The 9 Steps To Buying A Home Mortgage Numbermortgage Number

9 Steps To Buying A Home Home Buying Mortgage 5. complete a full mortgage application. after selecting a lender, the next step is to complete a full mortgage loan application. most of this application process was completed during the pre. Stick to your budget to ensure that you can comfortably afford your new home and avoid any financial strain. 4. build a strong credit history: although having an itin number may limit your access to credit, it’s important to build a strong credit history to improve your chances of securing favorable loan terms.

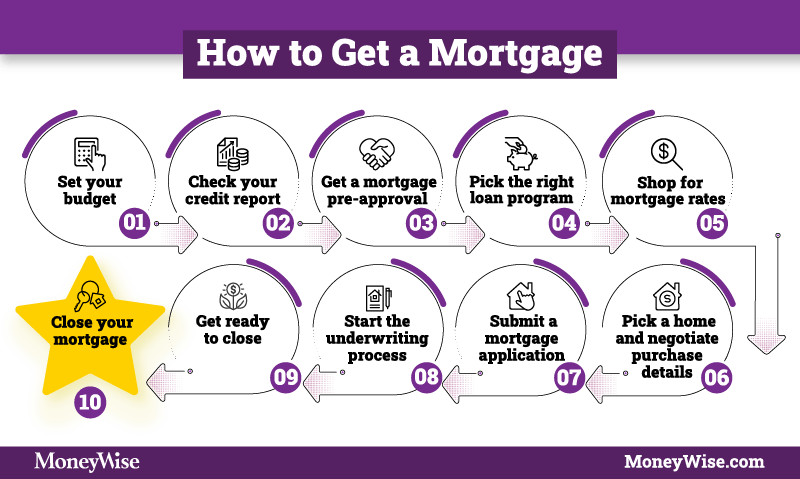

How To Buy Your First Home 9 Step Guide Moneywise Start looking at your timeline. begin by looking at your home buying timeline to help you do the math. if you have 24 months until you’re likely to make a home purchase, try to estimate what 20% down would look like and divide that by 24. for example, if you plan to buy a $200,000 home, 20% down would be $40,000. Schedule a home inspection. 13. have the home appraised. 14. negotiate any repairs or credits with the seller. 15. close on your new home. more like this first time home buyers deciding to buy a. 10. close on your new home. congratulations, the closing process is the final step to homeownership! your real estate agent and loan officer will take care of most of the work, but you will have a. We have thousands of articles in addition to our guides. search all our content for answers to your questions. or, speak to a lender and get personalized help. our guide to buying a home explains.

The 9 Steps To Buying A Home Mortgage Numbermortgage Number 10. close on your new home. congratulations, the closing process is the final step to homeownership! your real estate agent and loan officer will take care of most of the work, but you will have a. We have thousands of articles in addition to our guides. search all our content for answers to your questions. or, speak to a lender and get personalized help. our guide to buying a home explains. Your 8 step guide to the home loan process. follow these eight steps to get a mortgage loan and become a new homeowner. 1. figure out what you can afford. before you begin the mortgage process, it's important to assess your finances and make sure you’re ready to purchase a home. with a new monthly mortgage payment, it’s crucial to know if. Paperwork and the closing process. a good agent is imperative to guiding home buyers through many of the later steps on the home buying checklist. they are the ones on your side, watching out for your best interest – all of which helps take the stress off you and help you manage the emotions of home buying. 4.

How To Get A Mortgage With 9 Important Steps Credible Your 8 step guide to the home loan process. follow these eight steps to get a mortgage loan and become a new homeowner. 1. figure out what you can afford. before you begin the mortgage process, it's important to assess your finances and make sure you’re ready to purchase a home. with a new monthly mortgage payment, it’s crucial to know if. Paperwork and the closing process. a good agent is imperative to guiding home buyers through many of the later steps on the home buying checklist. they are the ones on your side, watching out for your best interest – all of which helps take the stress off you and help you manage the emotions of home buying. 4.

