The Cheat Sheet For Venture Capital Metrics Diligent Equity

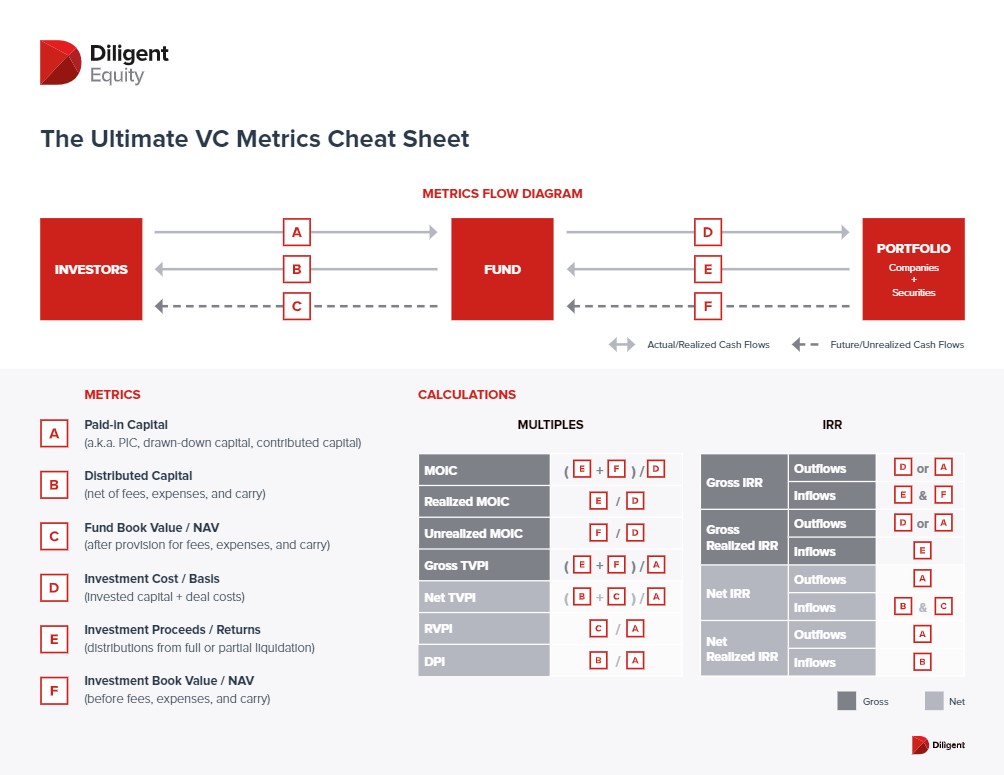

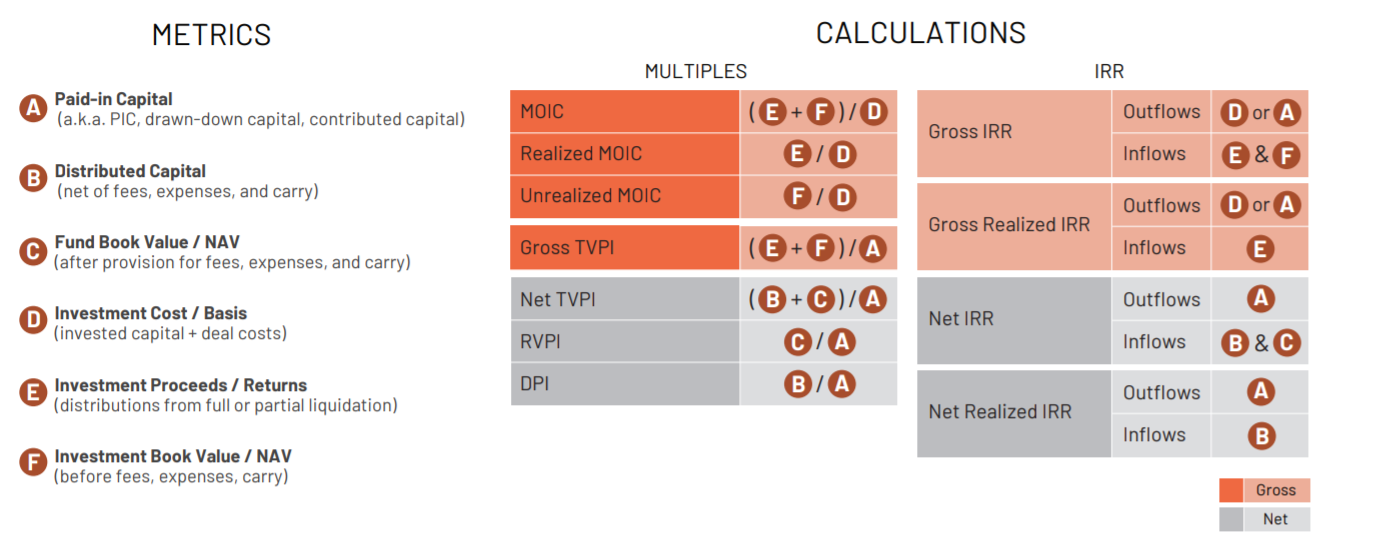

Venture Capital Metrics The Utlimate Cheat Sheet Diligent Equ Venture capital fund metrics cheat sheet. venture capital (vc) is a type of private equity financing many companies use to scale and grow. it requires investors to take educated risks and make calculations on companies with the potential for high growth. because of the risk involved, if you want to get deeper into the world of vc, it’s. Paid in capital (a.k.a. pic, drawn down capital, contributed capital) distributed capital (net of fees, expenses, and carry) fund book value nav (after provision for fees, expenses, and carry) investment cost basis (invested capital deal costs) investment proceeds returns (distributions from full or partial liquidation) investment book.

The Cheat Sheet For Venture Capital Metrics Diligent Equity Keep this two page cheat sheet on your desk to always refresh you on the metrics that are most important to your fund’s success. in this cheat sheet, you’ll learn: the 9 venture capital metrics you need to measure your fund’s health and performance. a breakdown of multiple and irr calculations. the key distinctions for differentiating. 9 venture capital metrics every vc should know [explained] venture capitalists use a variety of metrics to measure the potential success of a startup. in this article, we explain how vc metrics are calculated, used, and read for more profitable investment decisions. venture capital funds finance high growth potential companies, and to do so. Find examples and templates at templates and resources for modeling venture funds. diligent equity has a good overview of venture capital fund metrics at venture capital fund metrics cheat