The Ultimate Guide To Early Retirement With Rule 72t Distributions

The Ultimate Guide To Early Retirement With Rule 72t Distributions According to rule 72t, you may take withdrawals from your qualified retirement accounts and iras free of penalty, if you take them in “substantially equal period payments”. rule 72t allows you take substantially equal periodic payments (sepps) from your accounts free of penalty. no disability, death, or unemployment required. Using internal revenue service rule 72(t) can help you generate income from your nest egg in your 50s or earlier without paying that penalty.

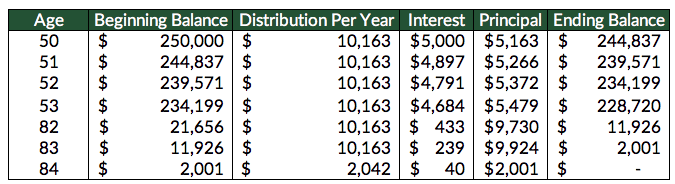

72t Distributions The Ultimate Guide To Early Retirement How 72 (t) distributions work. the 72 (t) plan must not be modified until 5 years have passed from the date of the first distribution for those who will reach 59.5 before the 5 year period is completed. however, it is not clear whether paul plans to take the 72t distributions from the employer plan or from a rollover ira. if the 72 (t) plan is. When you withdraw money from a qualified retirement account under rule 72 (t), the funds are distributed to you as sepps. these regular payments are made over the course of five years or until you. The bottom line. most retirement plans require you to wait until age 59 and 1 2 to make withdrawals without penalty, but irs rule 72t makes an important exemption for those that take substantially equal periodic payments. while taking this exemption isn’t usually recommended, it can be helpful for those that hope to retire early and have. The 72 (t) rules present a unique opportunity for individuals seeking access to their retirement funds without penalties before reaching the traditional retirement age. section 72 (t) offers a pathway to financial flexibility and early retirement by allowing for penalty free withdrawals under specific conditions.

72t Distributions The Ultimate Guide To Early Retirement Earl The bottom line. most retirement plans require you to wait until age 59 and 1 2 to make withdrawals without penalty, but irs rule 72t makes an important exemption for those that take substantially equal periodic payments. while taking this exemption isn’t usually recommended, it can be helpful for those that hope to retire early and have. The 72 (t) rules present a unique opportunity for individuals seeking access to their retirement funds without penalties before reaching the traditional retirement age. section 72 (t) offers a pathway to financial flexibility and early retirement by allowing for penalty free withdrawals under specific conditions. Rule 72 (t) allows you to take penalty free, early withdrawals from your ira, 401 (k), or 403 (b). there are other irs exemptions that can be used for medical expenses, purchasing a home, and more. Rule 72 (t) allows retirement account owners to make penalty free withdrawals before age 59 1 2 if they take the distributions in a specific way. if you need to withdraw funds from an individual.

Comments are closed.