Three Approaches To Value At Risk Var And Volatility Frm T4 1 Yo

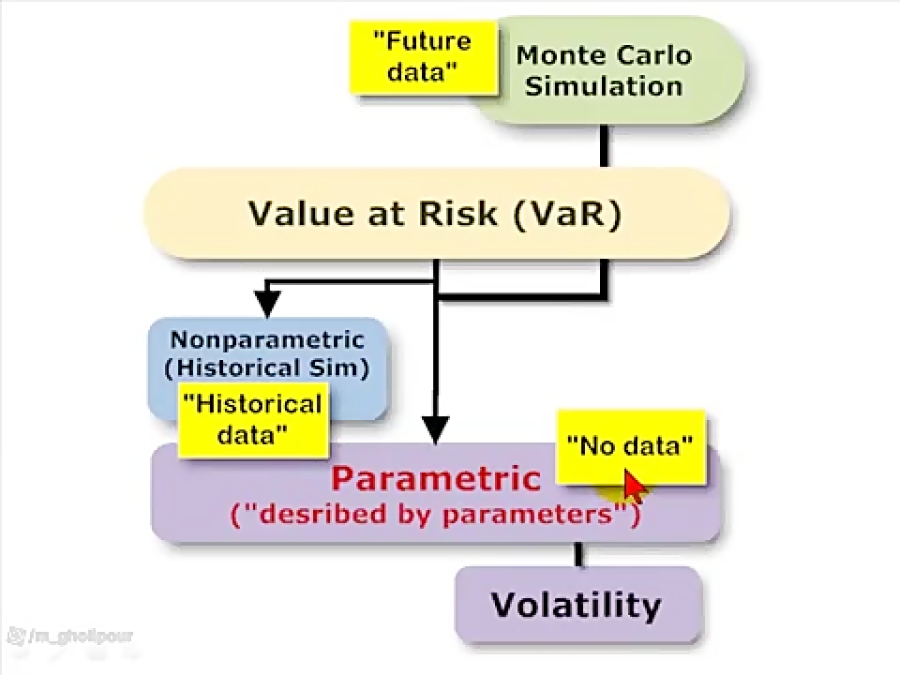

Three Approaches To Value At Risk Var And Volatility Frm о The three approaches are 1. parametric; aka, analytical; 2. historical simulation; and 3. monte carlo simulation (mcs). the parametric approach assumes a cle. Subscriber. the three approaches are 1. parametric; aka, analytical; 2. historical simulation; and 3. monte carlo simulation (mcs). the parametric approach assumes a clean function, the other two work with messy data. historical simulation is betrayed by a histogram, mcs is betrayed by a random number generator.

Frm Three Approaches To Value At Risk Var This is a brief introduction to the three basic approaches to value at risk (var): historical simulation, monte carlo simulation, parametric var (e.g., delta. Conventionally volatility is defined as a change of a variable value over a period of time. in the context risk management, volatility is defined as the standard deviation of an asset return in one day. the assets return in a day i is defined as: ri = si − si − 1 si − 1. where: ri: return on a day i. Specifically, at the end of the 12 week horizon, the position’s expected future value is $100 * (1 9%*12 52) = $102.077 due to its expected gain (aka, drift) of 9.0% per annum. the relative var is $15.803 because that is the worst expected loss relative to the expected future value of $102.077. Value at risk. value at risk = vm (vi v (i 1)) m = the number of days from which historical data is taken. vi = the number of variables on the day i. in calculating each daily return, we.

Comments are closed.