Us August Advance Retail Sales 0 3 Vs 0 0 E

Us August Advance Retail Sales 0 3 Vs 0 0ођ Real Retail Sales contract slightly in August 2024, showing a soft landing for the economy Click for my full review of the data and the likely impact on markets The consumer discretionary sector has been having a slow 2024 Since the start of the year, the S&P 500 Consumer Discretionary Select Sector SPDR (XLY) has advanced 83% as of Sept 18 However, with

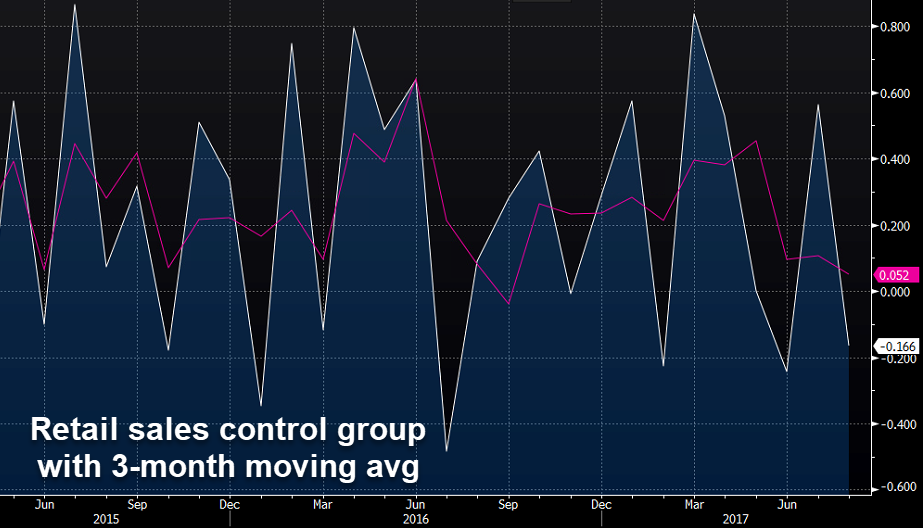

Us August Advance Retail Sales 0 2 Vs 0 1 Expected Average paychecks, particularly for lower-income Americans, have also risen sharply since the pandemic, which has allowed many Americans to continue spending even as many necessities became more The dollar is sensitive to interest rate expectations as well as predictions about the health of the US economy It has moved lower in recent weeks as weakening US data has cemented bets that the Fed Japan trade deficit for August was not as bad as citing sources -(US) Aug advance Retail Sales M/M: +01% V -02%E; Retail Sales (EX-AUTO) M/M: 01% V 02%E; Retail Sales (control group): 03% v US BUSINESS inventories increased slightly more than expected in July, suggesting that inventory investment could contribute to economic growth in the third quarter Read more at The Business Times

Us August Advance Retail Sales 0 1 Vs 0 4 Expected Japan trade deficit for August was not as bad as citing sources -(US) Aug advance Retail Sales M/M: +01% V -02%E; Retail Sales (EX-AUTO) M/M: 01% V 02%E; Retail Sales (control group): 03% v US BUSINESS inventories increased slightly more than expected in July, suggesting that inventory investment could contribute to economic growth in the third quarter Read more at The Business Times London stocks closed higher on Tuesday as investors focused on the start of the US Federal Reserve's two-day policy meeting, where a rate cut was widely anticipated The consumer discretionary industry is expected to be spurred by economic growth, growing spending, and rapid digital influence this holiday season Thus, it could be ideal to buy fundamentally solid The bull has trotted across all global markets, from the US to Asia to Europe after the Fed rate cut and awaiting the next ones soon The appetite for risk has returned and tech has celebrated Today, Investors are looking to retail sales data for clues to consumer health, the last piece of data that could factor into the Fed's rate decision

Macro Matters Us August Retail Sales Independent Strategy London stocks closed higher on Tuesday as investors focused on the start of the US Federal Reserve's two-day policy meeting, where a rate cut was widely anticipated The consumer discretionary industry is expected to be spurred by economic growth, growing spending, and rapid digital influence this holiday season Thus, it could be ideal to buy fundamentally solid The bull has trotted across all global markets, from the US to Asia to Europe after the Fed rate cut and awaiting the next ones soon The appetite for risk has returned and tech has celebrated Today, Investors are looking to retail sales data for clues to consumer health, the last piece of data that could factor into the Fed's rate decision At the regional level, results in August were mixed The selling rate in China remained relatively stable this month, with the market expected to gain momentum in the near-term I The Dow Jones Industrial Average (^DJI) lingered in negative territory until midday, closing by 058% higher As the holidays are right around the corner, retail sales are likely to increase

Comments are closed.