Venture Capital Metrics The Utlimate Cheat Sheet Diligent Equity

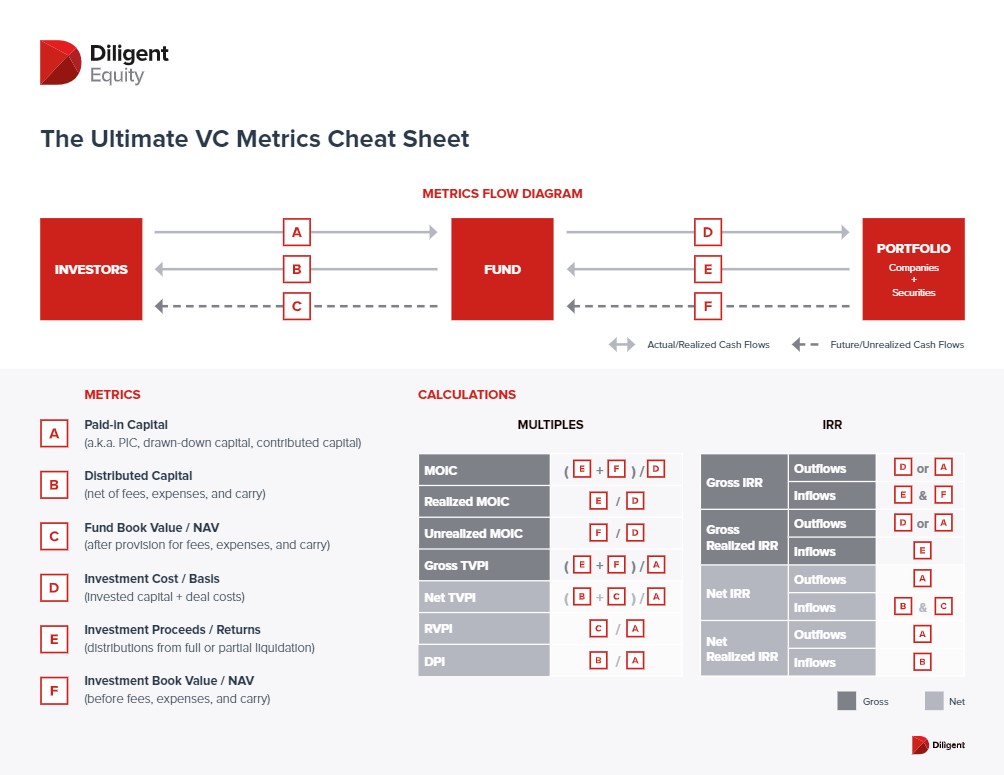

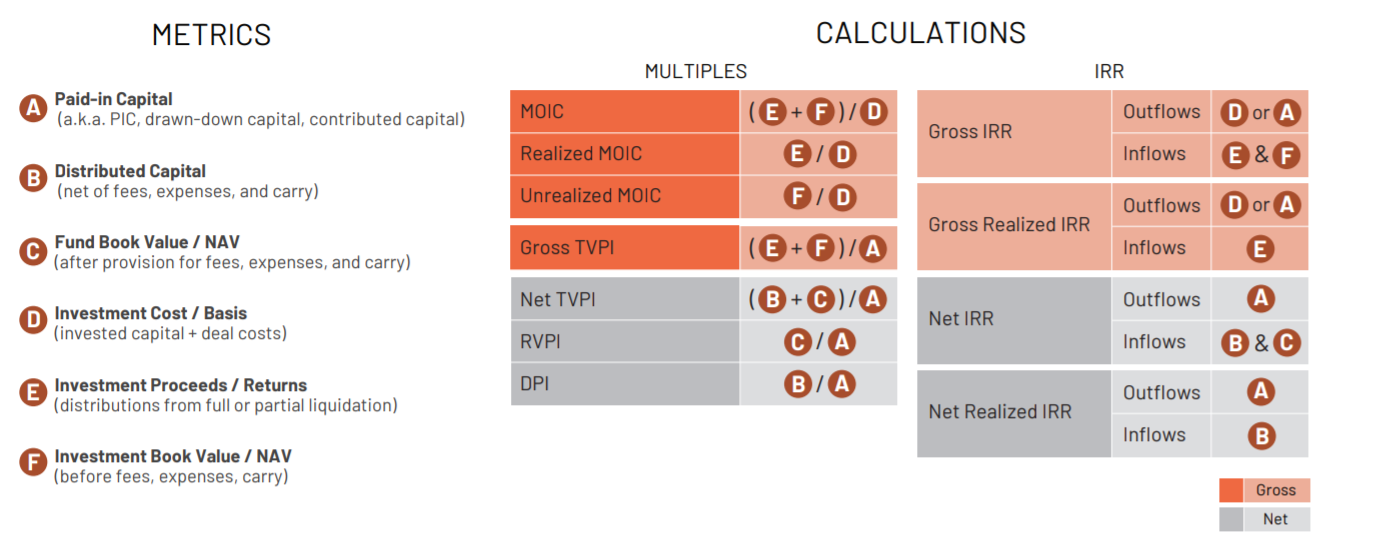

Venture Capital Metrics The Utlimate Cheat Sheet Diligent Equity Keep this two page cheat sheet on your desk to always refresh you on the metrics that are most important to your fund’s success. in this cheat sheet, you’ll learn: the 9 venture capital metrics you need to measure your fund’s health and performance. a breakdown of multiple and irr calculations. the key distinctions for differentiating. The ultimate vc metrics cheat sheet multiples internal rate of return (irr) gross net metric highlights a.k.a commentary multiple on invested capital (moic) • best multiple for gauging a gp’s raw investment acumen. • measures a gp’s ability to invest in big winners (measured as if the gp invested their own dollars).

Venture Capital Metrics The Utlimate Cheat Sheet Equityeffect Venture capital fund metrics cheat sheet. venture capital (vc) is a type of private equity financing many companies use to scale and grow. it requires investors to take educated risks and make calculations on companies with the potential for high growth. because of the risk involved, if you want to get deeper into the world of vc, it’s. Diligent equity the ultimate vc metrics cheat sheet free download as pdf file (.pdf), text file (.txt) or view presentation slides online. 9 venture capital metrics every vc should know [explained] venture capitalists use a variety of metrics to measure the potential success of a startup. in this article, we explain how vc metrics are calculated, used, and read for more profitable investment decisions. venture capital funds finance high growth potential companies, and to do so. 11. the venture capital fund model is a comprehensive tool designed to analyze the financial aspects of a venture capital fund, including its management company and supporting venture builder. the.

The Cheat Sheet For Venture Capital Metrics Diligent Equityођ 9 venture capital metrics every vc should know [explained] venture capitalists use a variety of metrics to measure the potential success of a startup. in this article, we explain how vc metrics are calculated, used, and read for more profitable investment decisions. venture capital funds finance high growth potential companies, and to do so. 11. the venture capital fund model is a comprehensive tool designed to analyze the financial aspects of a venture capital fund, including its management company and supporting venture builder. the. Find examples and templates at templates and resources for modeling venture funds. diligent equity has a good overview of venture capital fund metrics at venture capital fund metrics cheat sheet; allen latta also dives into more methods for comparing venture fund performance in his series on fund performance metrics. You may also like → 25 limited partners backing venture capital funds what they look for. capital metrics. total invested: the total amount of capital invested in portfolio companies. this includes initial capital and follow on capital. committed capital: the amount of money a limited partner promises to a venture capital fund.

Comments are closed.