The Irs Has Raised Its 401k Contribution Limits For 2022

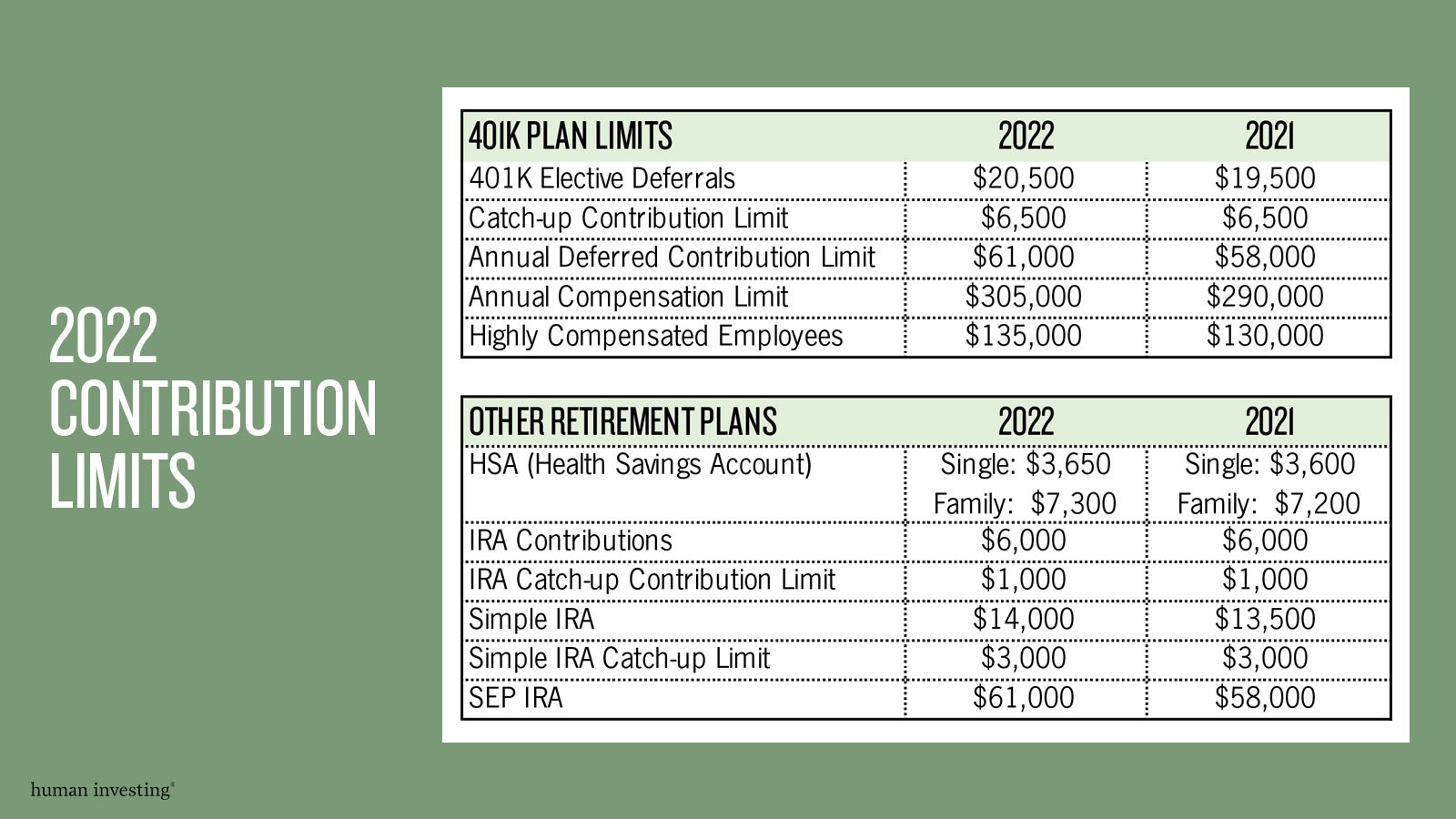

The Irs Has Raised Its 401 K Contribution Limits Ir 2021 216, november 4, 2021. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. the irs today also issued technical guidance regarding all of the cost‑of‑living adjustments affecting dollar. The maximum contribution taxpayers can make to 401 (k) plans in 2022 is $20,500. for taxpayers 50 and older, an additional $6,500 catch up amount brings the total to $27,000. the $20,500 limit.

The Irs Has Raised Its 401 K Contribution Limits For 2022 Irs tax tip 2021 170, november 17, 2021. next year taxpayers can put an extra $1,000 into their 401 (k) plans. the irs recently announced that the 2022 contribution limit for 401 (k) plans will increase to $20,500. the agency also announced cost‑of‑living adjustments that may affect pension plan and other retirement related savings next year. The ira catch‑up contribution limit for individuals aged 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $7,500, up from. Shutterstock. you can contribute a bit more to your retirement plan in 2022. the irs announced thursday that individuals can contribute $20,500 to their 401 (k) plan in 2022, up from $19,500 for 2021 and 2020. the contribution limit also applies to other retirement plans, like 403 (b)s, most 457 plans and the federal government's thrift savings. Employee 401 (k) contributions for 2022 will top off at $20,500 —a $1,000 increase from the $19,500 cap for 2021 and 2020—the irs announced on nov. 4. plan participants age 50 or older next.

The Irs Just Announced The 2022 401 K And Ira Contribution Limits Shutterstock. you can contribute a bit more to your retirement plan in 2022. the irs announced thursday that individuals can contribute $20,500 to their 401 (k) plan in 2022, up from $19,500 for 2021 and 2020. the contribution limit also applies to other retirement plans, like 403 (b)s, most 457 plans and the federal government's thrift savings. Employee 401 (k) contributions for 2022 will top off at $20,500 —a $1,000 increase from the $19,500 cap for 2021 and 2020—the irs announced on nov. 4. plan participants age 50 or older next. 401 (k) contribution limits. workers who are younger than age 50 can contribute a maximum of $20,500 to a 401 (k) in 2022. that’s up $1,000 from the limit of $19,500 in 2021. if you're age 50. Advertisement. the internal revenue service has announced that individuals will be allowed to contribute up to $20,500 to their 401 (k) plans in 2022, an increase of $1,000. the government occasionally increases the maximum 401 (k) contribution limits due to the increase in the cost of living. the 401 (k) contribution limit was at $19,500 in.

The Irs Has Increased Contribution Limits For 2022 вђ Human Investing 401 (k) contribution limits. workers who are younger than age 50 can contribute a maximum of $20,500 to a 401 (k) in 2022. that’s up $1,000 from the limit of $19,500 in 2021. if you're age 50. Advertisement. the internal revenue service has announced that individuals will be allowed to contribute up to $20,500 to their 401 (k) plans in 2022, an increase of $1,000. the government occasionally increases the maximum 401 (k) contribution limits due to the increase in the cost of living. the 401 (k) contribution limit was at $19,500 in.

Whatтащs The Maximum юаа401kюаб юааcontributionюаб юааlimitюаб In юаа2022юаб Mintlife Blog

Comments are closed.