Trading The Pivots Using The A B C D Pattern Midweek Market Report

Trading The Pivots Using The A B C D Pattern Midweek Market Report Join this channel to get access to perks: channel ucafxpqyft9ffjacxm jmpya joinlink to the last friday's market report for reference:h. Join this channel to get access to perks: channel ucafxpqyft9ffjacxm jmpya joinlink to last week's report for reference: youtu .

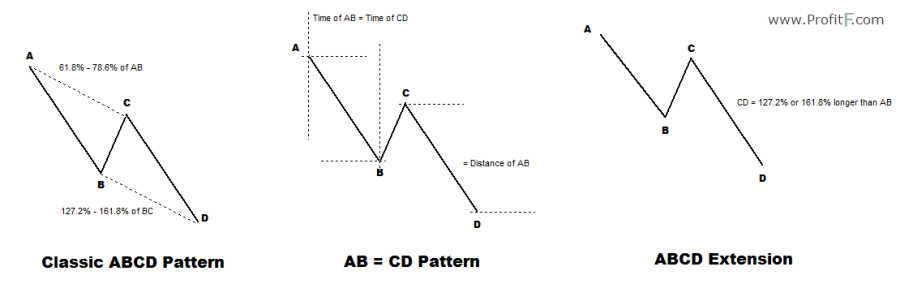

Abcd Pattern Trading Strategy 2 Forex Training Group Trading the pivots, using the a b c d pattern midweek market report with aj monte cmt. Typically, an abcd pattern in trading that is pointing upward is an indication of a bearish reversal. the initial intrada swing from a to b consolidates briefly in b to c. then, once the c to d portion of the move is complete, it often signals a bearish reversal. from a b and c d bulls are pushing the stock higher and higher with aggressive demand. Figure 2: an abc pattern a pivot long signal. confluence zones not shown. at the beginning of an uptrend, for example, the equity would make an aggressive move to an extreme pivot point (marked. Fibonacci pivot points: these pivot points use fibonacci studies (projections, extensions, and retracements) to determine trend direction and trading stance. demark pivot points : these pivot points were designed by renowned trader tom demark and are conditional in nature with an outcome that is based on the relationship between price bars.

Abcd Pattern Trading How To Trade The Abcd Figure 2: an abc pattern a pivot long signal. confluence zones not shown. at the beginning of an uptrend, for example, the equity would make an aggressive move to an extreme pivot point (marked. Fibonacci pivot points: these pivot points use fibonacci studies (projections, extensions, and retracements) to determine trend direction and trading stance. demark pivot points : these pivot points were designed by renowned trader tom demark and are conditional in nature with an outcome that is based on the relationship between price bars. Let’s take a closer look at how pivot points are calculated. the formula for calculating the pivot point is as follows: pivot point = (high low close) 3. once the pivot point is determined, the support and resistance levels can be calculated. the most commonly used levels are:. 2. pivot point bounce trading. this is another pivot point trading approach. instead of buying breakouts, in this pivot point trading strategy we emphasize the examples when the price action bounces from the pivot levels. if the stock is testing a pivot line from the upper side and bounces upwards, then you should buy that stock.

Market Pivots Daily Pivot Points The Market Pivots Forecaster Let’s take a closer look at how pivot points are calculated. the formula for calculating the pivot point is as follows: pivot point = (high low close) 3. once the pivot point is determined, the support and resistance levels can be calculated. the most commonly used levels are:. 2. pivot point bounce trading. this is another pivot point trading approach. instead of buying breakouts, in this pivot point trading strategy we emphasize the examples when the price action bounces from the pivot levels. if the stock is testing a pivot line from the upper side and bounces upwards, then you should buy that stock.

Comments are closed.