Types Of Investments

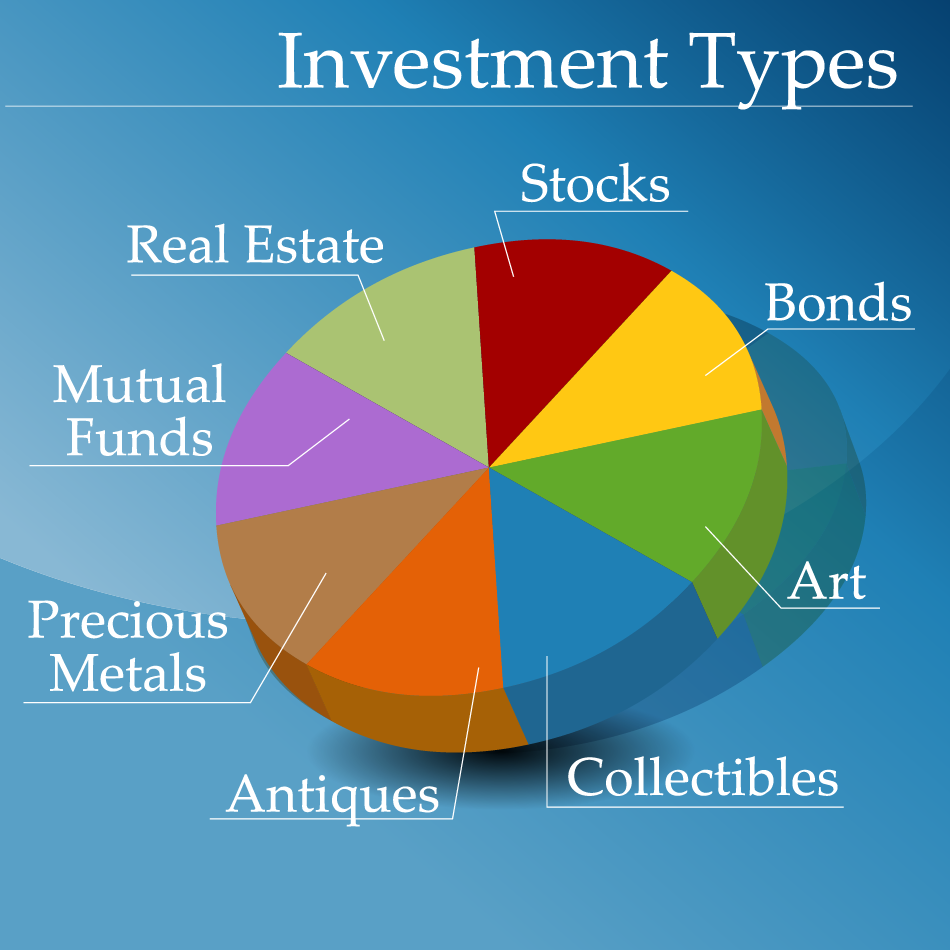

11 Types Of Investments What They Are How They Work Mint 1. stocks. stocks, also known as shares or equities, might be the most well known and simple type of investment. when you buy stock, you’re buying an ownership stake in a publicly traded company. many of the biggest companies in the country are publicly traded, meaning you can buy stock in them. Learn the basics of investing, the types of assets and instruments you can invest in, and the factors that affect your returns and risks. compare different investing styles, such as active vs. passive, and find out how to get started with investing.

Types Of Investment Portfolios Learn the basics of stocks, bonds, mutual funds, index funds, etfs and options, and how they differ in risk and return. compare the best online brokers for beginners and find out how to invest in each type of investment. Learn about different types of investments, from stocks and bonds to etfs and cryptocurrency. compare their risks, returns, and costs, and find out how to invest with acorns. Learn the basics of investing, from how much money you need to start, to what types of investments you can choose from, to how to invest in the stock market. compare individual stocks, mutual funds, index funds and etfs, and find out how to diversify your portfolio and avoid common pitfalls. Bonds. esg. stocks. cash investments. cryptocurrency. investment type comparisons. explore how much cash you should maintain in your portfolio. learn the benefits and risks of cash holdings and how they can provide liquidity and stability in your investments. learn about different types of esg funds to give you a feel for how they’re.

What Is Investment Orowealth Blog Learn the basics of investing, from how much money you need to start, to what types of investments you can choose from, to how to invest in the stock market. compare individual stocks, mutual funds, index funds and etfs, and find out how to diversify your portfolio and avoid common pitfalls. Bonds. esg. stocks. cash investments. cryptocurrency. investment type comparisons. explore how much cash you should maintain in your portfolio. learn the benefits and risks of cash holdings and how they can provide liquidity and stability in your investments. learn about different types of esg funds to give you a feel for how they’re. Historically, the three main asset classes are considered to be equities (stocks), debt (bonds), and money market instruments. today, many investors may consider real estate, commodities, futures. Learn what an investment is and how to choose from various types of investments, such as stocks, bonds, real estate, and more. find out how to calculate return on investment, manage risk, and diversify your portfolio.

Comments are closed.