Use Case Story Improving Brand Intelligence To Expand Consumer Banking

Use Case Story Improving Brand Intelligence To Expand Consumer Banking Use case story: improving brand intelligence to expand consumer banking. today's social media phenomenon takes brand intelligence tracking to new heights. now, brands are able to leverage a two way relationship where they can directly engage with customers and, in turn, analyze social data to understand the consumer. the challenge is to gather. Use case story: pr crisis management for recovering from a recent data breach by | 2020 12 07t05:20:10 05:00 | use case story: improving brand intelligence to expand consumer banking.

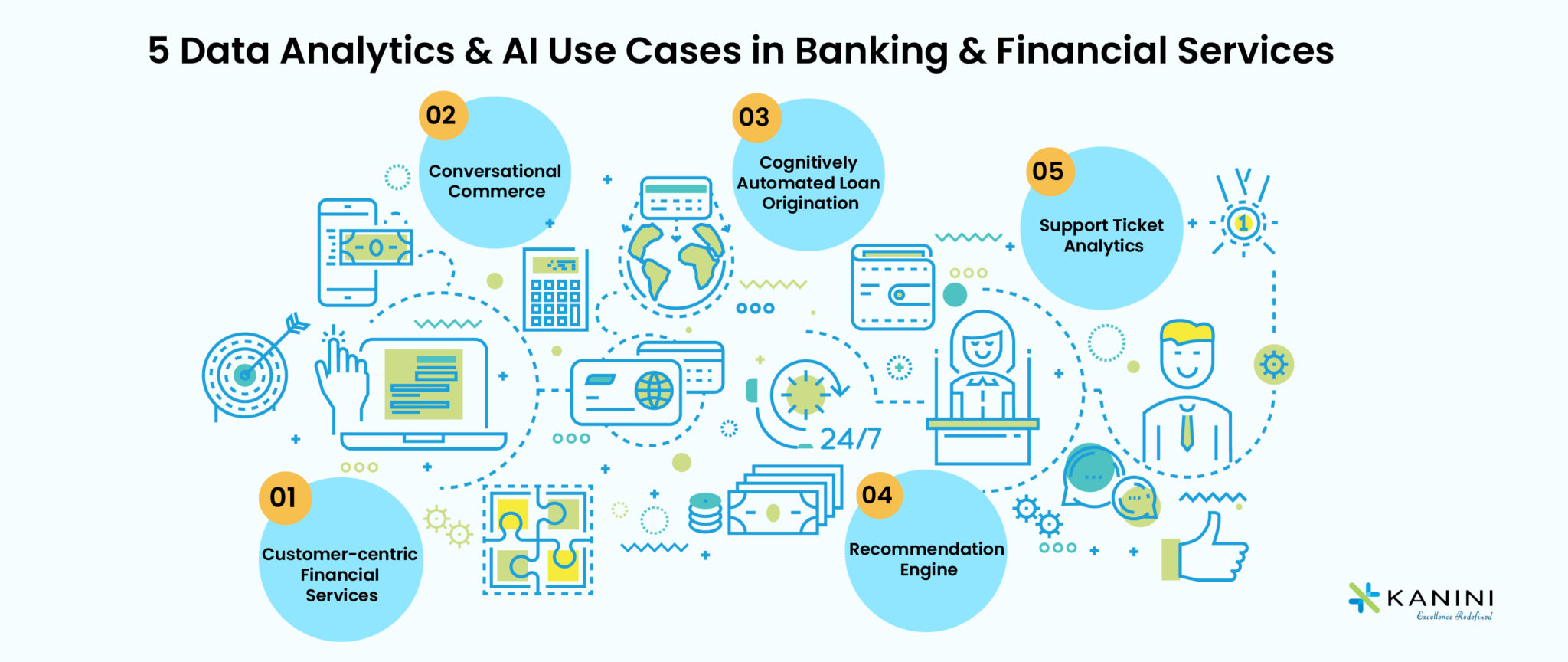

Use Case Vs User Story A Detailed Comparison The primary goals for marketers using ai are improving the customer experience and personalizing the customer journey, driving marketing effectiveness, customer lifetime value and retention. “ai and generative ai are rapidly transforming how we view personalized banking experiences. it’s enabled our ability to analyze vast amounts of data. A mckinsey survey of us retail banking customers found that at the banks with the highest degree of reported customer satisfaction, deposits grew 84 percent faster than at the banks with the lowest satisfaction ratings (exhibit 1). 1. superior experiences are not only a proven foundation for growth but also a crucial means of countering threats. Artificial intelligence is not new to the banking industry. for more than a decade, banks have been leveraging ai in fraud detection, credit scoring, and more recently, customer service through chatbots and virtual assistants. these applications improve operational efficiency and enhance the overall banking experience for customers and members. Mckinsey estimates that across the global banking sector, ai and generative ai in particular could add up to $340 billion or 4.7% of total industry revenues annually. generative ai use cases in banking are diverse and impactful, including enhanced customer service, fraud detection, regulatory compliance, and predictive analytics.

7 Business Intelligence Use Cases You Need To Know Vrogue Co Artificial intelligence is not new to the banking industry. for more than a decade, banks have been leveraging ai in fraud detection, credit scoring, and more recently, customer service through chatbots and virtual assistants. these applications improve operational efficiency and enhance the overall banking experience for customers and members. Mckinsey estimates that across the global banking sector, ai and generative ai in particular could add up to $340 billion or 4.7% of total industry revenues annually. generative ai use cases in banking are diverse and impactful, including enhanced customer service, fraud detection, regulatory compliance, and predictive analytics. 5 best examples of hyper personalisation in digital banking. here are some hyper personalisation examples that have gained momentum in the digital banking space so far: 1. custom made product recommendations. the type of customisation that users enjoy when platforms like netflix present them with movies and shows that they ‘might like’. The mckinsey global institute (mgi) estimates that across the global banking sector, gen ai could add between $200 billion and $340 billion in value annually, or 2.8 to 4.7 percent of total industry revenues, largely through increased productivity. 1 however, as banks and other financial institutions move to quickly implement the technology.

Comments are closed.