Uncertainty Consumer Utility

Ppt Lecture 5 Consumer Choice Under Uncertainty Powerpoint For the second inequality, write the left hand side as (β − α)p αp (1 − β)p and the right hand side as (β − α)p αp (1 − β)p, and again invoke independence. a similar argument works for the third inequality. step 2. now, i claim that for any p ∈ p, there exists a unique λp such that: λpp (1 − λp)p ∼ p. The consumer is risk averse because she would prefer a certain income of $20,000 (with a utility of 16) to a gamble with a .5 probability of $10,000 and a .5 probability of $30,000 (and expected utility of 14). the expected utility of the uncertain income is 14—an average of the utility at point a (10) and the utility at e (18)—and is shown.

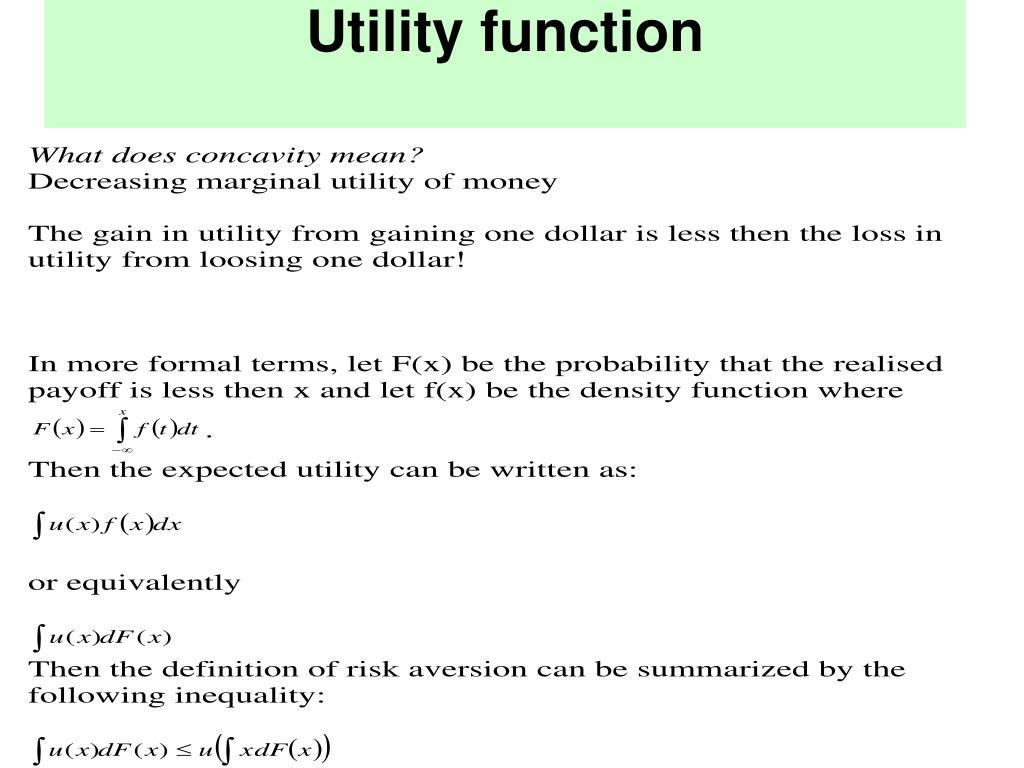

Ppt Consumption And Uncertainty Powerpoint Presentation Free Definition. a utility function u : p → has an expected utility form if. r. there exists a function u : c → such that. (p) = p (c) u (c) for all p ∈ p. c ∑. ∈c. in this case, the function u is called an expected utility function, and the function u is call a von neumann morgenstern utility function. Economics. in decision theory, the von neumann–morgenstern (vnm) utility theorem demonstrates that rational choice under uncertainty involves making decisions that take the form of maximizing the expected value of some cardinal utility function. this function is known as the von neumann–morgenstern utility function. The consumer’s expected utility is x ss 2) we have argued that the consumer’s choices are constrained to satisfy the following implicit budget constraint p x p x p w l p w 1 1 2 2 1 2 ()ÖÖ. this is the line depicted in the figure. group exercise: what must be the price ratio if the consumer purchases full coverage? (i.e. xx 12). Over risky outcomes. standard consumer theory continues to describe the utility of consumption of specific bundles. expected utility theory describes how a consumer might select among risky bundles. definition 5 the utility function u: £ →r has an expected utility form if there is an assignment of numbers (u.

Ppt Lecture 5 Consumer Choice Under Uncertainty Powerpoint The consumer’s expected utility is x ss 2) we have argued that the consumer’s choices are constrained to satisfy the following implicit budget constraint p x p x p w l p w 1 1 2 2 1 2 ()ÖÖ. this is the line depicted in the figure. group exercise: what must be the price ratio if the consumer purchases full coverage? (i.e. xx 12). Over risky outcomes. standard consumer theory continues to describe the utility of consumption of specific bundles. expected utility theory describes how a consumer might select among risky bundles. definition 5 the utility function u: £ →r has an expected utility form if there is an assignment of numbers (u. Risk averse consumer v x x v x v x( ) ( ) ( )s s s s 1 1 2 2 1 1 2 2 ! . in the lower figure ux() is strictly concave so that v x x v x v x v( ) ( ) ( ) [ ]s s s s 1 1 2 2 1 1 2 2 ! . in practice consumers exhibit aversion to such a risk. thus we will (almost) always assume that the expected utility function vx() is a strictly increasing. However, the world is filled with uncertainty. we don’t know if it will rain tomorrow, if the stock market will go up next year, or if a new business will succeed or fail. this lecture analyzes the implications of uncertainty for consumer decisions. the economics of uncertainty impacts our decision to play the lottery.

Ppt Lecture 5 Consumer Choice Under Uncertainty Powerpoint Risk averse consumer v x x v x v x( ) ( ) ( )s s s s 1 1 2 2 1 1 2 2 ! . in the lower figure ux() is strictly concave so that v x x v x v x v( ) ( ) ( ) [ ]s s s s 1 1 2 2 1 1 2 2 ! . in practice consumers exhibit aversion to such a risk. thus we will (almost) always assume that the expected utility function vx() is a strictly increasing. However, the world is filled with uncertainty. we don’t know if it will rain tomorrow, if the stock market will go up next year, or if a new business will succeed or fail. this lecture analyzes the implications of uncertainty for consumer decisions. the economics of uncertainty impacts our decision to play the lottery.

Ppt Lecture 5 Consumer Choice Under Uncertainty Powerpoint

Comments are closed.