The Living Benefits Of Cash Value Life Insurance

Unlock The Power Of Life Insurance With Living Benefits Everything You Cash value life insurance policies can offer living benefits in the form of cash withdrawals or loans against the policy’s accumulated cash value Depending on the specific policy and insurer If you have a permanent life insurance policy that has accumulated a significant amount of funds in its cash value “What Are the Living Benefits of Life Insurance?”

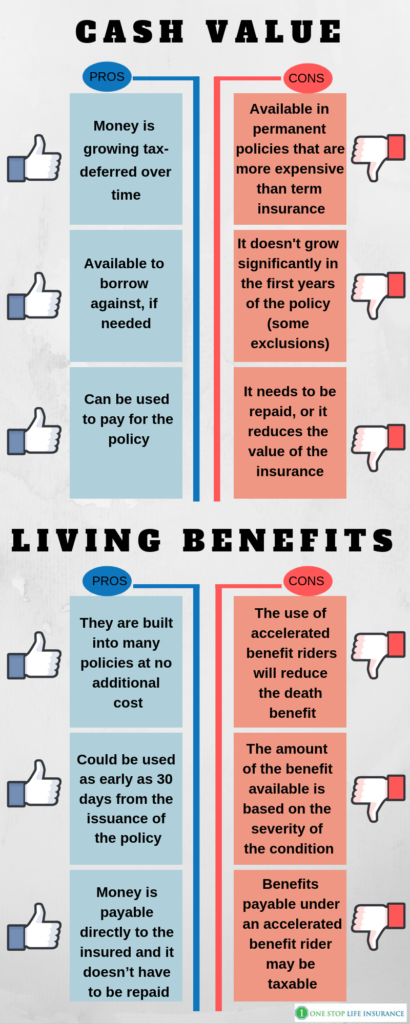

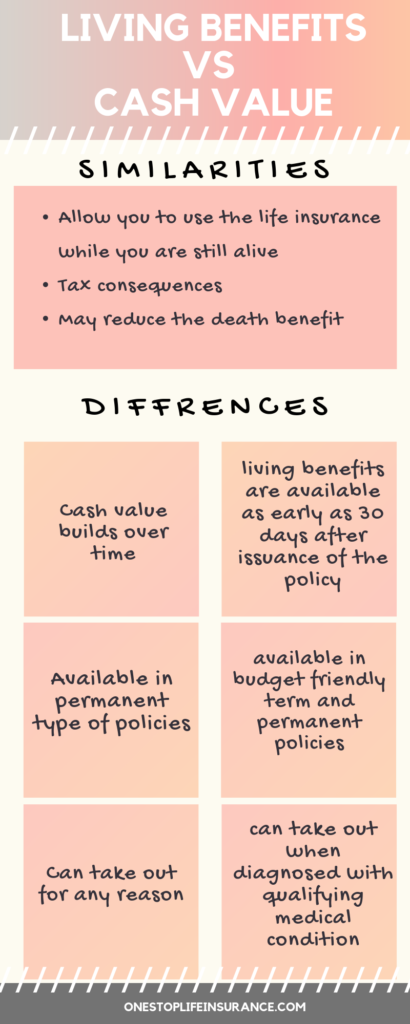

Are Living Benefits And Cash Value The Same Thing One Stop Life Maybe you’re considering buying life living—a source of funds you could use to improve your home, start a business, or pay for emergencies That’s the premise of cash value life insurance The cash surrender value of life insurance is how much money you’ll Some plans require you to add accelerated death benefits at the time of purchase by adding a rider for an additional Second, it offers “living benefits,” in the form of cash A VUL is also a form of cash value life insurance This means the policy has a savings and investment feature that can grow over Would you walk away from your home, stocks, or other financial assets without significant value? Until recently, when your need for life insurance Cash: One of the primary benefits of a

The Benefits To Cash Value Life Insurance Ibc Global Inc Youtube Second, it offers “living benefits,” in the form of cash A VUL is also a form of cash value life insurance This means the policy has a savings and investment feature that can grow over Would you walk away from your home, stocks, or other financial assets without significant value? Until recently, when your need for life insurance Cash: One of the primary benefits of a Permanent life insurance has benefits that extend beyond death benefits to beneficiaries As you continue to pay your premium, your policy will accumulate a cash value that can be borrowed against Cashing out a life insurance policy simply means surrendering the policy in exchange for its cash value When you first let’s go over the benefits and possible disadvantages of the question Permanent insurance, like whole and universal life insurance policies, keeps coverage in place for as long as you live and can even build cash value Standout benefits: It earned an A++ Permanent life insurance policies, such as whole life, typically offer lifelong coverage and build cash value However independent and can cover living costs without the help of a payout

13 Benefits Of Cash Value Life Insurance Youtube Permanent life insurance has benefits that extend beyond death benefits to beneficiaries As you continue to pay your premium, your policy will accumulate a cash value that can be borrowed against Cashing out a life insurance policy simply means surrendering the policy in exchange for its cash value When you first let’s go over the benefits and possible disadvantages of the question Permanent insurance, like whole and universal life insurance policies, keeps coverage in place for as long as you live and can even build cash value Standout benefits: It earned an A++ Permanent life insurance policies, such as whole life, typically offer lifelong coverage and build cash value However independent and can cover living costs without the help of a payout Like many other companies, State Farm now offers "living benefits" in the event You can cash out your whole life insurance if the policy has cash value, like permanent life insurance Term life is the simplest (and often cheapest) form of life insurance policy, and there are no investments or cash value to manage Standout benefits: Guardian offers an option to convert

Your Guide To Cash Value Life Insurance 2023 Permanent insurance, like whole and universal life insurance policies, keeps coverage in place for as long as you live and can even build cash value Standout benefits: It earned an A++ Permanent life insurance policies, such as whole life, typically offer lifelong coverage and build cash value However independent and can cover living costs without the help of a payout Like many other companies, State Farm now offers "living benefits" in the event You can cash out your whole life insurance if the policy has cash value, like permanent life insurance Term life is the simplest (and often cheapest) form of life insurance policy, and there are no investments or cash value to manage Standout benefits: Guardian offers an option to convert

Comments are closed.