Vat Value Added Tax Tutorial

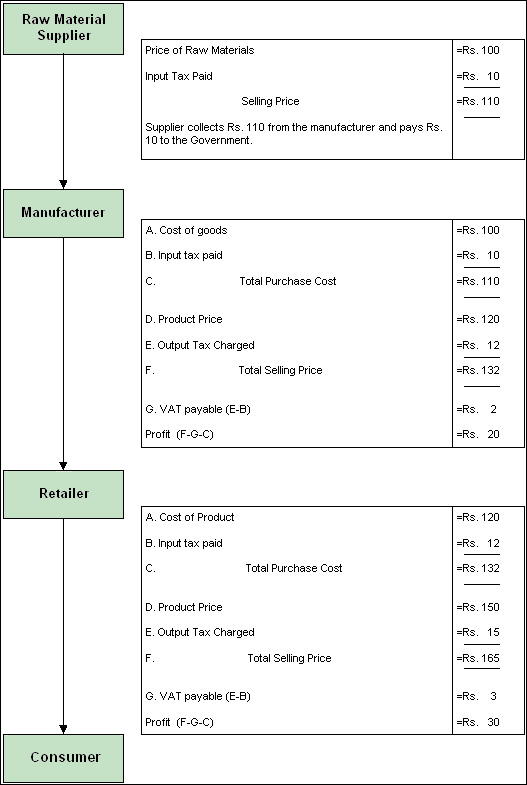

Vat Value Added Tax Tutorial What is vat? how does vat work? vat, or value added tax, is a system of indirect taxation. in this quick vat tutorial, i will walk you through the concept an. Consider the following example with a 10% vat assessed at each stage. a bike manufacturer purchases raw materials for $5.50, which includes a 10% vat. after completing the manufacturing of the parts, they are purchased by the assembler for $11, which includes a vat of $1. the manufacturer receives $11, of which he pays $0.50 to the government.

Vat Value Added Tax Tutorial How value added tax (vat) works. value added tax is typically a percentage of the sale price. for example, if you purchase a pair of shoes for $100, and the vat rate is 20%, you would pay $20 in. Understanding vat tax: how value added tax works. written by masterclass. last updated: jun 7, 2021 • 3 min read. value added tax holds every person or business within the supply chain liable for tax revenue on the production of a good, rather than just the end user. Vat definition. a value add tax is a tax charged on the gross profit of every step in the supply chain. it's best understood using an example: the country of decivat has a 10% value added tax. a flour manufacturer will buy $1,000 worth of grain from a farmer for $1,100, $100 of which will go to the government as vat, to create flour. Value added tax (vat) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. this includes labor and compensation charges, interest payments, and profits as well as materials. as with other consumption taxes, including goods and services tax (gst) or retail sales taxes, consumers pay.

Vat Value Added Tax Vat Forms I Tutorial Youtube Vat definition. a value add tax is a tax charged on the gross profit of every step in the supply chain. it's best understood using an example: the country of decivat has a 10% value added tax. a flour manufacturer will buy $1,000 worth of grain from a farmer for $1,100, $100 of which will go to the government as vat, to create flour. Value added tax (vat) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. this includes labor and compensation charges, interest payments, and profits as well as materials. as with other consumption taxes, including goods and services tax (gst) or retail sales taxes, consumers pay. Let us consider the following example to understand what is value added tax: example #1. theo is a chocolate manufactured and sold in the us. the us has a 10% value added tax. theo’s manufacturer procures the raw material at the cost of $10, plus vat of $1 – payable to the us government. the total price paid is $11. Value added tax (vat) is the international alternative to u.s. sales tax and is applied to the sale of goods and services in over 160 countries. however, vat tax is more complex than simple sales tax.

Vat Value Added Tax Vat Rate I Tutorial Youtube Let us consider the following example to understand what is value added tax: example #1. theo is a chocolate manufactured and sold in the us. the us has a 10% value added tax. theo’s manufacturer procures the raw material at the cost of $10, plus vat of $1 – payable to the us government. the total price paid is $11. Value added tax (vat) is the international alternative to u.s. sales tax and is applied to the sale of goods and services in over 160 countries. however, vat tax is more complex than simple sales tax.

Value Added Tax Vat Introduction Video Part 1 Youtube

Comments are closed.