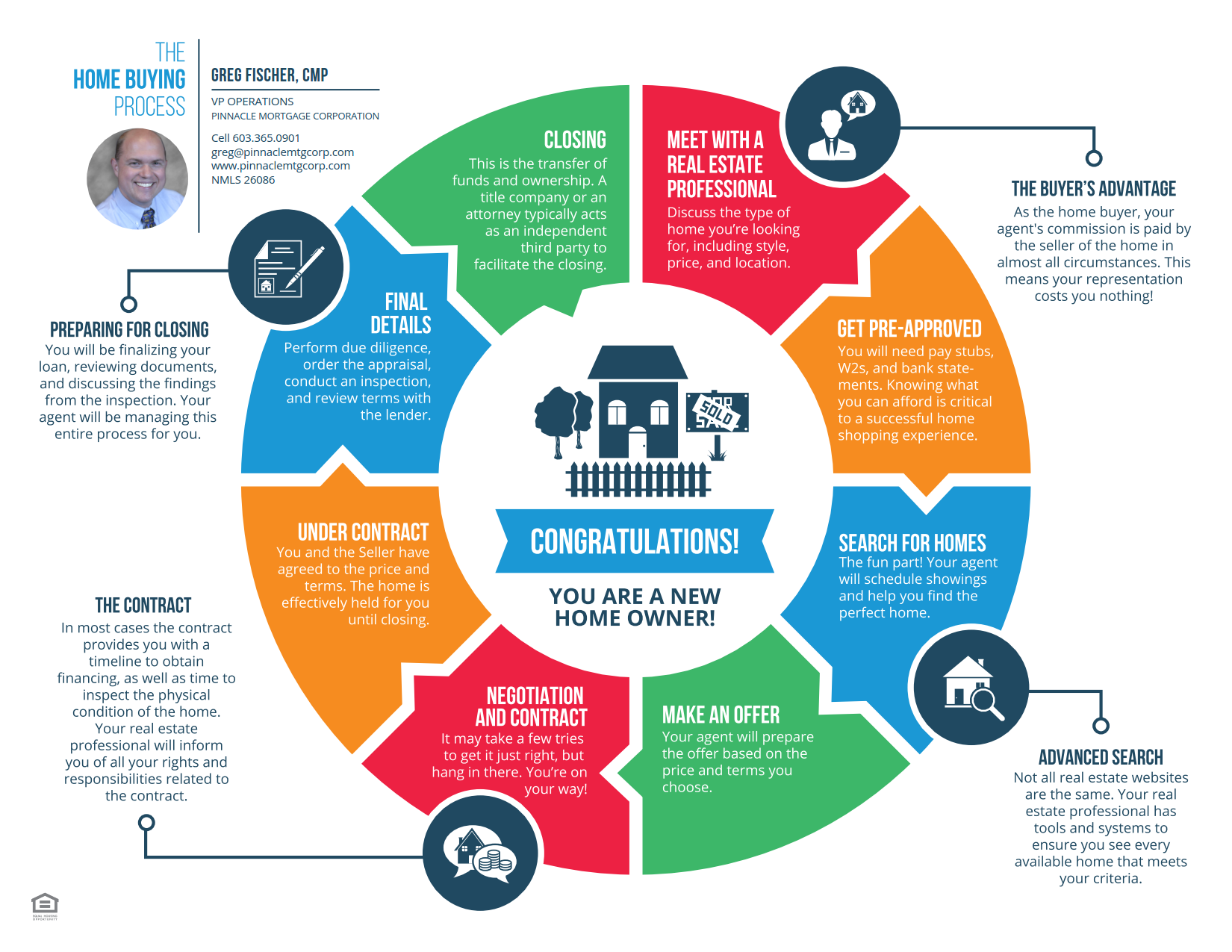

The Home Buying Cycle Pinnacle Mortgage Corp

Comments are closed.