The Powerful 1692gb Dispute Letter

The Powerful 1692g B Dispute Letter Youtube Learn how to use the powerful section 1692g(b) debt dispute letter to stop debt collection and credit reporting.download a copy at: pmedia.thinkific . To whom it may concern, please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. §1692g(b). i also request verification, validation, and the name and address of the original creditor pursuant to 15 u.s. c. §1692g(b). sincerely, your name.

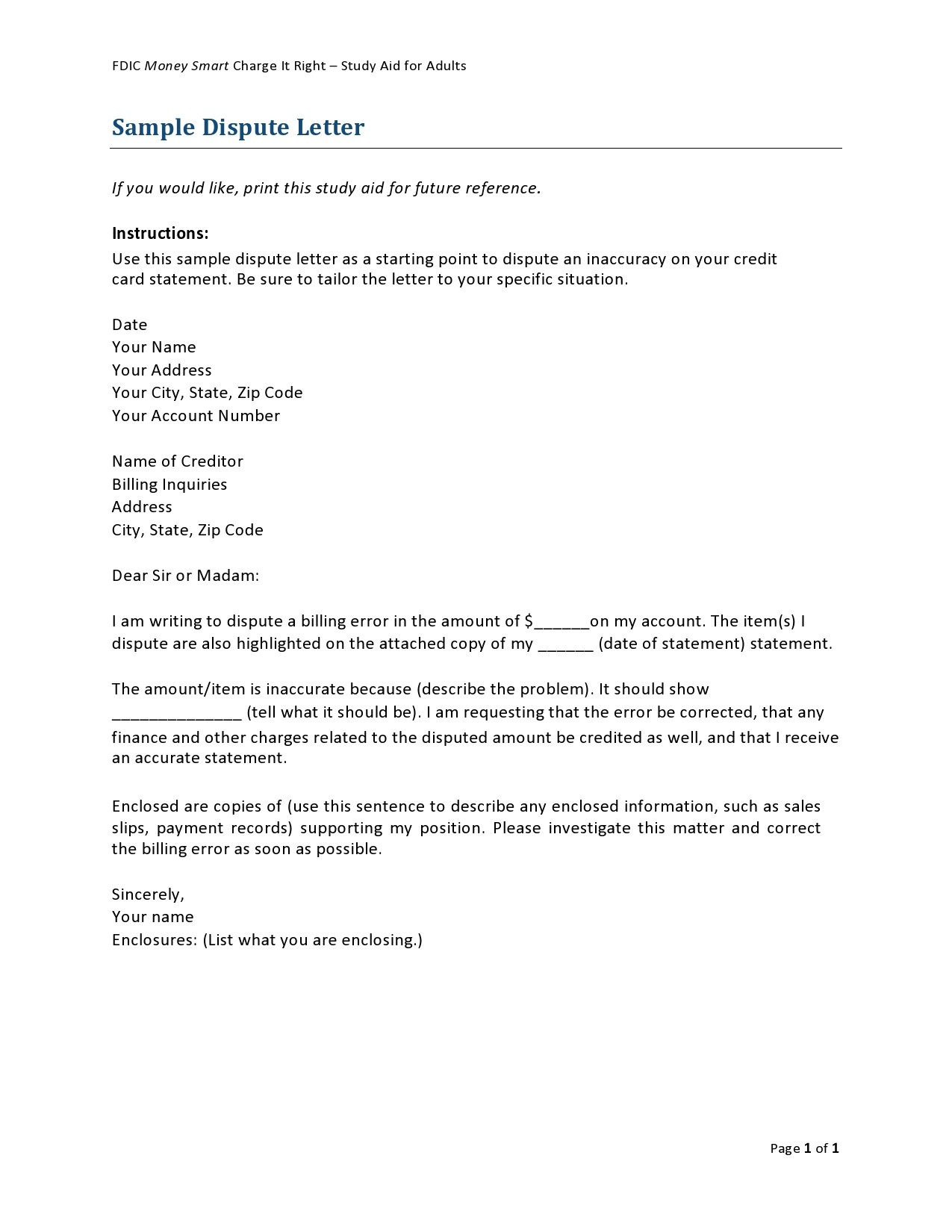

100 Powerful Dispute Letter Templates By Teewix Fiverr 15 u.s. code § 1692g – validation of debts. one of the most important sections within the fair debt collection practices act, or fdcpa, is section g, which describes the debt dispute and validation process, including the precisely worded notice that you must be given about your rights. this section is the fdcpa’s most technical, and unlike. This letter serves as a dispute of collection debt pursuant to sections 1692e(8) and 1692g(b) of the fdcpa. this letter also request verification from debt collectors pursuant to section 1692g(b) of the fdcpa. Step 1 – fill in basic information. the first step in writing a debt validation letter is filling in your basic information, including your name, email address, phone number, and home address. you should also fill in the basic information of the debt collector, including their name and contact information. #fdcpa #debt #creditrepair access templates and more: linktr.ee brianlponderlike, comment, & subscribethank you for supporting the channel by clickin.

50 Best Credit Dispute Letters Templates Free бђ Templatelab Step 1 – fill in basic information. the first step in writing a debt validation letter is filling in your basic information, including your name, email address, phone number, and home address. you should also fill in the basic information of the debt collector, including their name and contact information. #fdcpa #debt #creditrepair access templates and more: linktr.ee brianlponderlike, comment, & subscribethank you for supporting the channel by clickin. Step 4 – create and send your letter. use a credit dispute letter template to draft your correspondence. be concise about the items you are disputing and the reasons for your dispute. include the date, source, and type of the item. specify whether you want the bureau to correct or remove the items. 15 u.s. code § 1692g validation of debts. a statement that, upon the consumer ’s written request within the thirty day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor. if the consumer notifies the debt collector in writing within the thirty day.

Repossession Dispute Letter Template Repossession Dispute Letter Step 4 – create and send your letter. use a credit dispute letter template to draft your correspondence. be concise about the items you are disputing and the reasons for your dispute. include the date, source, and type of the item. specify whether you want the bureau to correct or remove the items. 15 u.s. code § 1692g validation of debts. a statement that, upon the consumer ’s written request within the thirty day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor. if the consumer notifies the debt collector in writing within the thirty day.

Comments are closed.