What Are The Five Main Credit Factors Leia Aqui What Are The 5 Key

What Are The Five Main Credit Factors Leia Aqui What Are The 5 Key The five biggest factors that affect your credit score are payment history, amounts owed, length of credit history, new credit, and types of credit. to improve your credit, it's important to. While your credit scores can look slightly different, depending on which credit bureau it’s pulled from (equifax or transunion), the same five factors are primarily used to determine the final number. here’s an explanation of each factor and how you can stay on top of them. 1. your payment history.

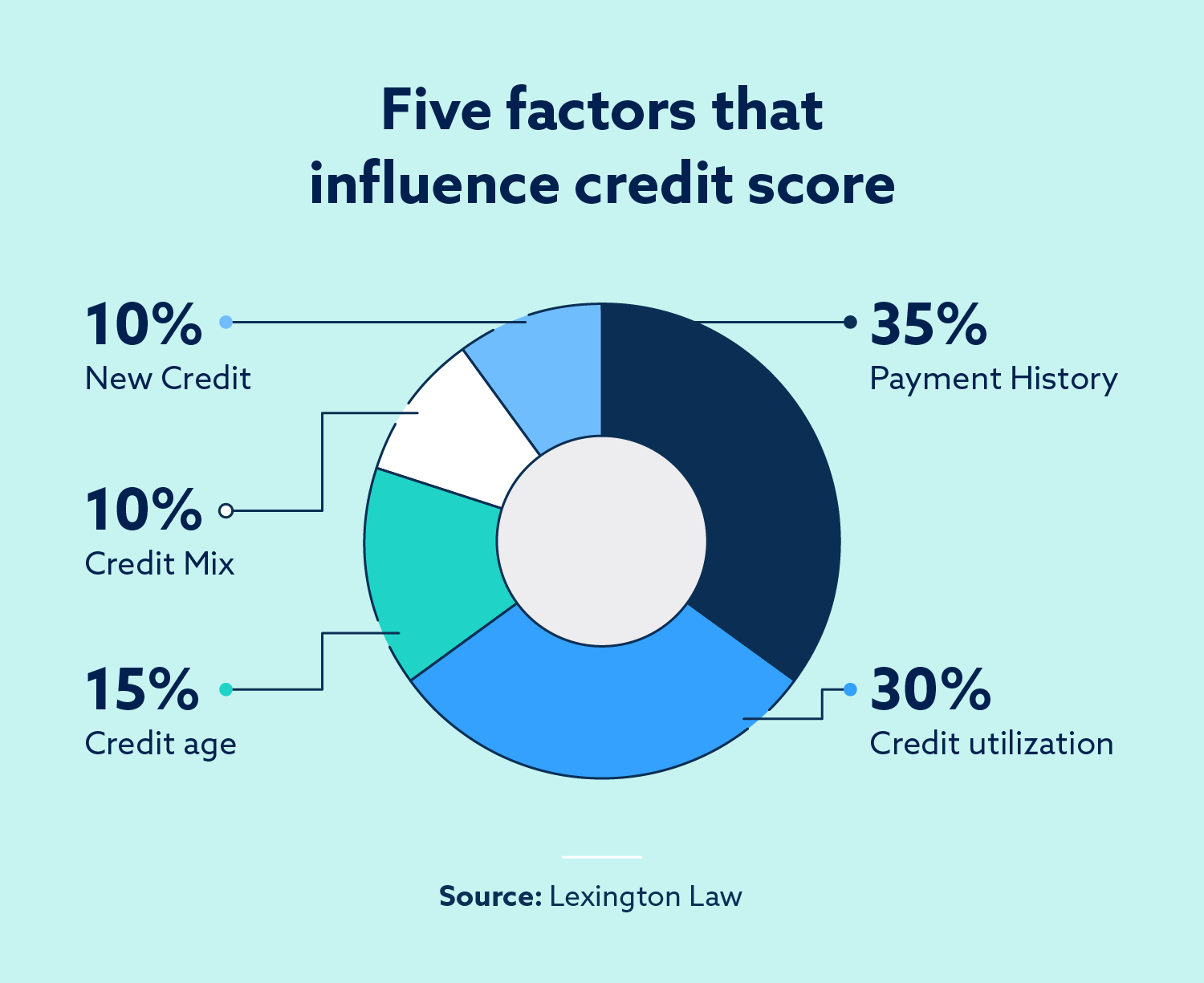

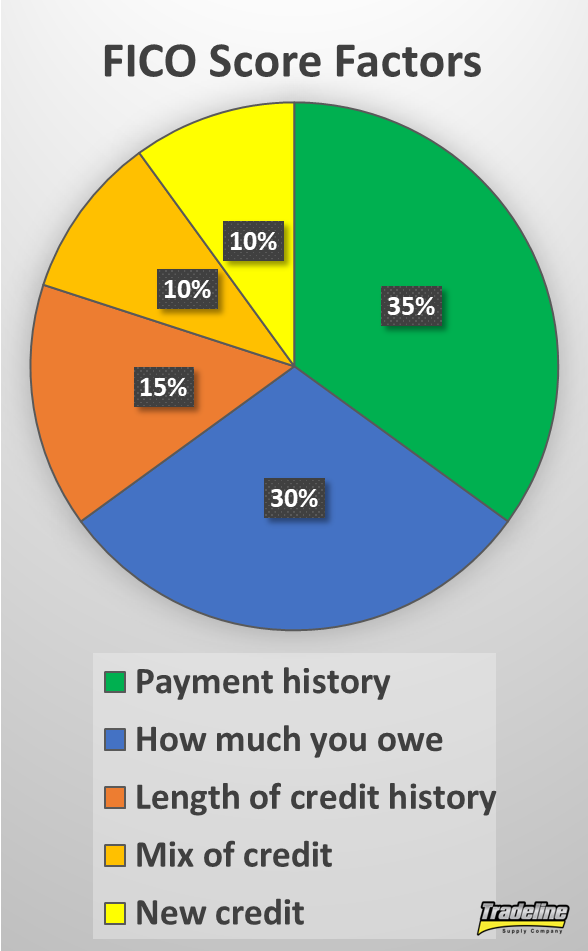

What Are The Five Main Credit Factors Leia Aqui What Are The 5 Key But it does tell us that the following five credit factors determine your score: payment history for loans and lines of credit: 35%. credit utilization (i.e., how much of your total available credit you’re using): 30%. length of credit history: 15%. credit mix: 10%. new credit and hard inquiries: 10%. These five factors help explain how information in your credit reports will be evaluated when your personal credit scores are calculated. the better you score on each of these factors, the higher your credit scores. using the fico model, here are the five main factors that affect your credit score: payment history (35%) debt utilization (30%). 3. somewhat important: length of credit history. a variety of factors related to the length of your credit history can affect your credit, including the following: the age of your oldest account. the age of your newest account. the average age of your accounts. whether you’ve used an account recently. 5 major factors impact your score. based on the credit score chart above, you can see that a credit score is developed using data from about 5 categories, often including: payment history. credit utilization (amount owed) length of credit history. credit mix. new credit.

