Vat Value Added Tax Explained The Basics

Vat Value Added Tax Explained The Basics Youtube Value added tax (vat) is collected on a product at every stage of the supply chain where value is added to it, from production to point of sale. tax basics for investors. 501(c) organization. How value added tax (vat) works. value added tax is typically a percentage of the sale price. for example, if you purchase a pair of shoes for $100, and the vat rate is 20%, you would pay $20 in.

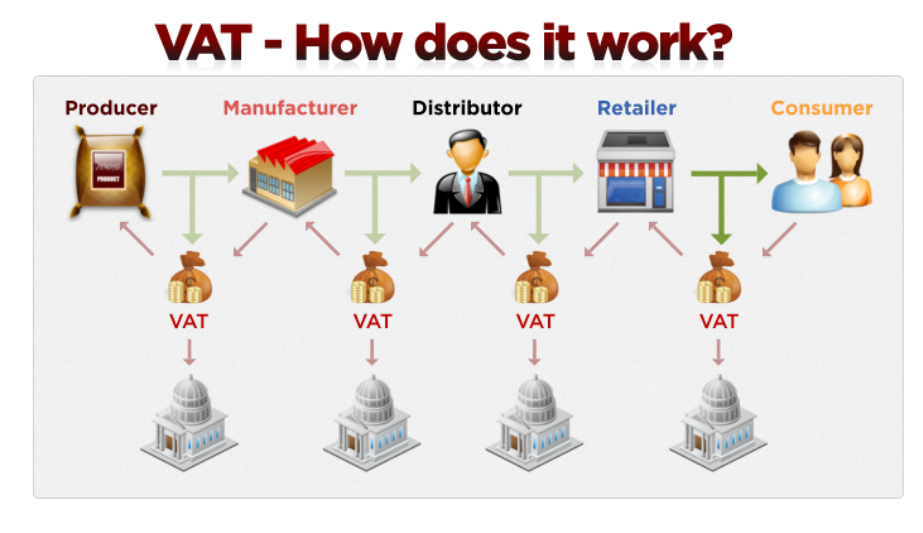

Vat Basics For Your Business Uk Value Added Tax Explained Youtub In short, value tax is the difference between the cost of goods and the sale price, known as the gross margin. vat depends on the cost of the item at the time when more value has been added. the. Value added tax (vat) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. this includes labor and compensation charges, interest payments, and profits as well as materials. as with other consumption taxes, including goods and services tax (gst) or retail sales taxes, consumers pay. Value added tax (vat): a guide for business owners. value added taxes (vat), which are a type of consumption tax, are major sources of revenue for countries in the organization for economic co operation and development (oecd), among other regions. according to the tax foundation, vat actually contributed to one third of the oecd countries. Vat definition. a value add tax is a tax charged on the gross profit of every step in the supply chain. it's best understood using an example: the country of decivat has a 10% value added tax. a flour manufacturer will buy $1,000 worth of grain from a farmer for $1,100, $100 of which will go to the government as vat, to create flour.

Vat Value Added Tax Explained Youtube Value added tax (vat): a guide for business owners. value added taxes (vat), which are a type of consumption tax, are major sources of revenue for countries in the organization for economic co operation and development (oecd), among other regions. according to the tax foundation, vat actually contributed to one third of the oecd countries. Vat definition. a value add tax is a tax charged on the gross profit of every step in the supply chain. it's best understood using an example: the country of decivat has a 10% value added tax. a flour manufacturer will buy $1,000 worth of grain from a farmer for $1,100, $100 of which will go to the government as vat, to create flour. The worldwide average value added tax rate is around 15 percent, with regional averages ranging from about 12 percent in asia to 20 percent in europe. the u.s. is unique among major countries in that it levies state and local sales taxes instead of a nationwide value added tax. the average u.s. state and local sales tax rate is 6.6 percent in. A value added tax (vat or goods and services tax (gst), general consumption tax (gct)), is a consumption tax that is levied on the value added at each stage of a product's production and distribution. vat is similar to, and is often compared with, a sales tax. vat is an indirect tax because the consumer who ultimately bears the burden of the.

Value Added Tax How Does It Work Classyright Business Consultancy The worldwide average value added tax rate is around 15 percent, with regional averages ranging from about 12 percent in asia to 20 percent in europe. the u.s. is unique among major countries in that it levies state and local sales taxes instead of a nationwide value added tax. the average u.s. state and local sales tax rate is 6.6 percent in. A value added tax (vat or goods and services tax (gst), general consumption tax (gct)), is a consumption tax that is levied on the value added at each stage of a product's production and distribution. vat is similar to, and is often compared with, a sales tax. vat is an indirect tax because the consumer who ultimately bears the burden of the.

Comments are closed.