What Is Divergence Cheat Sheet Education

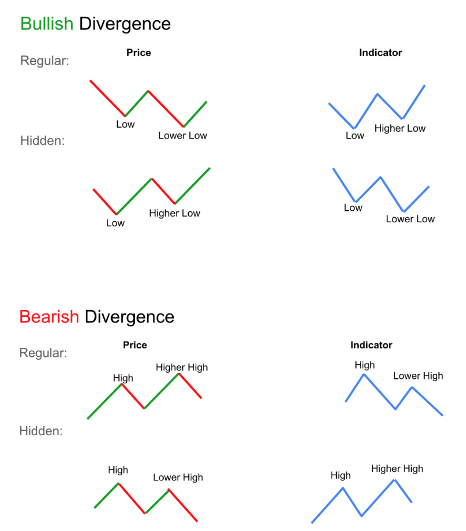

What Is Divergence Cheat Sheet Education Traders can exploit these price discrepancies for profit. the divergence cheat sheet below offers an easily accessible, in depth look at what a divergence is, the different types of divergences, and how to trade divergence efficiently. note: you can get your free divergence cheat sheet pdf below. Divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. there are two types of divergences: regular divergence. hidden divergence. each type of divergence will contain either a bullish bias or a bearish bias. since you’ve all be studying hard and not.

Divergence Cheat Sheet The Success Academy Understanding divergence: a key concept in trading. divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. this pattern provides valuable insights into potential price reversals or changes in trends. the divergence cheat sheet. Divergence cheat sheet (free download) trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. with this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. and, if used properly, it can turn out. The purpose of the divergence cheat sheet is to help traders identify these patterns and make informed decisions about their trades. a cheat sheet on hand saves time and reduces the risk of missing key signals in fast paced trading. using a cheat sheet in trading offers several advantages. firstly, it helps traders stay organized and focused. In technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. for instance, if price forms a higher high while the rsi forms a lower high, it indicates bearish divergence. price and the rsi, which should typically move in tandem, end up showing contradictory signals.

Comments are closed.