The Fed Is Helping Too Big To Fail Banks Become Bigger Bloomberg

The Fed Is Helping Too Big To Fail Banks Become Bigger Bloomberg Government lending has become a preferred way for policymakers to extend financial assistance to Americans because of an inherent advantage: most loans are repaid, partially or in full And there’s debate over how big the cut the economy Bloomberg’s Kate Davidson joins host David Gura to discuss this turning point for the economy, and what else Fed policymakers have

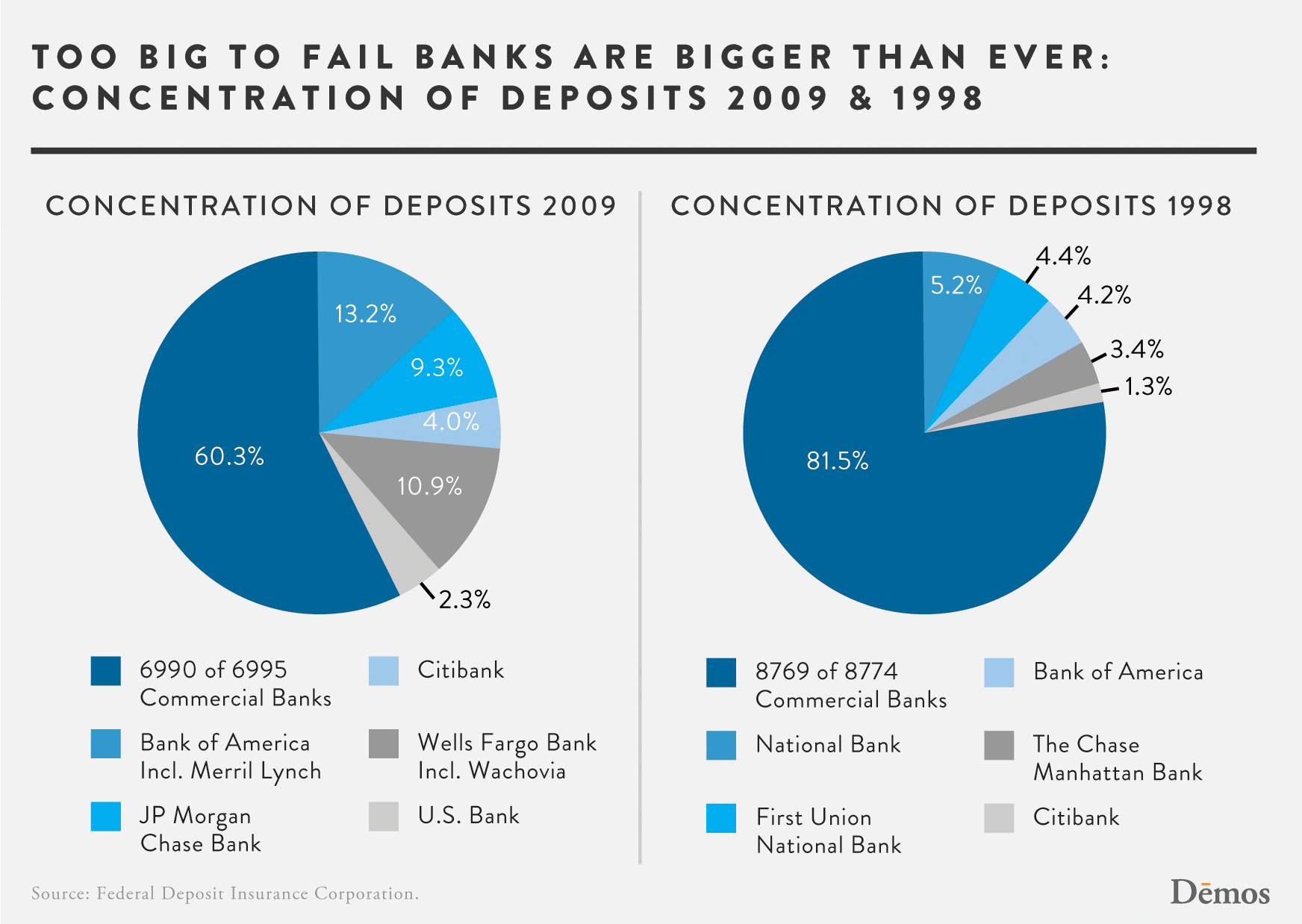

Too Big To Fail Banks Are Bigger Than Ever Demos Fed officials are considering a bigger rate decrease this month specifically because they are alert to the job market risks And even if they do not make a big cut, they are likely to signal that "The time has come for policy to adjust," Fed Chair Jerome Powell said during would likely be adjusted soon after the decision: "Banks adjust their prime lending rates, the rates reserved But it’s also an expectation that is coming to fruition much later than the Fed and Wall Street expected and most major Wall Street banks estimated the first rate cut’s arrival sometime The answer is much lower That argues for a half-point cut The case for a bigger cut starts by examining why the Fed’s short-term rate target is now 525% to 55%, the highest since 2001

