Value At Risk Definition How It Works History And Methods Of

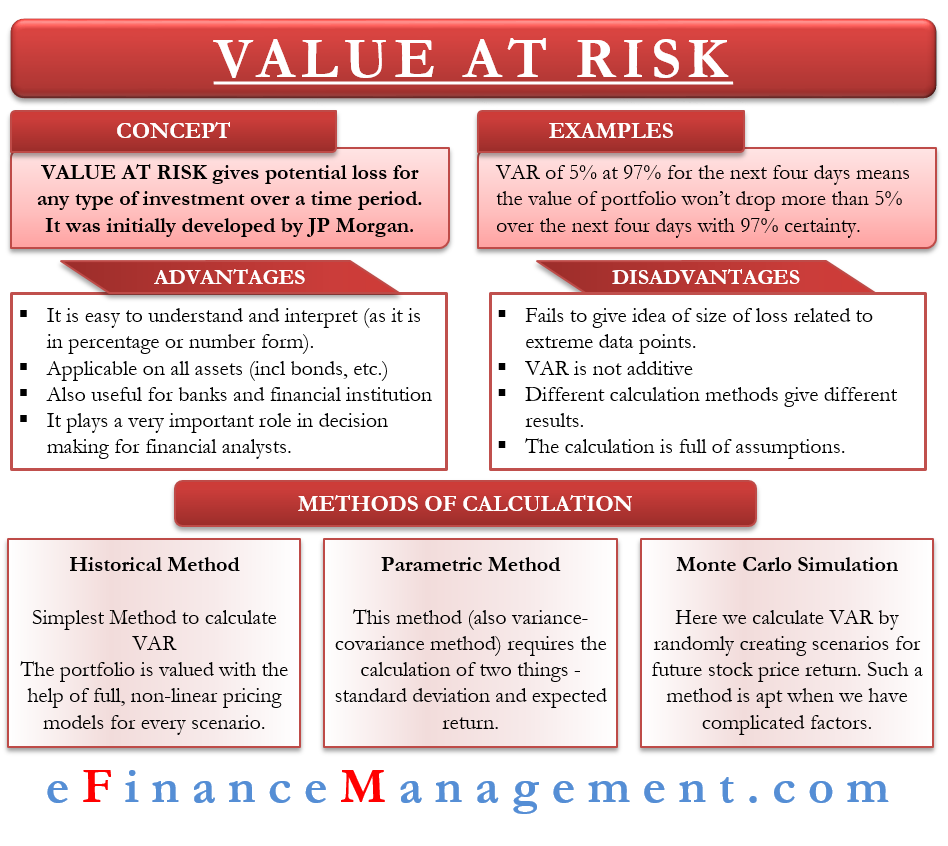

What Is Value At Risk Var Definition And Meaning Market Business News Value at risk (var) is a tool for every investment decision. value at risk is a financial metric to calculate the maximum financial loss that can occur over a period of time. a value at risk metric can only be specified after identifying 3 things. 1) the period of time over which a possible loss will be calculated. Though there are several different methods of calculating var, the historical method is the simplest: value at risk = vm (vi v(i 1)) m is the number of days from which historical data is taken.

Value At Risk Var вђ All You Need To Know Value at risk. value at risk = vm (vi v (i 1)) m = the number of days from which historical data is taken. vi = the number of variables on the day i. in calculating each daily return, we. Value at risk is a widely used risk measure that estimates the potential loss in the value of a portfolio or financial instrument over a specific time horizon and with a given level of confidence. it quantifies the maximum potential loss an investor could experience in a specified period under normal market conditions. Var. value at risk is a statistical metric to compute a portfolio's risk. it displays the highest possible loss and a given confidence level. it considers the market price and the volatility in a given time frame. investors, analysts, and regulators widely use var to measure the risks in their portfolios. Understanding the basics. value at risk, commonly referred to as var, seeks to quantify the maximum potential loss an investment portfolio could face over a specified period for a given confidence interval. source: wallstreet mojo.

Value At Risk Wikipedia Var. value at risk is a statistical metric to compute a portfolio's risk. it displays the highest possible loss and a given confidence level. it considers the market price and the volatility in a given time frame. investors, analysts, and regulators widely use var to measure the risks in their portfolios. Understanding the basics. value at risk, commonly referred to as var, seeks to quantify the maximum potential loss an investment portfolio could face over a specified period for a given confidence interval. source: wallstreet mojo. Value at risk is commonly used to determine the extent and probabilities of potential losses in a given portfolio. managers use var to measure and control their overall level of risk exposure. The 5% value at risk of a hypothetical profit and loss probability density function. value at risk (var) is a measure of the risk of loss of investment capital. it estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. var is typically used by firms and.

:max_bytes(150000):strip_icc()/Value_At_Risk-41be4adde1ef4915a1ca7f85407d77c6.jpg)

Understanding юааvalueюаб юааat Riskюаб Var And How Itтащs Computed Value at risk is commonly used to determine the extent and probabilities of potential losses in a given portfolio. managers use var to measure and control their overall level of risk exposure. The 5% value at risk of a hypothetical profit and loss probability density function. value at risk (var) is a measure of the risk of loss of investment capital. it estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. var is typically used by firms and.

Value At Risk Definition How It Works History And Methods Of

Comments are closed.