What Is Consumer Venture Capital Pitchbook

Pitchbook Publishes 2021 Us Venture Capital Outlook Predicting Record Consumer venture capital is a subset of vc that targets consumer focused companies and deals. as such, its investors pursue opportunities in the business to consumer (b2c) space rather than those relating to business to business (b2b). though the name may conjure images of individual investors allocating funds, consumer vc is largely carried. Aum: $1b. b2c investments: 287. zhenfund is a vc firm and seed fund based in beijing, created in collaboration with the previously mentioned sequoia capital china. they prioritize investments relating to e commerce, education, mobile internet, media, entertainment, sports, virtual reality, fintech, and healthcare.

What Is Consumer Venture Capital Pitchbook Venture capital (vc) is a form of financing where capital is invested into a company—a startup or small business—in exchange for equity in the company. to invest, vc firms employ general partners (gps) to raise funds from investors called limited partners (lps). both the gp’s firm and the lp gain if the company does well. In 2021, a record year for global venture capital, consumer companies raised more than $215 billion in funding, according to pitchbook. consumer companies may see investor enthusiasm take a hit. Just take venture capital. according to pitchbook, the amount of vc money in beauty surged from barely anything at the turn of the century (there were literally two beauty vc deals in 2003) to. How pitchbook sources data. our data operations team has logged over 3.5 million hours researching, organizing, and integrating the information you need most. information on investments, active portfolio, exits, fund performance, dry powder, team and co investors for areca ventures. use the pitchbook platform to explore the full profile.

5 Ways Venture Capital Is Evolving Pitchbook Just take venture capital. according to pitchbook, the amount of vc money in beauty surged from barely anything at the turn of the century (there were literally two beauty vc deals in 2003) to. How pitchbook sources data. our data operations team has logged over 3.5 million hours researching, organizing, and integrating the information you need most. information on investments, active portfolio, exits, fund performance, dry powder, team and co investors for areca ventures. use the pitchbook platform to explore the full profile. Record growth achieved by a few outliers such as wiz and rubrik has raised the bar for other software startups in a tough funding environment. Nevertheless, pitchbook is widely considered the most robust capital market database used by researchers and investors in several sectors. 11 our analysis, including 402 vc investments in 163 plastic and aesthetic surgery might also face underreporting issues due to nondisclosed transaction values. misclassification bias could also be present.

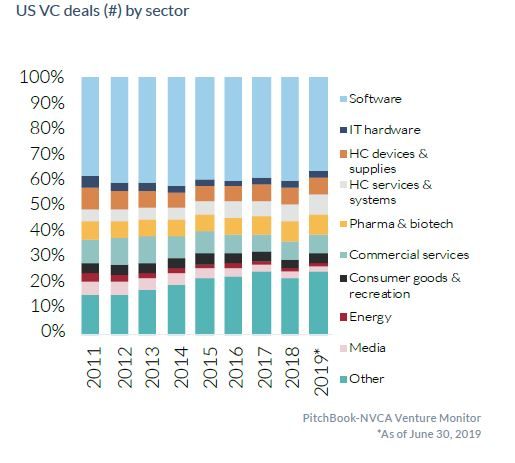

21 Charts Showing Current Trends In Us Venture Capital Pitchbook Record growth achieved by a few outliers such as wiz and rubrik has raised the bar for other software startups in a tough funding environment. Nevertheless, pitchbook is widely considered the most robust capital market database used by researchers and investors in several sectors. 11 our analysis, including 402 vc investments in 163 plastic and aesthetic surgery might also face underreporting issues due to nondisclosed transaction values. misclassification bias could also be present.

What Is Consumer Venture Capital Pitchbook

Comments are closed.