The Venture Capital Cheat Sheet

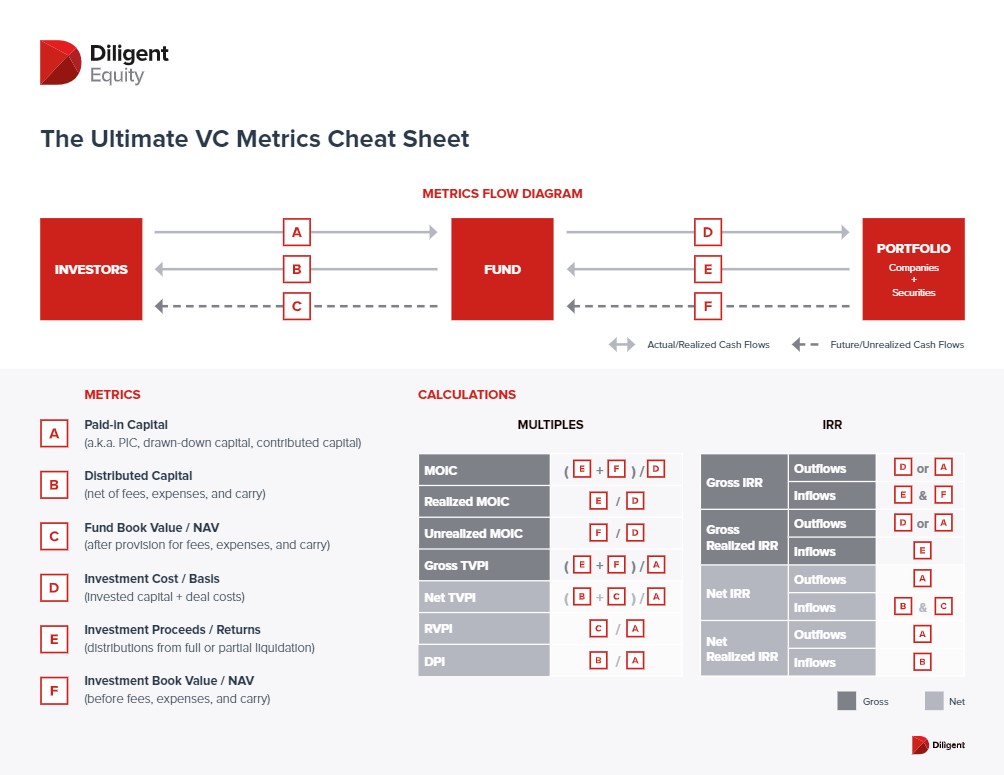

The Venture Capital Cheat Sheet Venture capital fund metrics cheat sheet. venture capital (vc) is a type of private equity financing many companies use to scale and grow. it requires investors to take educated risks and make calculations on companies with the potential for high growth. because of the risk involved, if you want to get deeper into the world of vc, it’s. Keep this two page cheat sheet on your desk to always refresh you on the metrics that are most important to your fund’s success. in this cheat sheet, you’ll learn: the 9 venture capital metrics you need to measure your fund’s health and performance. a breakdown of multiple and irr calculations. the key distinctions for differentiating.

Venture Capital Cheat Sheet R Startups The ultimate vc metrics cheat sheet multiples internal rate of return (irr) gross net metric highlights a.k.a commentary multiple on invested capital (moic) • best multiple for gauging a gp’s raw investment acumen. • measures a gp’s ability to invest in big winners (measured as if the gp invested their own dollars). Venture capital for dummies. navigating the world of venture capital as you seek to raise funds for your business can be scary and confusing because of the high stakes. after you identify whether venture capital is a good choice of funding for your company, you can begin to seek out investors. when seeking venture capital, you need to know who. Diligent equity has a good overview of venture capital fund metrics at venture capital fund metrics cheat sheet; allen latta also dives into more methods for comparing venture fund performance in his series on fund performance metrics. Venture capital for dummies cheat sheet . navigating the world of venture capital as you seek to raise funds for your business can be scary and confusing because of the high stakes. after you identify whether venture capital is a good choice of funding for your company, you can begin to seek out investors.

Venture Capital Metrics The Utlimate Cheat Sheet Diligent Equity Diligent equity has a good overview of venture capital fund metrics at venture capital fund metrics cheat sheet; allen latta also dives into more methods for comparing venture fund performance in his series on fund performance metrics. Venture capital for dummies cheat sheet . navigating the world of venture capital as you seek to raise funds for your business can be scary and confusing because of the high stakes. after you identify whether venture capital is a good choice of funding for your company, you can begin to seek out investors. A term sheet is a nonbinding offer of equity investment from a venture capital (vc) fund. the sheet lays out the terms of what will become the eventual agreement with the fund. if you’ve gotten. A venture capital term sheet is the blueprint for an investment. although term sheets have a set of formalized components, terms are generally undefined. the parties involved may have different understandings of what the terms mean. nonetheless, the term sheet does require everyone to forecast the likelihood of various outcomes for your.

Venture Capital Metrics The Utlimate Cheat Sheet Equityeffect A term sheet is a nonbinding offer of equity investment from a venture capital (vc) fund. the sheet lays out the terms of what will become the eventual agreement with the fund. if you’ve gotten. A venture capital term sheet is the blueprint for an investment. although term sheets have a set of formalized components, terms are generally undefined. the parties involved may have different understandings of what the terms mean. nonetheless, the term sheet does require everyone to forecast the likelihood of various outcomes for your.

Comments are closed.