What Is A Health Savings Account Hsa Rules Limits How To Open

What Is A Health Savings Account Hsa Rules Limits How To Open The irs sets limits that determine the combined amount that you, your employer, and any other person can contribute to your hsa each year: for 2022,the maximum contribution amounts are $3,650 for. Health savings accounts (hsas) let you save and pay for qualified medical expenses with tax free dollars. 1,2 but there are limits to how much you can contribute each year. overcontributing can lead to unexpected tax penalties. keep these rules for hsa contributions in mind.

:max_bytes(150000):strip_icc()/rules-having-health-savings-account-hsa_final-58180fce30aa4fe8b278b4137e8ccb48.png)

Health Savings Account Hsa Rules And Limits Here are the maximum amounts you can contribute to an hsa in 2024: if you have self only coverage, you can contribute up to $4,150 ($3,850 for 2023). if you have family coverage, you can. The maximum contribution for an hsa in 2024 is $4,150 for an individual (rising to $4,300 for 2025) and $8,300 for a family ($8,550 in 2025). the annual limits on contributions apply to the total. You must participate in a high deductible health plan to contribute to an hsa. for 2024, this means: an annual deductible of $1,600 or more for individual coverage and $3,200 or more for family. For 2023, the hsa contribution limit is $3,850 if you are enrolled in an hsa eligible plan for yourself only. if you have family coverage, the limit is $7,750. there's also a $1,000 catch up.

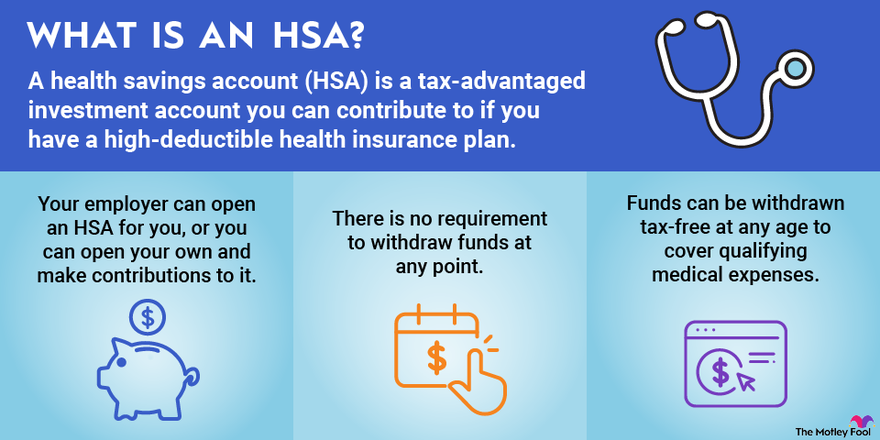

Health Savings Accounts Hsas Explained The Motley Fool You must participate in a high deductible health plan to contribute to an hsa. for 2024, this means: an annual deductible of $1,600 or more for individual coverage and $3,200 or more for family. For 2023, the hsa contribution limit is $3,850 if you are enrolled in an hsa eligible plan for yourself only. if you have family coverage, the limit is $7,750. there's also a $1,000 catch up. A health savings account (hsa) is a tax advantaged way to save for qualified medical expenses. hsas pair with an hsa eligible health plan. because it offers potential tax advantages and money within the account can be invested, an hsa can be used to pay for both near term medical expenses and expenses in retirement. Health savings accounts, or hsas, have higher contribution limits in 2023 and 2024, allowing you to save more for your healthcare expenses if you’re using a high deductible healthcare plan.

Health Savings Account Hsa Rules And Limits Updated For 2021 You A health savings account (hsa) is a tax advantaged way to save for qualified medical expenses. hsas pair with an hsa eligible health plan. because it offers potential tax advantages and money within the account can be invested, an hsa can be used to pay for both near term medical expenses and expenses in retirement. Health savings accounts, or hsas, have higher contribution limits in 2023 and 2024, allowing you to save more for your healthcare expenses if you’re using a high deductible healthcare plan.

Comments are closed.