Value At Risk With Monte Carlo Simulation

Value At Risk With Monte Carlo Simulation Monte carlo var is a method for calculating value at risk (var) that uses a computational technique called monte carlo simulation to generate random scenarios based on historical data. it is more flexible and can accommodate non linear relationships and correlations between assets compared to other var methods like the variance covariance method and historical simulation var. There are three methods of calculating value at risk (var) including the historical method, the variance covariance method, and the monte carlo simulation. 1. historical method.

Monte Carlo Simulation Of Value At Risk Var In Excel Youtube The monte carlo analysis is a decision making tool that can help an investor or manager determine the degree of risk that an action entails. finding value at risk in excel. the monte carlo. 90% eurvalue at risk. do your calculations three times, using sample sizes m of 100, 1000, and 10,000. compare your results for the different sample sizes, and compare them with the corresponding results you obtained for exercise 10.3. solution. monte carlo value at risk: numerical transformations based upon the monte carlo method were applied. A monte carlo simulation for the above scenario might have inputs. $100, 000 initial investment; 9.5% expected return; 18.5% volatility; 30 year time frame; however run for 50,000 simulations and look at all 50,000 results. A monte carlo simulation allows analysts and advisors to convert investment chances into choices by factoring in a range of values for various inputs. finding value at risk in excel.

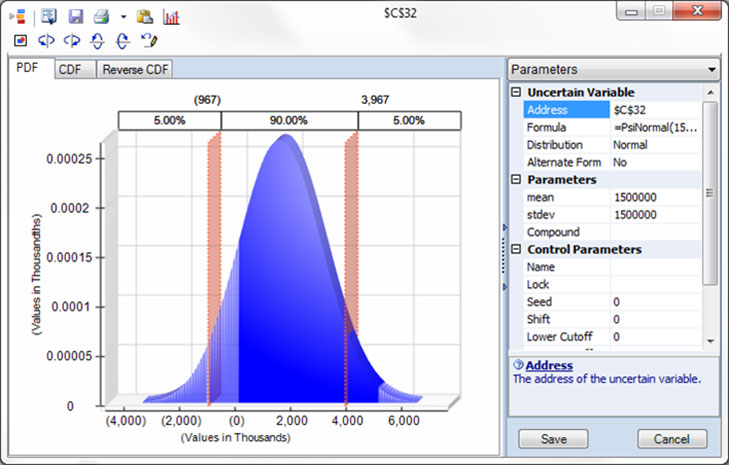

Tutorial Risk Analysis And Monte Carlo Simulation Solver A monte carlo simulation for the above scenario might have inputs. $100, 000 initial investment; 9.5% expected return; 18.5% volatility; 30 year time frame; however run for 50,000 simulations and look at all 50,000 results. A monte carlo simulation allows analysts and advisors to convert investment chances into choices by factoring in a range of values for various inputs. finding value at risk in excel. Step 5 – rank the m terminal stock prices from the smallest to the largest, read the simulated value in this series that corresponds to the desired (1 \alpha α)% confidence level (95% or 99% generally) and deduce the relevant var, which is the difference between si and the ath lowest terminal stock price. Running hypothetical portfolios through historical data or from monte carlo simulations. in this section, we describe and compare the approaches.1 variance covariance method since value at risk measures the probability that the value of an asset or portfolio will drop below a specified value in a particular time period, it should be relatively.

Comments are closed.