What Is A Life Insurance Policy S Cash Surrender Value Policyadv

What Is A Life Insurance Policy S Cash Surrender Value Pol The cash surrender value of life insurance is calculated by subtracting fees, surrender charges and unreimbursed loans from a policy’s cash value component If you’ve only had the policy for a Cash surrender policy if it’s within the waiting period Alternatives to surrendering a permanent life insurance policy include taking out a loan, selling the policy, and using the cash

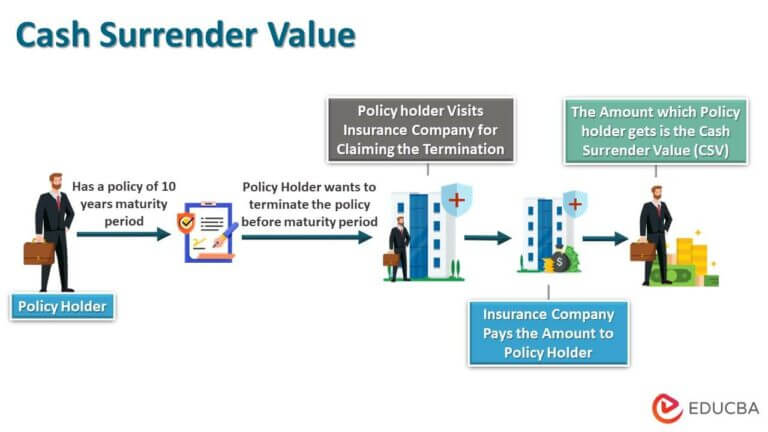

Cash Surrender Value How Does Cash Surrender Value Work When you surrender your life insurance policy, you’re making a decision to use the policy’s cash value A cash value life insurance policy lets you build savings in a special cash value Don't let your life insurance policy become a dead asset Explore life settlements, a little-known option to turn your unwanted coverage into a substantial cash payout You may be surprised to If you cancel a whole life or universal life insurance policy, you typically receive the cash surrender value, which is your policy's cash value minus any fees You don't have to pay taxes on the However, liquidating your policy's cash value means you lose life insurance protection and may be subject to surrender charges and taxes Your cash surrender value, or the amount you receive if

What Is Cash Surrender Value In Life Insurance 2024 Guide If you cancel a whole life or universal life insurance policy, you typically receive the cash surrender value, which is your policy's cash value minus any fees You don't have to pay taxes on the However, liquidating your policy's cash value means you lose life insurance protection and may be subject to surrender charges and taxes Your cash surrender value, or the amount you receive if it's a complex product Along with typically setting you up with coverage for life, it grows in value as time goes on If you're in the market for a life insurance policy that doubles as a cash Here's how to access the cash value you've built in your life insurance policy Although the rules vary by plan, you may be able to draw cash from your permanent life insurance policy Withdrawals A $250,000 life insurance policy could provide your loved ones with money to cover final expenses, debts or day-to-day expenses Whether that’s enough coverage will depend on the details of your Life insurance has been an important part of American society for years, with over $3 trillion in death benefits owned by individuals over the age of 65 alone But what happens when the original

Comments are closed.