Various Startup Funding Rounds And Development Stages Funding Slides

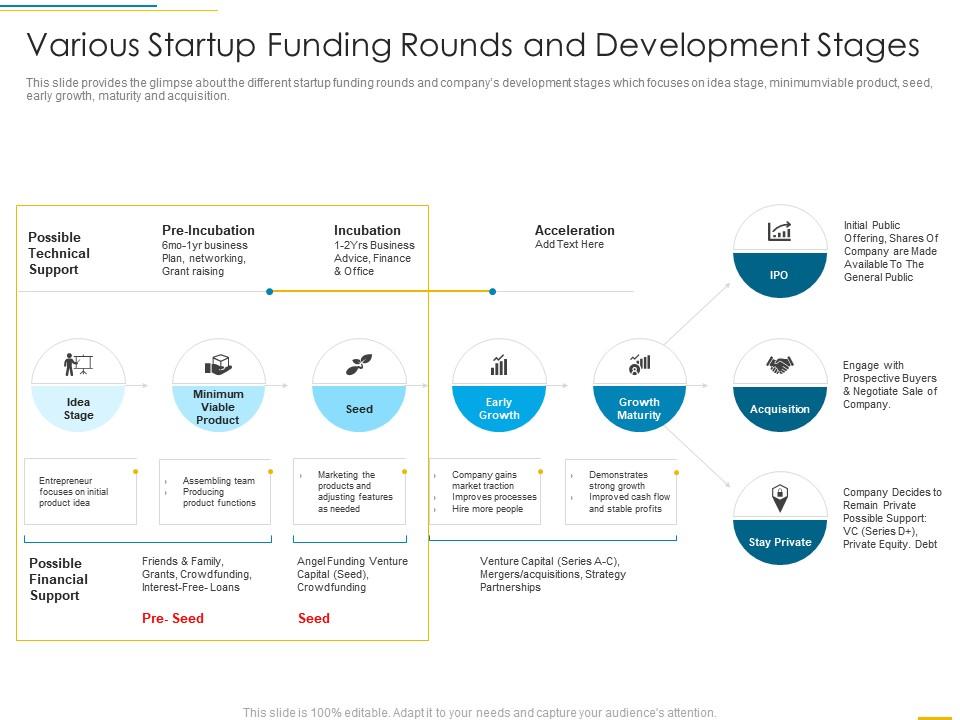

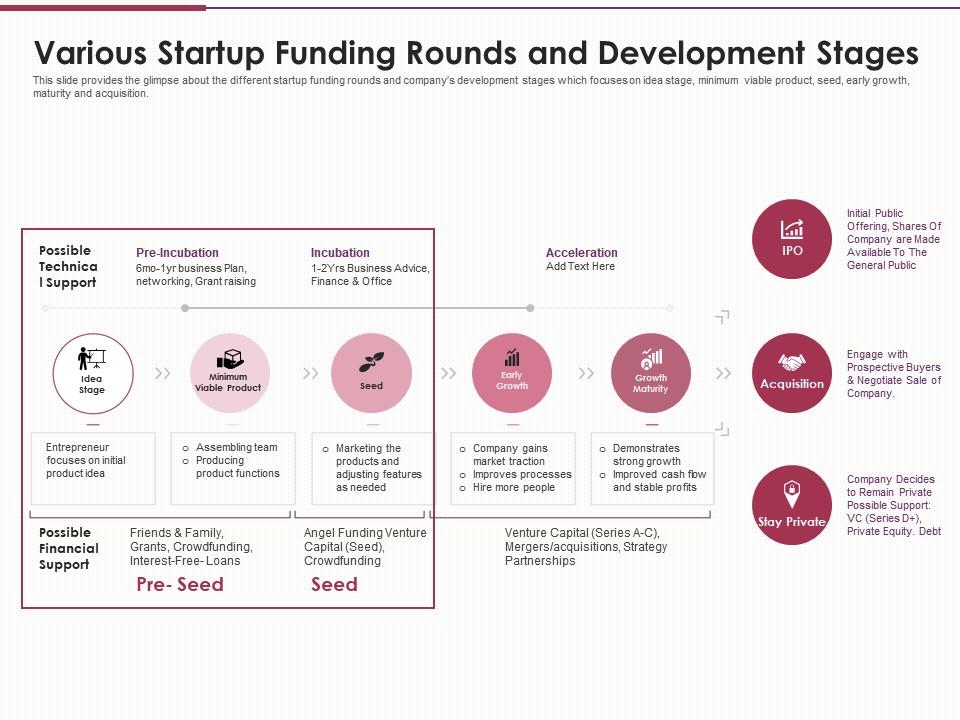

Various Startup Funding Rounds And Development Stages Funding Slides The four main stages of venture capital funding are pre seed, seed, series a, and series b rounds. each stage offers a different form of investment to help businesses grow and reach their goals. ultimately, it is essential for startups to understand these rounds in order to secure the right funding for their venture. This slide provides the glimpse about the different startup funding rounds and companys development stages which focuses on idea stage, minimum viable product, seed, early growth, maturity and acquisition. increase audience engagement and knowledge by dispensing information using various startup funding rounds and development stages funding slides.

Various Startup Funding Rounds And Development Stages Use Of As you can see, there is a yoy decline of 50%. even the angel seed round has drastically declined to $3.4 billion in q1 23 from $6.1 billion in q1 22. by understanding how startup funding trends and amounts vary for different startup funding stages, you as a founder would be better informed to take advantage of this knowledge. startup funding. Equity: seed investors typically get between 15% 35% of equity. valuations: typical seed round valuations in 2024 land between $1m to $15m. runway: seed capital should last 12 24 months on average, depending on your burn rate. average seed funding amount: over the past decade, seed checks have increased significantly. These challenges can undermine investor confidence and the startup's overall viability. funding in the series a stage typically ranges from $3m to $10m, sourced from institutional venture capitalists. this capital is instrumental in scaling the startup's operations, expanding the team, and entering new markets. –first round capital. at this stage, both the level of risk and potential payoff are at their highest. seed funding. after the initial stages, seed funding—the first official funding round for many companies—takes place. entrepreneurs use the funds for market testing, product development, and bringing operations up to speed.

Funds Usage Various Startup Funding Rounds And Development St These challenges can undermine investor confidence and the startup's overall viability. funding in the series a stage typically ranges from $3m to $10m, sourced from institutional venture capitalists. this capital is instrumental in scaling the startup's operations, expanding the team, and entering new markets. –first round capital. at this stage, both the level of risk and potential payoff are at their highest. seed funding. after the initial stages, seed funding—the first official funding round for many companies—takes place. entrepreneurs use the funds for market testing, product development, and bringing operations up to speed. We have crafted this editable free startup template showing the 6 stages of the funding process: pre seed, seed, early stage, growth, expansion, and exit. the first slide, our free startup funding stages powerpoint template, shows a six column design where each segment represents the stages. above each column, there are meaningful illustrations. Funding at various stages helps mitigate these risks by providing the necessary capital to address challenges and unforeseen obstacles. validation and traction: securing funding at different stages is a validation of a startup’s potential. it demonstrates to investors, customers, and partners that the business concept is worth pursuing.

Comments are closed.