What Is A Loan Payoff

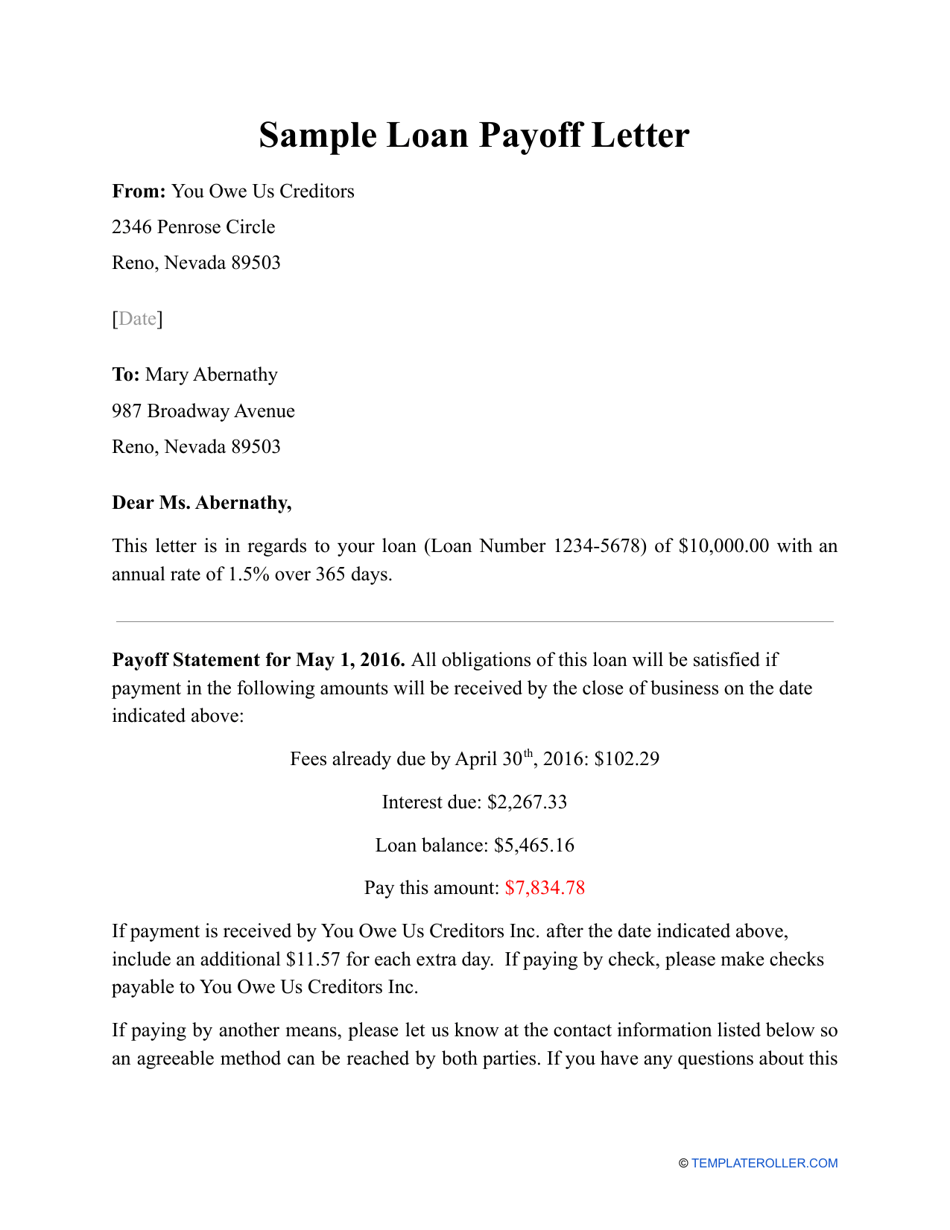

Sample Loan Payoff Letter Fill Out Sign Online And Download Pdf She served as the phenomenal host of the Women in Money conference and mentors her clients to crush their money goals She also paid off $300,000 of her own debt in just three years and is releasing A $30,000 loan might allow you to consolidate debt, fund major expenses or pay for emergencies Here’s how to get one

What Is A Loan Payoff Letter Cape Coral Fort Myers Title Insurance Tip: A debt payoff app may help you keep track of those debts as the balances drop Debt consolidation involves taking out a single loan to pay off multiple higher-interest debts Imagine that the The easiest and fastest comparison is the average loan size In January it was $11,716,472 per loan; August saw $24,594,552 per loan The loan value more than doubled Foreclosures grew 2726 percent from January through August this year reaching $192 billion at the close of last month, CRED iQ data shows Happy Money’s Payoff Loan™ helps borrowers consolidate (and hopefully eliminate) their existing debt With a debt consolidation loan, you’ll apply for a loan that’s equivalent to the total amount of

Loan Payoff Schedule Mortgage Amortization Excel Template Etsy Foreclosures grew 2726 percent from January through August this year reaching $192 billion at the close of last month, CRED iQ data shows Happy Money’s Payoff Loan™ helps borrowers consolidate (and hopefully eliminate) their existing debt With a debt consolidation loan, you’ll apply for a loan that’s equivalent to the total amount of Yes Most personal loans require a hard credit check that can lower your credit score by up to five points In addition to inquiries, failing to pay your loan on time could lower your credit score You can also choose to lower your loan amount by increasing monthly payments or transferring a lump-sum payment toward the principal amount, so long as the payoff terms don’t have a prepayment Debt limits your future financial options See how your debt compares to other Americans to find out if you owe more or less to creditors An assumable mortgage can be a major selling point for a home, especially if it has a very low interest rate However, selling a home with an assumable loan can be a lengthy and complex process

Comments are closed.