sheet; allen latta also dives into more methods for comparing venture fund performance in his series on fund performance metrics. But successful vc investors will go well past the surface in their due diligence process when looking at a potential company to invest in. our suggested vc diligence checklist includes: 1. the company and its competitive environment. understand the company’s business model. research the target market.

The Cheat Sheet For Venture Capital Metrics Diligent Equity Find examples and templates at templates and resources for modeling venture funds. diligent equity has a good overview of venture capital fund metrics at venture capital fund metrics cheat sheet; allen latta also dives into more methods for comparing venture fund performance in his series on fund performance metrics. But successful vc investors will go well past the surface in their due diligence process when looking at a potential company to invest in. our suggested vc diligence checklist includes: 1. the company and its competitive environment. understand the company’s business model. research the target market. The role of metrics in venture capital. metrics are instrumental in the venture capital industry. they: enable venture capitalists to make informed investment decisions. aid in assessing the potential return on investment (roi). assist in comparing investment opportunities. help in monitoring and evaluating the performance of portfolio companies. Due diligence is beneficial both for venture capital firms and the companies seeking investment. it determines the valuation of the company and—if done thoroughly—provides a clear picture of the risk. venture capital due diligence is an essential step in making good investments. to make it less overwhelming and time consuming, it can help.

Comments are closed.