True Cost Of Homeownership Home Ownership Homeowners Insurance Real

True Cost Of Homeownership Home Ownership Homeowners Insurance Real Homeowners spend an average of $17,958 each year on expenses, not including payments toward their mortgage principal and interest. that cost has risen $500, or 2.9%, since 2023. spending $17,958 per year, it would take a homeowner just five years and seven months to rack up $100,000 in additional expenses. But current homeowners, perhaps less visibly, are also feeling the pain of expensive housing costs. entering 2023, the true cost of owning a home is climbing quickly. in addition to their mortgage payments, the average u.s. homeowner spends $17,459 annually on hidden costs. those costs include: $4,975 for utilities.

What Is Homeowners Insurance And What Does It Cover The best time to get a sense of the costs involved in home ownership is before you begin to look for one, especially since the “hidden costs” of owning a home can top $14,000 a year for the average u.s. homeowner and exceed $22,000 in pricey metros such as san francisco and new york. the sum — which pencils out to $1,180 a month for the. According to our data, the share of homeowners spending at least $10,000 on maintenance and repairs each year tripled from 6% in 2019 to 20% in 2022. one in three homeowners (33%) spend $5,000 or more annually. overall, 94% of homeowners devoted some amount of money to home repairs: 13% of homeowners spent $1 $499. According to one recent report from wallethub, the average homeowner pays around $2,869 a year in property taxes. but that tax rate can vary wildly. in new jersey, for example, the tax rate is 2. On a $275,000 (the median u.s. home price in early 2020), closing costs can run between $8,250 and $16,500. taxes and insurance. the annual cost of homeownership, beyond a monthly mortgage payment, includes property taxes and homeowners insurance, which together cost the average u.s. homeowner more than $4,000 each year.

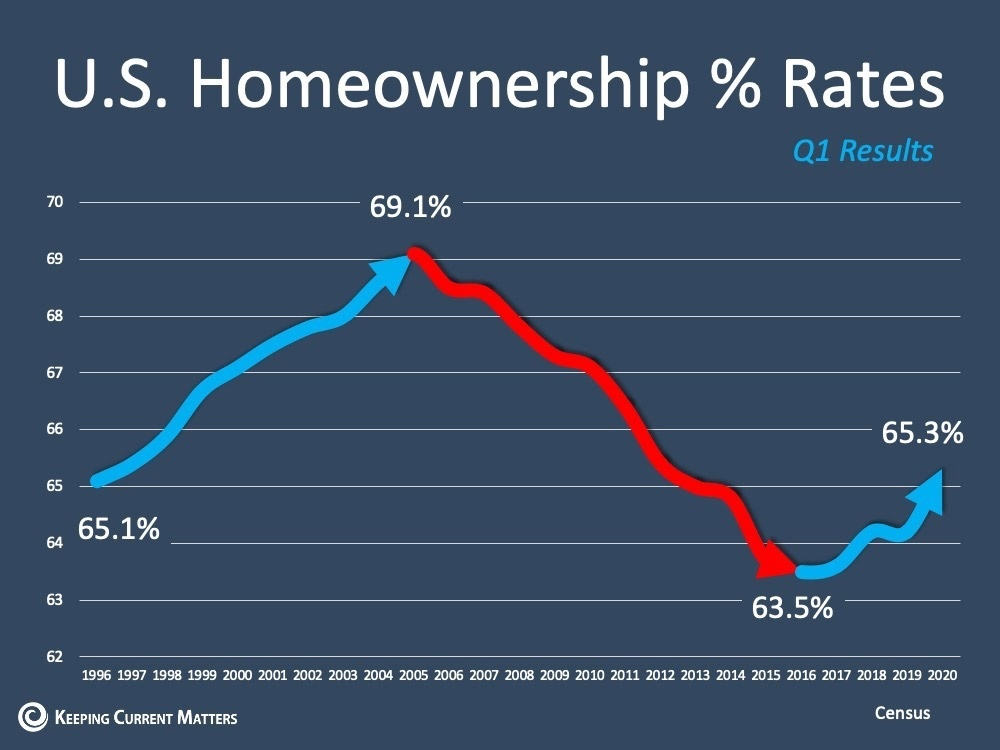

Home Ownership Chart Usa According to one recent report from wallethub, the average homeowner pays around $2,869 a year in property taxes. but that tax rate can vary wildly. in new jersey, for example, the tax rate is 2. On a $275,000 (the median u.s. home price in early 2020), closing costs can run between $8,250 and $16,500. taxes and insurance. the annual cost of homeownership, beyond a monthly mortgage payment, includes property taxes and homeowners insurance, which together cost the average u.s. homeowner more than $4,000 each year. In the example below, i’ve listed estimated monthly carrying costs for a $400,000 home with a $371,160 mortgage (10% down) and a 2.49% mortgage rate amortized over 25 years. Key findings. the average u.s. homeowner spends $2,676 on maintenance and repairs, $6,649 on home improvements [1], $2,600 in property taxes [2], and $1,228 on homeowners insurance [3] every year. 59% of homeowners making renovations are using some combination of credit cards, personal loans, and home equity loans to fund their projects.

These Are The Most And Least Expensive States For Home Insurance In the example below, i’ve listed estimated monthly carrying costs for a $400,000 home with a $371,160 mortgage (10% down) and a 2.49% mortgage rate amortized over 25 years. Key findings. the average u.s. homeowner spends $2,676 on maintenance and repairs, $6,649 on home improvements [1], $2,600 in property taxes [2], and $1,228 on homeowners insurance [3] every year. 59% of homeowners making renovations are using some combination of credit cards, personal loans, and home equity loans to fund their projects.

Comments are closed.