Understanding The Forex Abcd Pattern Blueberry Markets

Understanding The Forex Abcd Pattern Blueberry Markets The bullish three drive pattern in forex trading is a rare pattern that gives traders information about the forex market's potential at its most bearish point, and in turn, suggests probabilities for a market reversal. How to identify the abcd pattern? to identify the abcd pattern, traders need to look for specific characteristics in the price chart. firstly, the ab leg should be a.

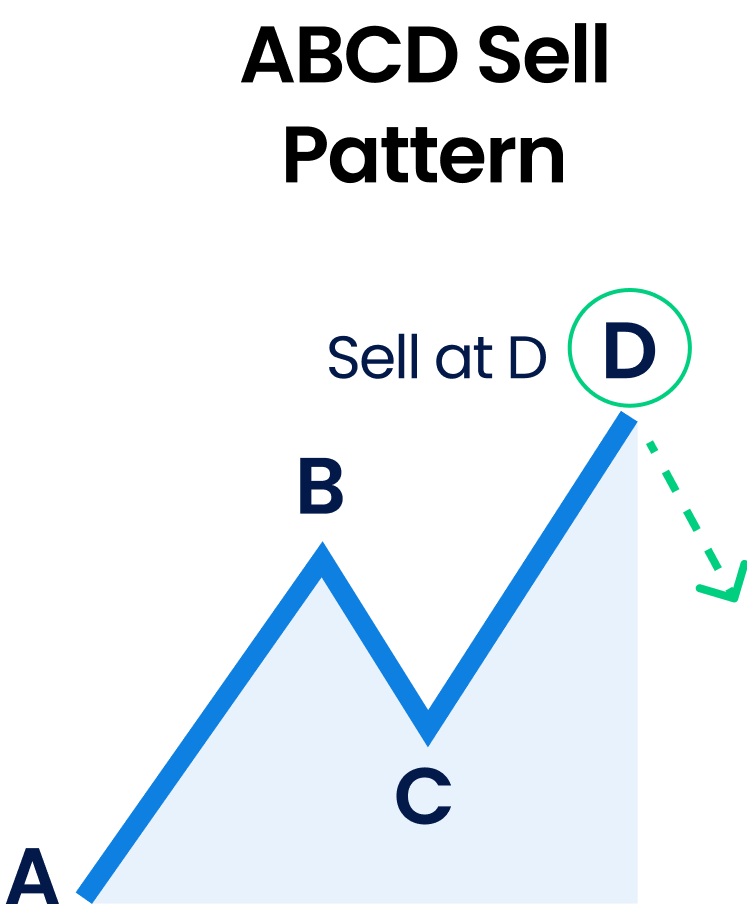

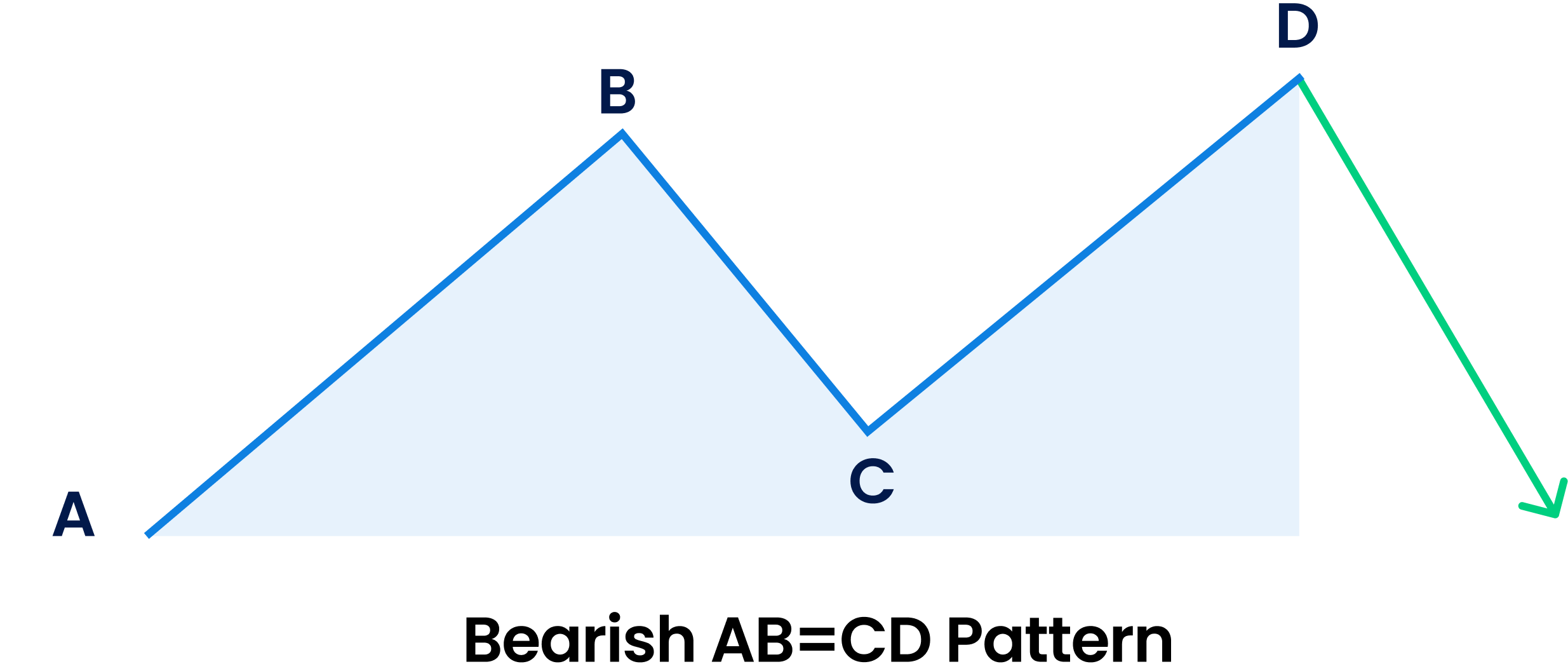

Understanding The Forex Abcd Pattern Blueberry Markets By the time the whole three drive pattern is complete, that’s when you can pull the trigger on your long or short trade. typically, when the price reaches point b, you can already set your short or long orders at the 1.272 extension so that you won’t miss out!. Harmonic price patterns allow traders to accurately predict future price movements and trend reversals in order to make ideal entry and exit decisions in the forex market. the financial markets follow the ebb and flow cycles which are always in sync with the growth and decline phases of the different markets. By understanding the characteristics of the pattern, confirming its validity, and effectively managing risk, traders can increase their chances of success in the forex market. however, it is important to remember that no trading strategy guarantees profits, and traders should always exercise caution and perform thorough analysis before making. Cd should then be 127.2% or 161.8% of bc. on a bearish abcd, you might choose to enter a sell position at this point. on a bullish one, you might want to buy the market.

Comments are closed.