What Is A Traditional Ira And How Does It Work The Tech Edvocate

What Is A Traditional Ira And How Does It Work The Tech Edvocate Spread the loveintroduction a traditional individual retirement account (ira) is a tax deferred retirement savings account designed to help people save for their future. those who contribute to a traditional ira enjoy a range of tax benefits, which makes it one of the most popular forms of investing for retirement in the united states. in this article, we will explore what a traditional ira is. What is a traditional ira? a traditional ira is a tax deferred retirement account you open outside of an employer’s retirement plan. in certain cases, you’ll receive a tax deduction equal to.

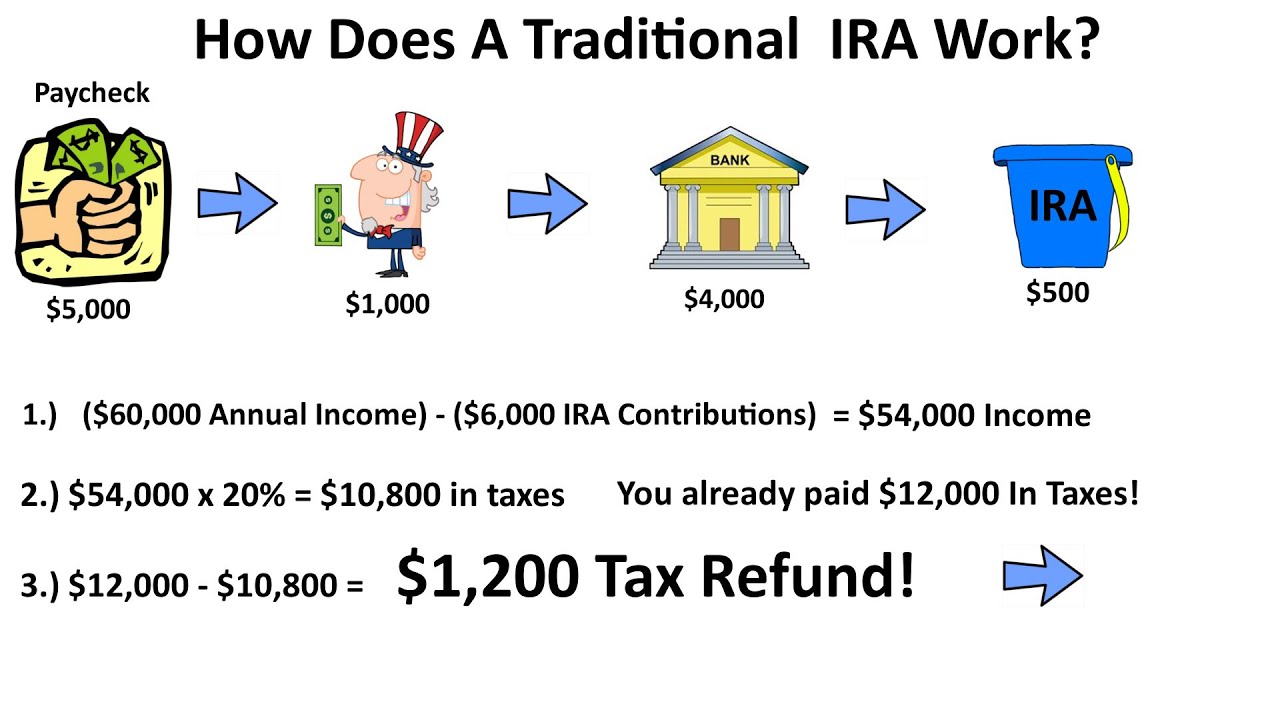

How Does An Ira Work Traditional Ira Explained In A Flow Chart Tax What makes a traditional ira different from other types of iras is that owners receive a tax benefit when making contributions. for example, if your income is $60,000 and you contribute $6,000 to. A traditional ira is a type of individual retirement account that provides your investments with tax deferred growth. contributions to a traditional ira are made pre tax, and you may be able to. Traditional ira vs. roth ira. there are two basic types of iras: traditional iras and roth iras, which came into law later. the key difference is tax treatment: unlike a traditional ira, you fund a roth with after tax dollars, and withdrawals are tax free as long as you meet certain criteria. A traditional individual retirement account (ira) is a tax advantaged account designed specifically for retirement savings. unlike roth iras, which you fund with after tax dollars in exchange for tax free income in retirement, a traditional ira offers the potential to save on taxes upfront when you contribute and defer taxes until you take.

What Is An Ira And How Does It Work 2024 Traditional ira vs. roth ira. there are two basic types of iras: traditional iras and roth iras, which came into law later. the key difference is tax treatment: unlike a traditional ira, you fund a roth with after tax dollars, and withdrawals are tax free as long as you meet certain criteria. A traditional individual retirement account (ira) is a tax advantaged account designed specifically for retirement savings. unlike roth iras, which you fund with after tax dollars in exchange for tax free income in retirement, a traditional ira offers the potential to save on taxes upfront when you contribute and defer taxes until you take. A traditional individual retirement account (ira) is a retirement account that an individual opens independently from an employer's retirement plan. it allows annual contributions with pre tax money, which helps in saving more over time and reducing the current tax burden. a pre tax deduction is any amount subtracted from an employee's gross. Under certain conditions, you can withdraw money from your ira without penalty. the rules vary depending on the type of ira you have. generally, for a traditional ira, distributions prior to age 59½ are subject to a 10% penalty in addition to federal and state taxes unless an exception applies. 2 starting at age 59½, you can begin taking money out of your ira without penalty, but you will.

How Does A Roth Ira Work The Tech Edvocate A traditional individual retirement account (ira) is a retirement account that an individual opens independently from an employer's retirement plan. it allows annual contributions with pre tax money, which helps in saving more over time and reducing the current tax burden. a pre tax deduction is any amount subtracted from an employee's gross. Under certain conditions, you can withdraw money from your ira without penalty. the rules vary depending on the type of ira you have. generally, for a traditional ira, distributions prior to age 59½ are subject to a 10% penalty in addition to federal and state taxes unless an exception applies. 2 starting at age 59½, you can begin taking money out of your ira without penalty, but you will.

Comments are closed.