Stocks Vs Bonds Suma Wealth

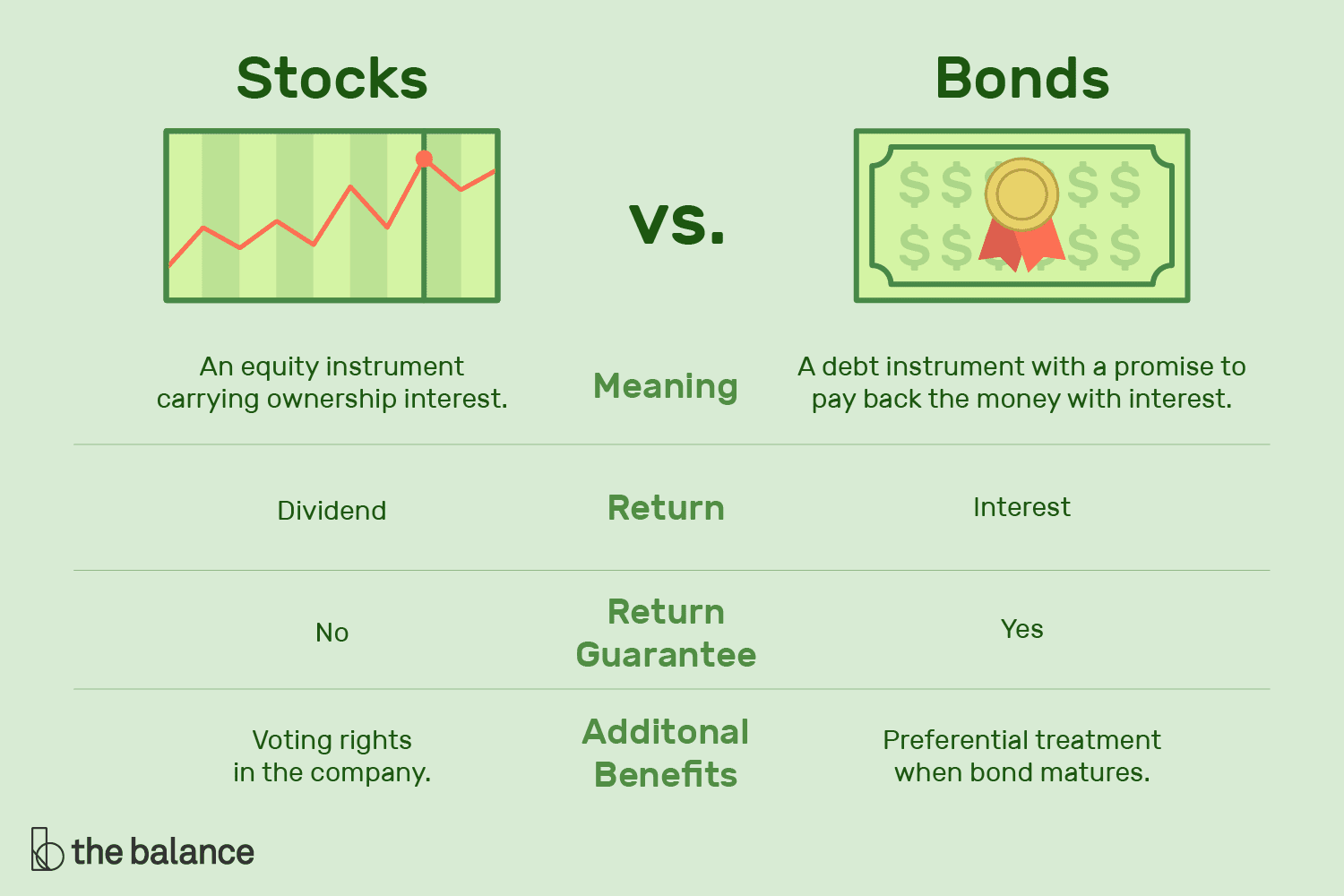

Stocks Vs Bonds Suma Wealth Stocks are ownership shares of individual companies. you can own a small piece of a company, and if they do well in the market and the company is successful, that small piece becomes more and more valuable. stocks are risky, but the rewards can be high. roll that dice baby! 🤑 🎲. bonds are loans with a promise to pay you back with interest. History has shown that owning stocks and bonds is a good way to build wealth. according to data compiled by vanguard, a 60 40 portfolio 60% stocks and 40% bonds generated an average of 8.8%.

Whitehead Wealth Management Blog 4 The Basics Stocks And Bonds How the securities are taxed is another major differentiator between stocks and bonds. with stocks, you pay capital gains taxes when you sell a stock at a profit and on any dividends you receive. Stocks represent partial ownership, or equity, in a company. when you buy stock, you’re purchasing a tiny slice of the company — one or more "shares." and the more shares you buy, the more of. Large cap stocks are companies with a total value of outstanding shares, known as market cap, of $10 billion or more. these stocks make up the s&p 500 and russell 1000 indexes. midcap stocks are. Using strategic asset allocation, you can determine how much to invest in stocks and bonds related to how comfortable you are with the risk involved. for example, if you have a higher tolerance, you can invest 70% in stocks and 30% in bonds, but you could use a 60 40 plan if you have a lower tolerance.

Stocks And Bonds Large cap stocks are companies with a total value of outstanding shares, known as market cap, of $10 billion or more. these stocks make up the s&p 500 and russell 1000 indexes. midcap stocks are. Using strategic asset allocation, you can determine how much to invest in stocks and bonds related to how comfortable you are with the risk involved. for example, if you have a higher tolerance, you can invest 70% in stocks and 30% in bonds, but you could use a 60 40 plan if you have a lower tolerance. A well timed stock investment can accumulate generational wealth in the long run, but that scenario is more difficult with bonds. bonds have much lower ceilings than stocks because their returns. Because bonds are a loan, they can be a little more complex than stocks. whenever a loan is made, certain terms have to be established. the same is true with bonds. when a company raises money through a bond, it's called a new issue. in a new issue, millions of dollars of bonds are commonly available. the issuer determines a value of the bond.

Stocks And Bonds A well timed stock investment can accumulate generational wealth in the long run, but that scenario is more difficult with bonds. bonds have much lower ceilings than stocks because their returns. Because bonds are a loan, they can be a little more complex than stocks. whenever a loan is made, certain terms have to be established. the same is true with bonds. when a company raises money through a bond, it's called a new issue. in a new issue, millions of dollars of bonds are commonly available. the issuer determines a value of the bond.

Comments are closed.