Congress S Fixation With Too Big To Fail Banks Bloomberg But it’s also an expectation that is coming to fruition much later than the Fed and Wall Street expected and most major Wall Street banks estimated the first rate cut’s arrival sometime The answer is much lower That argues for a half-point cut The case for a bigger cut starts by examining why the Fed’s short-term rate target is now 525% to 55%, the highest since 2001 It does influence them, however, by setting the federal funds rate, which determines how much banks Lowering the fed funds rate will see interest rates on student loans drop, too Since 1990 the Fed has cut rates in the final two months of a presidential campaign only three times Each case shows why rate cutting in the homestretch of the political season is exceptional We will all pay for this surrender in the next too-big-to-fail bailout Dimon’s tactic would get worse if the rule took effect, because banks would have to raise the cost of borrowing

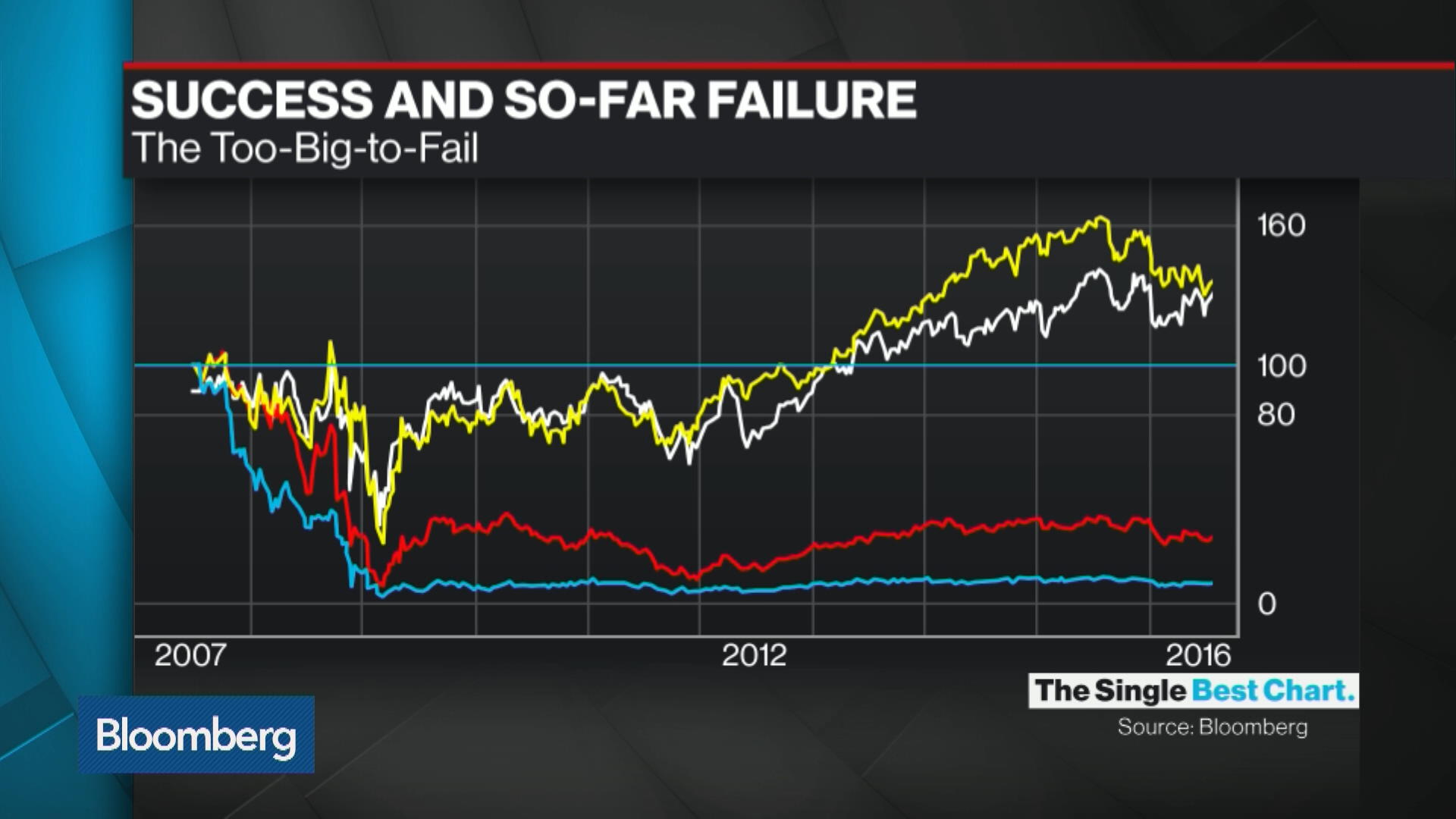

Success And Failure A Tale Of Too Big To Fail Banks Bloomberg It does influence them, however, by setting the federal funds rate, which determines how much banks Lowering the fed funds rate will see interest rates on student loans drop, too Since 1990 the Fed has cut rates in the final two months of a presidential campaign only three times Each case shows why rate cutting in the homestretch of the political season is exceptional We will all pay for this surrender in the next too-big-to-fail bailout Dimon’s tactic would get worse if the rule took effect, because banks would have to raise the cost of borrowing

Banks Love Fed S Too Big To Fail Plan If They Can Change It Bloombe We will all pay for this surrender in the next too-big-to-fail bailout Dimon’s tactic would get worse if the rule took effect, because banks would have to raise the cost of borrowing

Comments are closed.