The Truth About An Hsa For Financial Independence Health Savings

Hsa Accounts Understanding Health Savings Accounts Using Hsas For The maximum contribution to an hsa in 2024 is $4,150 for individuals and $8,300 for families. hsa funds used for qualified medical expenses can be withdrawn tax free. these expenses can include. Health savings accounts (hsas) are tools that let you save money for health care tax free. here’s how they work: save on taxes: you put money in before taxes from your paycheck, which can lower your tax bill. 2024 hsa contribution limits: single coverage: the limit is $4,150, up 7.8% from $3,850 in 2023. family coverage: the limit increases.

Health Savings Account The Truth About Hsas Arrest Your Debt Getty. health savings accounts (hsas) let you save money to cover the cost of a wide range of qualified medical expenses. hsas offer a trio of tax advantages, and you can invest money saved in an. The main benefits of a high deductible medical plan with an hsa are tax savings, the ability to cover some expenses that your insurance doesn’t, the ability to have others contribute to your. The maximum contribution for an hsa in 2024 is $4,150 for an individual (rising to $4,300 for 2025) and $8,300 for a family ($8,550 in 2025). the annual limits on contributions apply to the total. For 2023, the maximum amounts are $3,850 for individuals and $7,750 for families. if you are 55 or older, you can add up to $1,000 more as a catch up contribution. hsas have no use it or lose it.

Hsa Health Savings Account The Truth About The Benefits Your The maximum contribution for an hsa in 2024 is $4,150 for an individual (rising to $4,300 for 2025) and $8,300 for a family ($8,550 in 2025). the annual limits on contributions apply to the total. For 2023, the maximum amounts are $3,850 for individuals and $7,750 for families. if you are 55 or older, you can add up to $1,000 more as a catch up contribution. hsas have no use it or lose it. Opening an hsa allows you to pay lower federal income taxes by making tax free deposits into your account each year. for 2024, the hsa contribution limit is $4,150 if your hdhp covers just yourself, and $8,300 if you have family hdhp coverage. 1 if you’re covered under an hdhp in 2024 (even if it’s just in december), you’ll have until. The best hsa accounts in 2024. best for accessibility: lively. best for investment options: fidelity investments. best for short term spending: healthequity. best for mobile payments: hsa bank.

Health Savings Account The Truth About Hsas Arrest Your Debt Opening an hsa allows you to pay lower federal income taxes by making tax free deposits into your account each year. for 2024, the hsa contribution limit is $4,150 if your hdhp covers just yourself, and $8,300 if you have family hdhp coverage. 1 if you’re covered under an hdhp in 2024 (even if it’s just in december), you’ll have until. The best hsa accounts in 2024. best for accessibility: lively. best for investment options: fidelity investments. best for short term spending: healthequity. best for mobile payments: hsa bank.

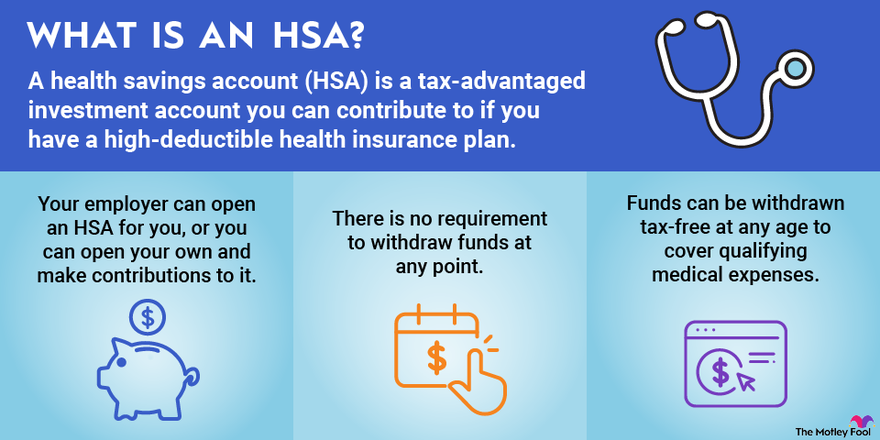

Health Savings Accounts Hsas Explained The Motley Fool

Comments are closed.