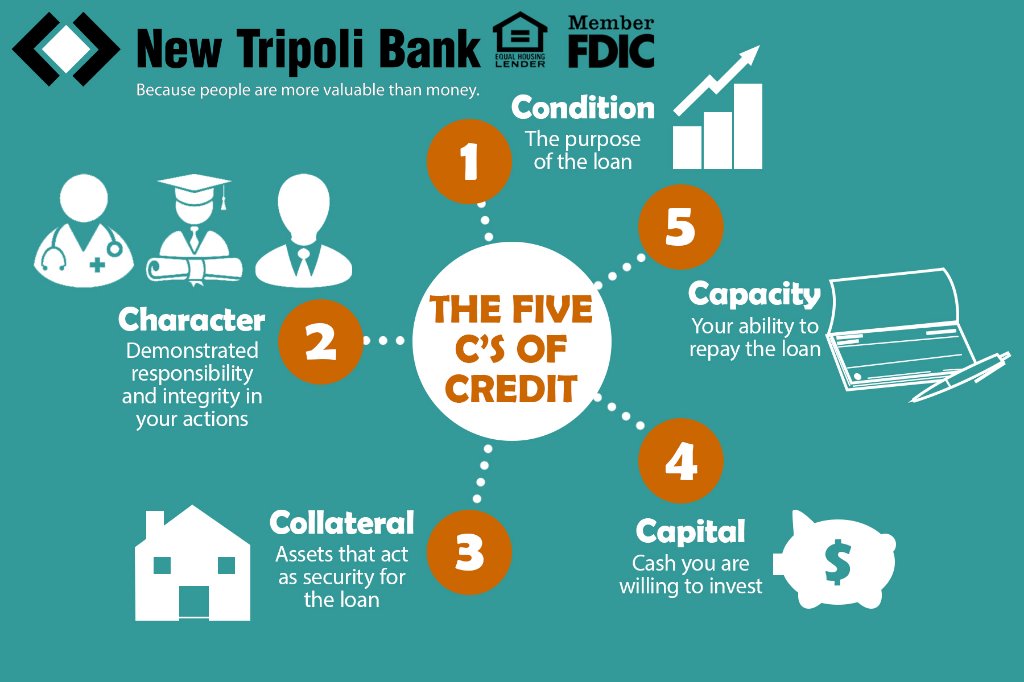

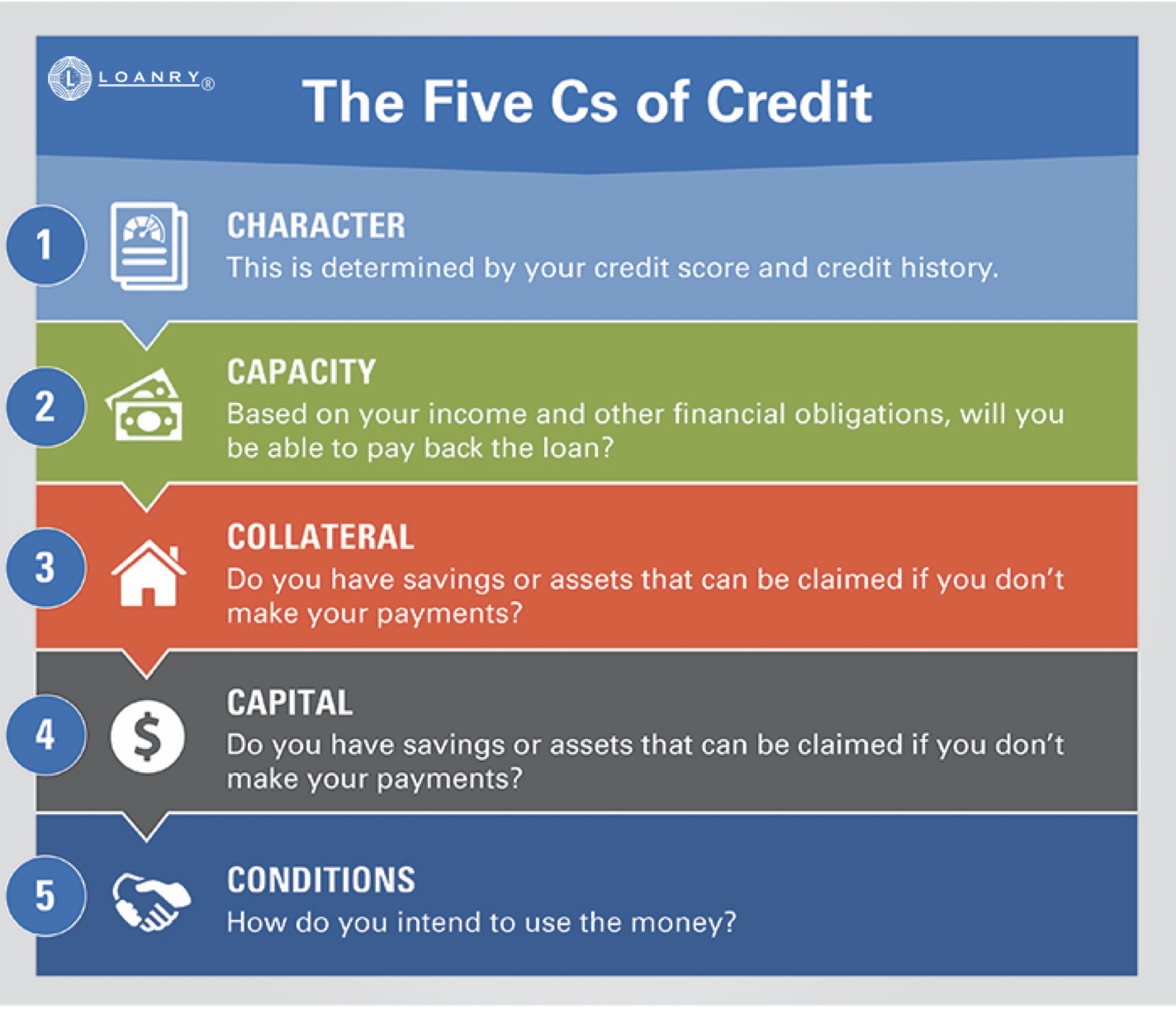

What Is The юааfiveюаб Cтащs Of юааcreditюаб юааleiaюаб юааaquiюаб юааwhat Are The 5юаб Cs Of юааcre 3. somewhat important: length of credit history. a variety of factors related to the length of your credit history can affect your credit, including the following: the age of your oldest account. the age of your newest account. the average age of your accounts. whether you’ve used an account recently. 5 major factors impact your score. based on the credit score chart above, you can see that a credit score is developed using data from about 5 categories, often including: payment history. credit utilization (amount owed) length of credit history. credit mix. new credit. The 5 factors that impact your credit score. knowing how credit scores are calculated can help you boost your standing if you pay close attention to these five criteria: 1. payment history. payment history is the most important factor influencing your credit score – accounting for 35% of the total score. Creditors and lenders also use your credit score to set the pricing and terms for your credit card or loan. having a higher credit score will help you qualify for lower interest rates on credit cards and loans. having no credit history or lower credit scores will result in being offered higher interest rates, which are ultimately more expensive.

What Are 5 Credits Leia Aqui What Are The 5 Cs Of Credit And Why The 5 factors that impact your credit score. knowing how credit scores are calculated can help you boost your standing if you pay close attention to these five criteria: 1. payment history. payment history is the most important factor influencing your credit score – accounting for 35% of the total score. Creditors and lenders also use your credit score to set the pricing and terms for your credit card or loan. having a higher credit score will help you qualify for lower interest rates on credit cards and loans. having no credit history or lower credit scores will result in being offered higher interest rates, which are ultimately more expensive.

What Are The 5 Things Which Impact A Credit Score Leia Aqui What Are

Comments are closed.