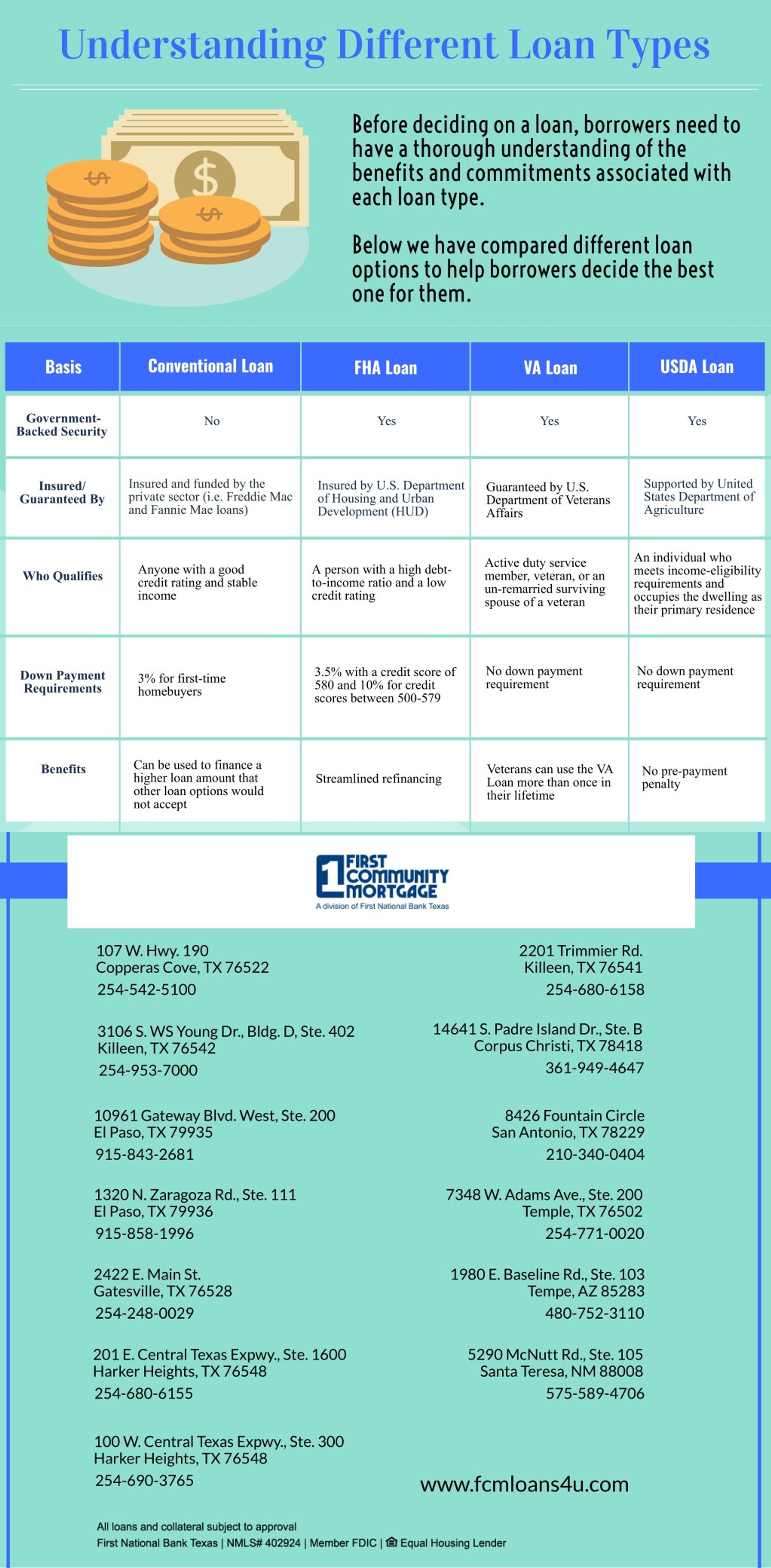

Understanding Different Loan Types

Understanding The Different Types Of Mortgage Loans Infographic Banking systems around the world have huge effects on our lives, yet few people understand how banks work Worse yet, even fewer understand the malign powers of This means you'll pay a fixed amount in interest over the life of your loan This type of interest is usually the APY will directly impact the amount of interest you earn Understanding the

Ppt Understanding Different Loan Types Powerpoint Presentation Free Divi is the CEO and founder of Writeable: A Copywriting Agency and works with a variety of different brands s real estate market, understanding the various types of mortgages can make a Free learning opportunities will be available from Northern Initiatives, a nonprofit lender working throughout Michigan — Applying for a Business Loan 101: This free webinar Tuesday can help As an English-as-a-Second-Language (ESL) student at the University of Texas at Austin, navigating loan options can be a daunting task Balancing academic responsibilities with financial obligations Our guide can help you understand home equity loan risks and how to protect your financial future from the drawbacks of home equity loans Read on to learn how to avoid home equity loan risks

Explore Personal Loan Types Key Differences What You Need To Know As an English-as-a-Second-Language (ESL) student at the University of Texas at Austin, navigating loan options can be a daunting task Balancing academic responsibilities with financial obligations Our guide can help you understand home equity loan risks and how to protect your financial future from the drawbacks of home equity loans Read on to learn how to avoid home equity loan risks When you start repaying your debt depends on the type of student loans you have, your lender, and other factors Learn more about starting loan repayments Minimum down payments for first-time homebuyers range from 0% to 20%, though down payment assistance programs can help lower this upfront cost Understanding the difference between banks and credit unions can help you make the best decisions for your household Explore the challenges and financial solutions related to understanding unemployment Learn about the impact of unemployment on individuals and economies

Comments are closed.