Three Approaches To Value At Risk Var And Volatility Frm T4 1

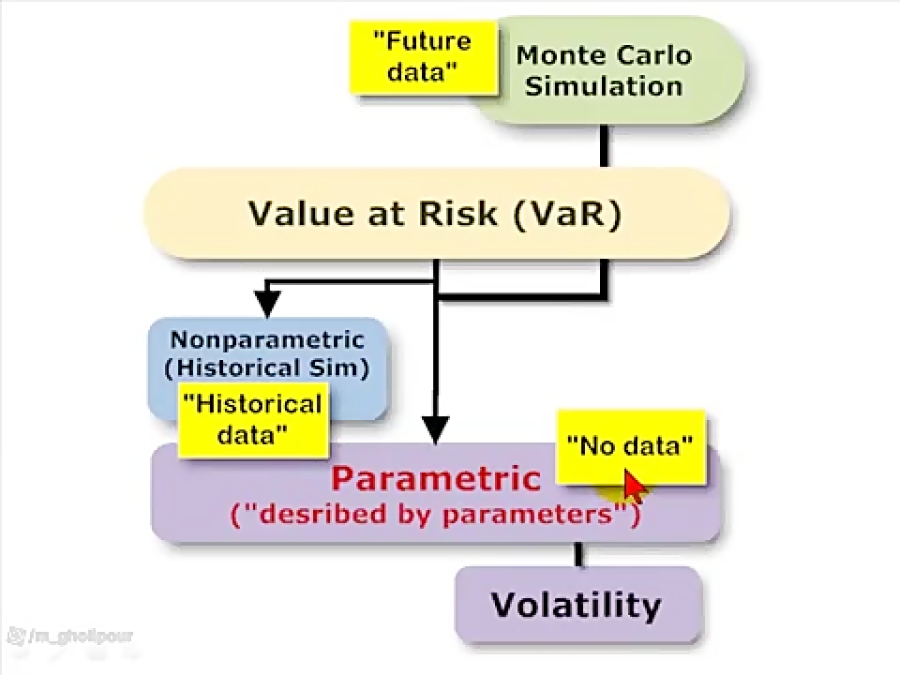

Frm Three Approaches To Value At Risk Var The three approaches are 1. parametric; aka, analytical; 2. historical simulation; and 3. monte carlo simulation (mcs). the parametric approach assumes a cle. Subscriber. the three approaches are 1. parametric; aka, analytical; 2. historical simulation; and 3. monte carlo simulation (mcs). the parametric approach assumes a clean function, the other two work with messy data. historical simulation is betrayed by a histogram, mcs is betrayed by a random number generator.

Three Approaches To Value At Risk Var And Volatility Frm T4 1 Youtube 804.2. dennis the risk analyst is calculating the 95.0% value at risk (var) under the hybrid approach which is a hybrid between the historical simulation (hs) and exponentially weighted moving average (ewma). his historical window is only 90 days and he has set his smoothing parameter 0.860; that is, λ = 0.860 and k = 90 days. For example, if the one day volatility is 1.0%, then the 10 day volatility is 1.0%*sqrt(10) = 3.162%. the key, unrealistic requirement (aka, assumption) of such scaling is that the returns are independent and identically distributed (i.i.d.). like the simulation approaches, the parametric approach is an umbrella that contains many model variations. Conventionally volatility is defined as a change of a variable value over a period of time. in the context risk management, volatility is defined as the standard deviation of an asset return in one day. the assets return in a day i is defined as: ri = si − si − 1 si − 1. where: ri: return on a day i. Value at risk. value at risk = vm (vi v (i 1)) m = the number of days from which historical data is taken. vi = the number of variables on the day i. in calculating each daily return, we.

Comments are closed.