it lets people send and receive payments online quickly and easily. it is widely.

Fintech 101 Intro To Financial Technology In 2024, open banking will reach unprecedented levels of interconnectedness as insights and solutions from traditional financial institutions, fintechs and businesses converge more seamlessly. from a provider perspective, the widespread distribution of apis is levelling the playing field, fostering increased innovation, new revenue streams and. Paypal (nasdaq:pypl), a top american fintech company, is considered the world’s leading non bank payment company. it lets people send and receive payments online quickly and easily. it is widely. It's a newcomer on the fintech 50. e ven amid layoffs and a funding drought, financial technology startups continued to worm themselves into the money routines of millions. six personal finance. At $27.27 per share, current investors enjoy a mouth watering 114.01% year to date gain. an added charm is the decent 2.03% dividend. had you invested $7,000 in prl one year ago, your money would.

Comments are closed.