What Is Capital Budgeting Definition And Examples The Vrogue Co

Capital Budgeting Definition Types Process Features I Vrogue Co Capital budgeting is a process that businesses use to evaluate potential major projects or investments. building a new plant or taking a large stake in an outside venture are examples of. Capital budgeting is defined as the process by which a business determines which fixed asset purchases or project investments are acceptable and which are not. using this approach, each proposed investment is given a quantitative analysis, allowing rational judgment to be made by the business owners. capital asset management requires a lot of.

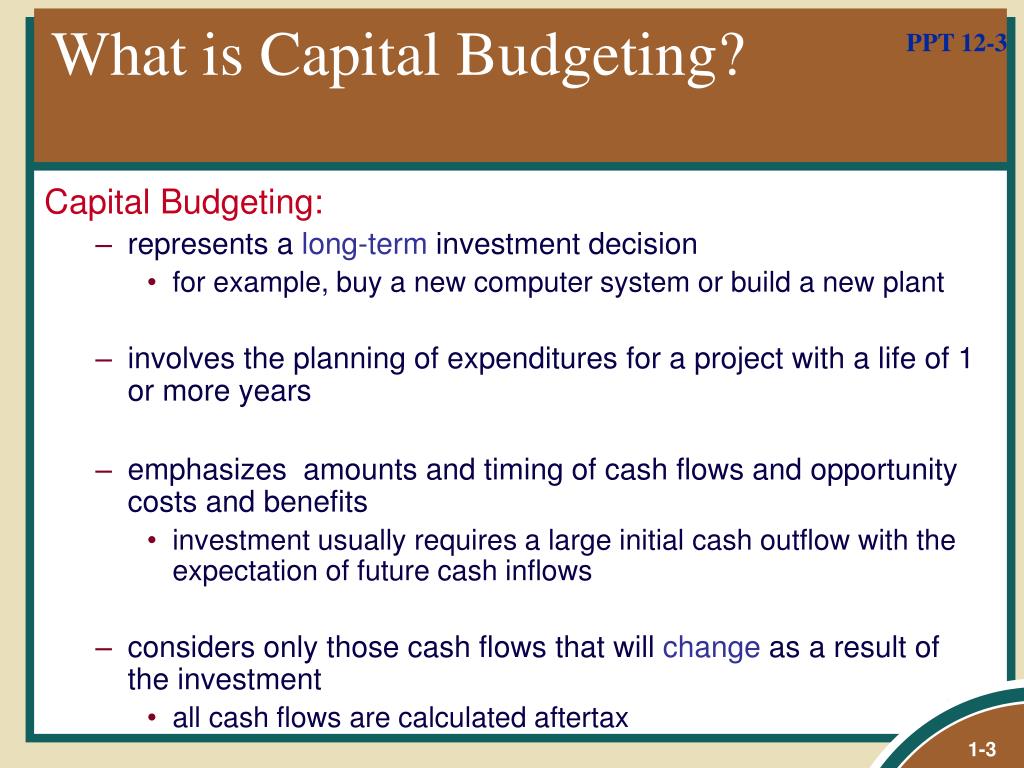

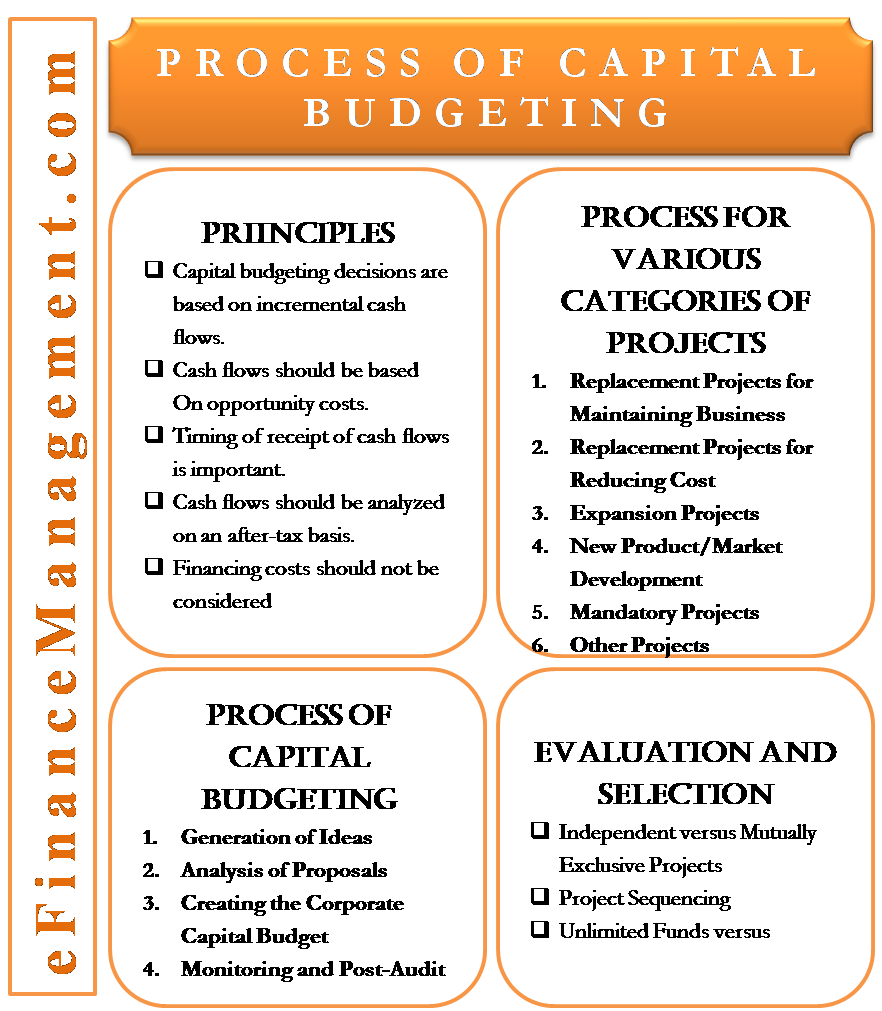

Capital Budgeting Definition Types Process Features I Vrogue Co Example #1. a company is considering two projects to select anyone. the projected cash flows are as follows. wacc for the company is 10 %. solution: using the more common capital budgeting decision tools, let us calculate and see which project should be selected over the other. npv for project a . What is capital budgeting and an example? capital budgeting is the process of evaluating long term investments. examples include the addition or replacement of a fixed asset, like machinery, or a large scale project, such as buying real estate or another company. what are the 3 methods of capital budgeting?. Capital budgeting is a critical financial process that involves evaluating and selecting long term investments that are worth more than their cost. this method prioritizes projects based on their potential to increase a company’s value, focusing on cash flows, timing, and risk analysis. let’s dive into the world of capital budgeting. Capital budgeting is a process by which investments in large scale projects are analyzed, evaluated and prioritized. these are investments of significant value, such as the purchase of a new facility, fixed assets or real estate. the use of capital budgeting offers an objective view that helps managers figure out how to invest capital in order.

