Using An Hsa As A Retirement Account вђ Raa Blog

Using An Hsa As A Retirement Account вђ Raa Blog There are few vehicles as tax efficient as a health savings account (hsa). i like to think of hsas as a roth on steroids. as you know, in most cases[1], with a roth account you can invest after tax dollars that grow tax free and are withdrawn tax free in retirement. with an hsa, you can deposit pre tax dollars…. From personal experience i highly recommend fidelity for hsa accounts. unlike hsa bank and other vendors, there is no monthly account fee, no minimum account balance to invest, and you get access to fidelity’s funds and awesome customer service. most hsa vendors charge a monthly account maintenance fee of $2.50 to $4 and require anywhere.

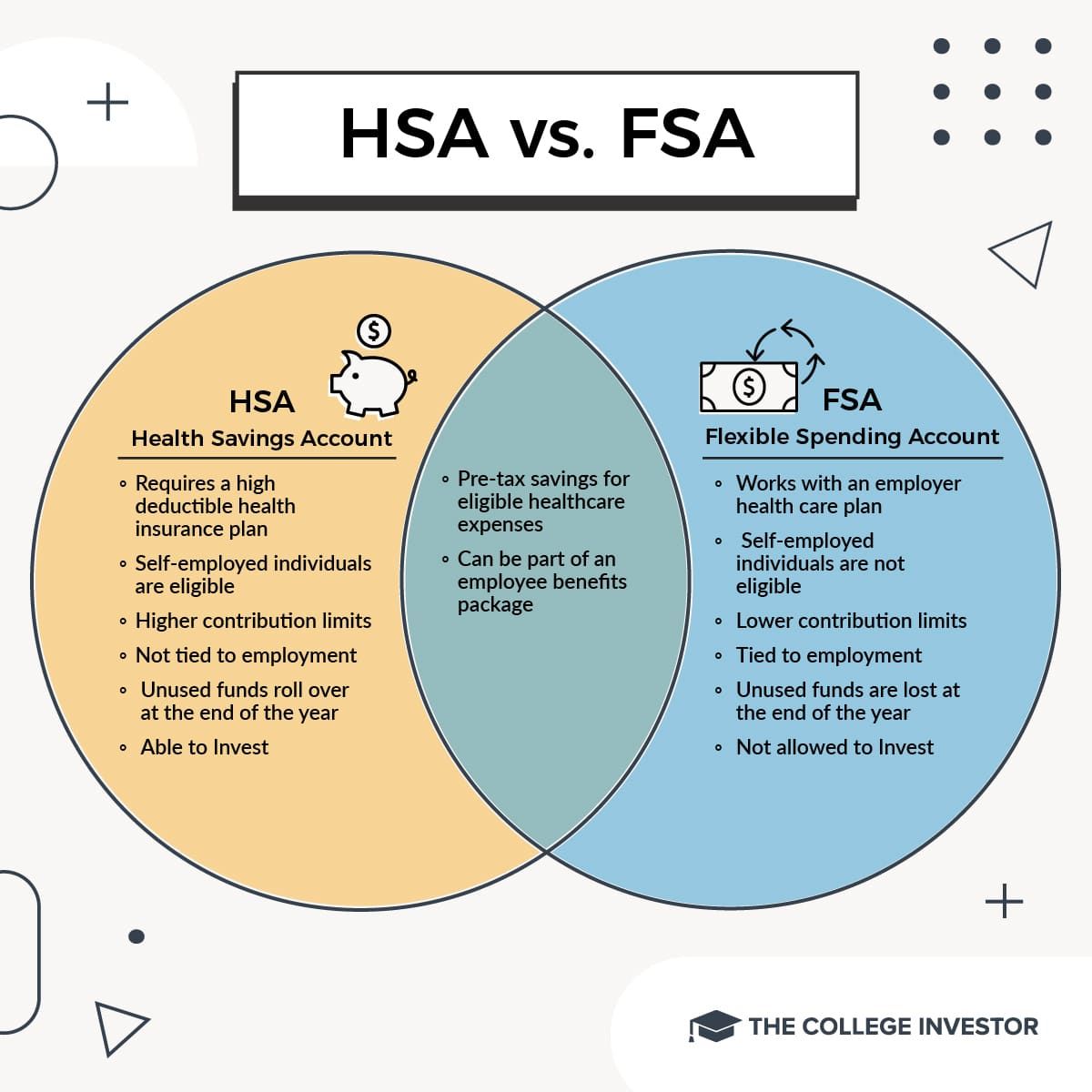

Why An Hsa Is The Ultimate Retirement Account The Money Ninja If you’d like to dive deeper into this topic, read this article about using an hsa as a retirement account. how can an hsa be used? an hsa can be used for many health care costs before retirement, but there are four primary ways to leverage this account once you exit the workforce. 1. long term care insurance coverage. Yes, you can use an hsa for retirement. the hsa rules relax once you reach age 65. at that point, you can continue using your hsa for qualified medical expenses tax free. and you can use it for. Say you're 40, on individual coverage, and you max out your hsa every year until you turn 65. assuming a 10% annual return, your account would grow to $398,513. but not everyone can max out their. Hsas are savings accounts that can be used to pay for medical expenses for those with high deductible health plans. in order to be eligible for an hsa, your health plan’s annual deductible.

Using Your Hsa For Retirement вђ How To Track It Easily And Efficiently Say you're 40, on individual coverage, and you max out your hsa every year until you turn 65. assuming a 10% annual return, your account would grow to $398,513. but not everyone can max out their. Hsas are savings accounts that can be used to pay for medical expenses for those with high deductible health plans. in order to be eligible for an hsa, your health plan’s annual deductible. Health savings accounts have a couple tax benefits that help you make the most of your assets. your contributions are pre tax, meaning you can deduct them from your income taxes. you can use these funds at any time to pay for qualified medical expenses without paying taxes or penalties. and when you turn 65, you can use your hsa for anything. There are a lot of ways to make hsas work for you—whether you are still employed, getting ready to retire, or even retired and enrolled in medicare. to get started, consider these 5 ways that hsas can help fortify your retirement. 1. understand the triple tax advantage and how hsas work.

How To Use An Hsa In Retirement The Secret Ira Hack Health savings accounts have a couple tax benefits that help you make the most of your assets. your contributions are pre tax, meaning you can deduct them from your income taxes. you can use these funds at any time to pay for qualified medical expenses without paying taxes or penalties. and when you turn 65, you can use your hsa for anything. There are a lot of ways to make hsas work for you—whether you are still employed, getting ready to retire, or even retired and enrolled in medicare. to get started, consider these 5 ways that hsas can help fortify your retirement. 1. understand the triple tax advantage and how hsas work.

Comments are closed.