What Is A Secured Credit Card Can It Help You Lexington Law

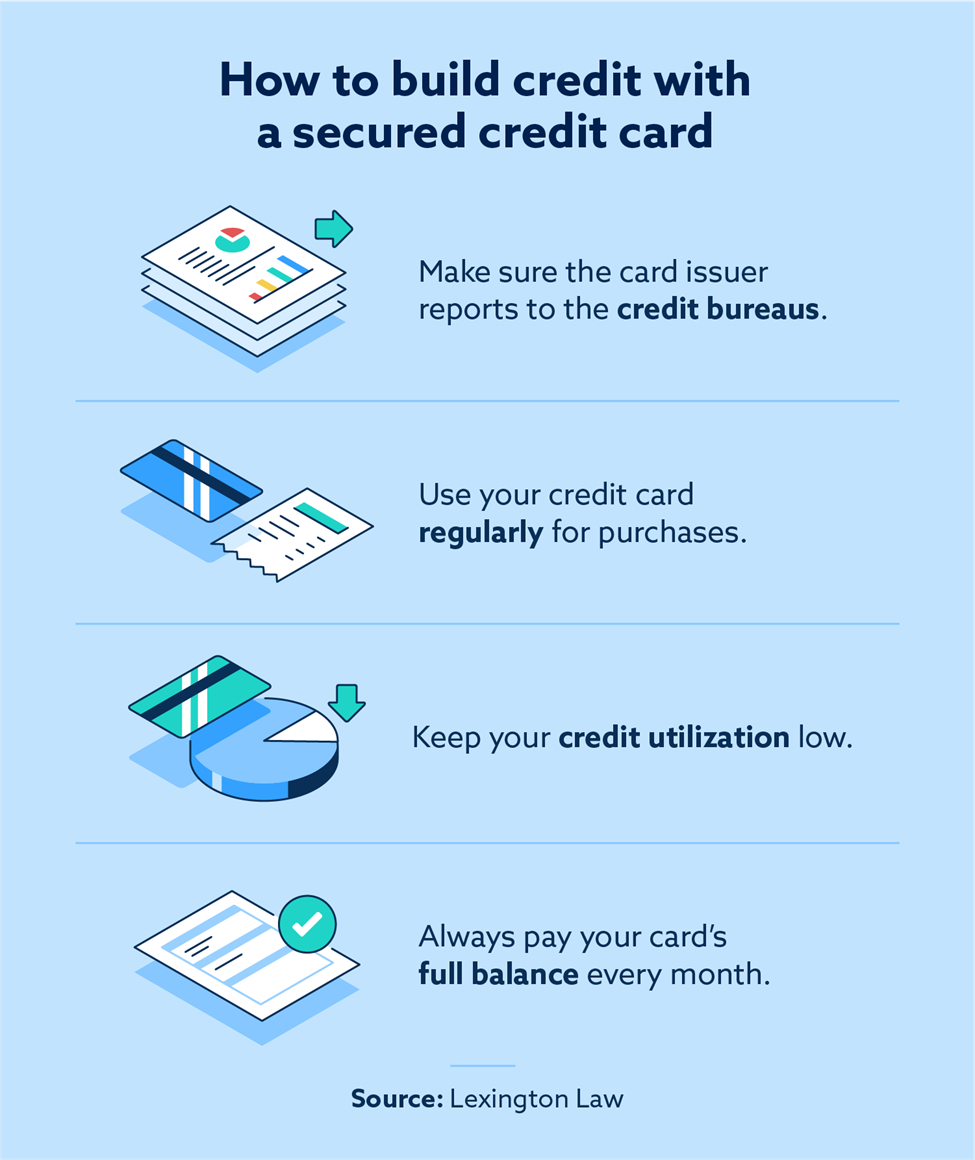

What Is A Secured Credit Card Can It Help You Lexington Law See lexington law’s editorial disclosure for more information. the pros of secured credit cards are that they can help you build credit, get approved easier, earn rewards and have a refundable deposit. cons of secured credit cards are that they require a safety deposit, may charge high credit card fees and interest rates and have a low credit. See lexington law’s editorial disclosure for more information. secured credit cards can help build credit when used responsibly. these cards are also backed by a cash deposit that lenders use as collateral. secured credit cards can help you improve your credit if you use them regularly, pay off your full balance each month and keep your.

What Is A Secured Credit Card Can It Help You Lexington Law 2. put down your deposit. after you’ve been approved, the credit card issuer will tell you your credit limit and ask you to pay your deposit. make sure you do so quickly—if you don’t get your deposit in on time, they may close your account before you have a chance to use it. No it is not worth it. all they do is dispute negative items on your credit report, even if they're accurate, and hope they get deleted. you can easily do that yourself for free if it's something you really want to do. you may find these links helpful: i am a bot, and this action was performed automatically. To help build your credit, keep your utilization rate low. do that by carrying a balance that’s no more than ideally 10% to at least 30% of your credit limit. running up your card balance hurts your ratio, damaging your credit score. for example, if your credit limit is $300, keep your balance under $75. A secured card is one with a credit limit that’s secured by collateral you put up. in the case of these cards, the collateral is a cash deposit you make to secure the credit limit. typically, your credit limit is equal to your deposit, and you may have an option for how much that is. for example, some cards allow you to deposit $200 to $3,000.

What Is A Secured Credit Card And How Does It Work To help build your credit, keep your utilization rate low. do that by carrying a balance that’s no more than ideally 10% to at least 30% of your credit limit. running up your card balance hurts your ratio, damaging your credit score. for example, if your credit limit is $300, keep your balance under $75. A secured card is one with a credit limit that’s secured by collateral you put up. in the case of these cards, the collateral is a cash deposit you make to secure the credit limit. typically, your credit limit is equal to your deposit, and you may have an option for how much that is. for example, some cards allow you to deposit $200 to $3,000. Lexington law currently offers only one package of credit repair services. for $139.95 per month, you get the entire range of services available. however, lexington law does offer focus tracks to. Lexington law can be reached at (800) 341 8441 during business hours. if you find yourself unable to call them to cancel, check out your customer portal online or in the app. the specific process and timeframe for canceling or changing your lexington law program will be outlined in your membership agreement.

What Is A Secured Credit Card And How Does It Work Lexington law currently offers only one package of credit repair services. for $139.95 per month, you get the entire range of services available. however, lexington law does offer focus tracks to. Lexington law can be reached at (800) 341 8441 during business hours. if you find yourself unable to call them to cancel, check out your customer portal online or in the app. the specific process and timeframe for canceling or changing your lexington law program will be outlined in your membership agreement.

Comments are closed.