What Is Capital Budgeting Process Features Objectives Vrogue Co Capital budgeting is a critical financial process that involves evaluating and selecting long term investments that are worth more than their cost. this method prioritizes projects based on their potential to increase a company’s value, focusing on cash flows, timing, and risk analysis. let’s dive into the world of capital budgeting. Capital budgeting is a process by which investments in large scale projects are analyzed, evaluated and prioritized. these are investments of significant value, such as the purchase of a new facility, fixed assets or real estate. the use of capital budgeting offers an objective view that helps managers figure out how to invest capital in order. Several important definitions of capital budgeting are given below: 1. charles t. harngreen: "capital budgeting is long term planning for making and financing proposed capital outlay." 2. richards and green law: "capital budgeting generally refers to acquiring inputs with long run returns." 3. The employees of any company have a fiduciary obligation to act in the best interests of the owners of the company, and evaluating the financial returns on various projects through the process of capital budgeting is one way to do that. capital budgeting is the process of figuring out which projects are financially worth an investment.

Capital Budgeting Definition Types Process Features I Vrogue Co Several important definitions of capital budgeting are given below: 1. charles t. harngreen: "capital budgeting is long term planning for making and financing proposed capital outlay." 2. richards and green law: "capital budgeting generally refers to acquiring inputs with long run returns." 3. The employees of any company have a fiduciary obligation to act in the best interests of the owners of the company, and evaluating the financial returns on various projects through the process of capital budgeting is one way to do that. capital budgeting is the process of figuring out which projects are financially worth an investment.

What Is Capital Budgeting Definition And Examples The Vrogue Co

Comments are closed.