The Difference Between Hmo And Ppo Health Benefits 50 Off

The Difference Between Hmo And Ppo Health Benefits 50 O That’s compared to $512 monthly for a ppo plan for the same person. the difference is more than $1,000 over a year on average. cheaper out of pocket costs: hmo plans typically have lower out of. The price difference depends on the ppo health plan. you may still receive a negotiated rate on an out of network provider — or you could get stuck paying the entire bill. unlike an hmo, a ppo doesn’t restrict coverage to a specific service area. if you get ill or injured while traveling and must use an out of network provider, your ppo.

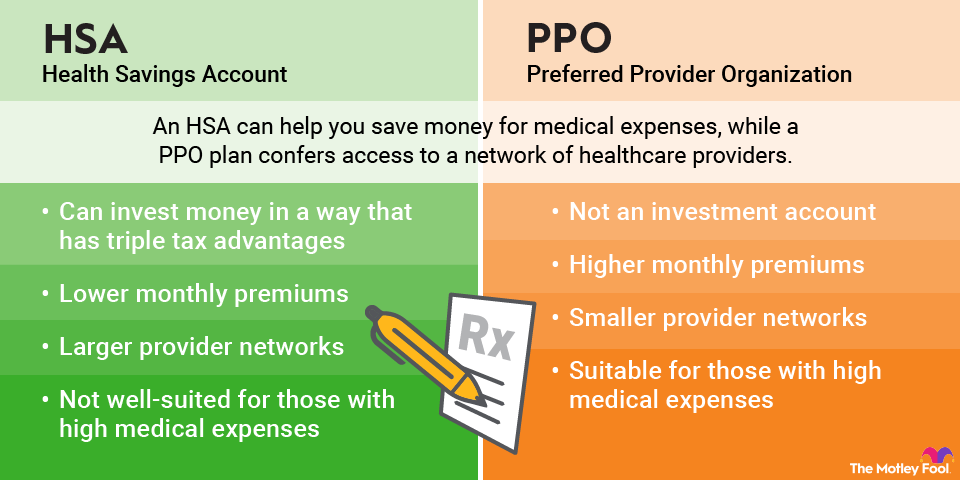

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Lower cost. hmo plans typically have lower monthly premiums. you can also expect to pay less out of pocket. higher cost. ppos tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. out of pocket medical costs can also run higher with a ppo plan. Providers or doctors either work for the hmo or contract for set rates. networks include providers and facilities that have negotiated lower rates on the services they perform. ppo health plans have access to those negotiated rates. doctors and facilities that participate in an epo are paid per service. Hmo and ppo dental and medical plans are also similar in their payment structures when it comes to deductibles, coinsurance and copays. there is one main difference between a ppo dental plan and ppo medical plans — some ppo dental plans include an annual maximum, which is the most your plan will pay for covered services in a year. once that. The costs of a ppo plan. ppo plans often have higher monthly premiums and out of pocket costs than hmo plans. you may also need to pay a deductible before your benefits begin. if you see an out of network doctor, you’ll typically have to pay the full cost of your visit and then file a claim to get money back from your ppo plan.

Comments are closed.