Startup Funding Stages 6 Steps To Success

Startup Funding Stages 6 Steps To Success The four main stages of venture capital funding are pre seed, seed, series a, and series b rounds. each stage offers a different form of investment to help businesses grow and reach their goals. ultimately, it is essential for startups to understand these rounds in order to secure the right funding for their venture. Series b funding represents the next phase in a startup’s fundraising journey, typically following successful completion of series a funding. at this stage, startups have already validated their business model, demonstrated market traction, and are now focused on scaling their operations to capture a larger market share.

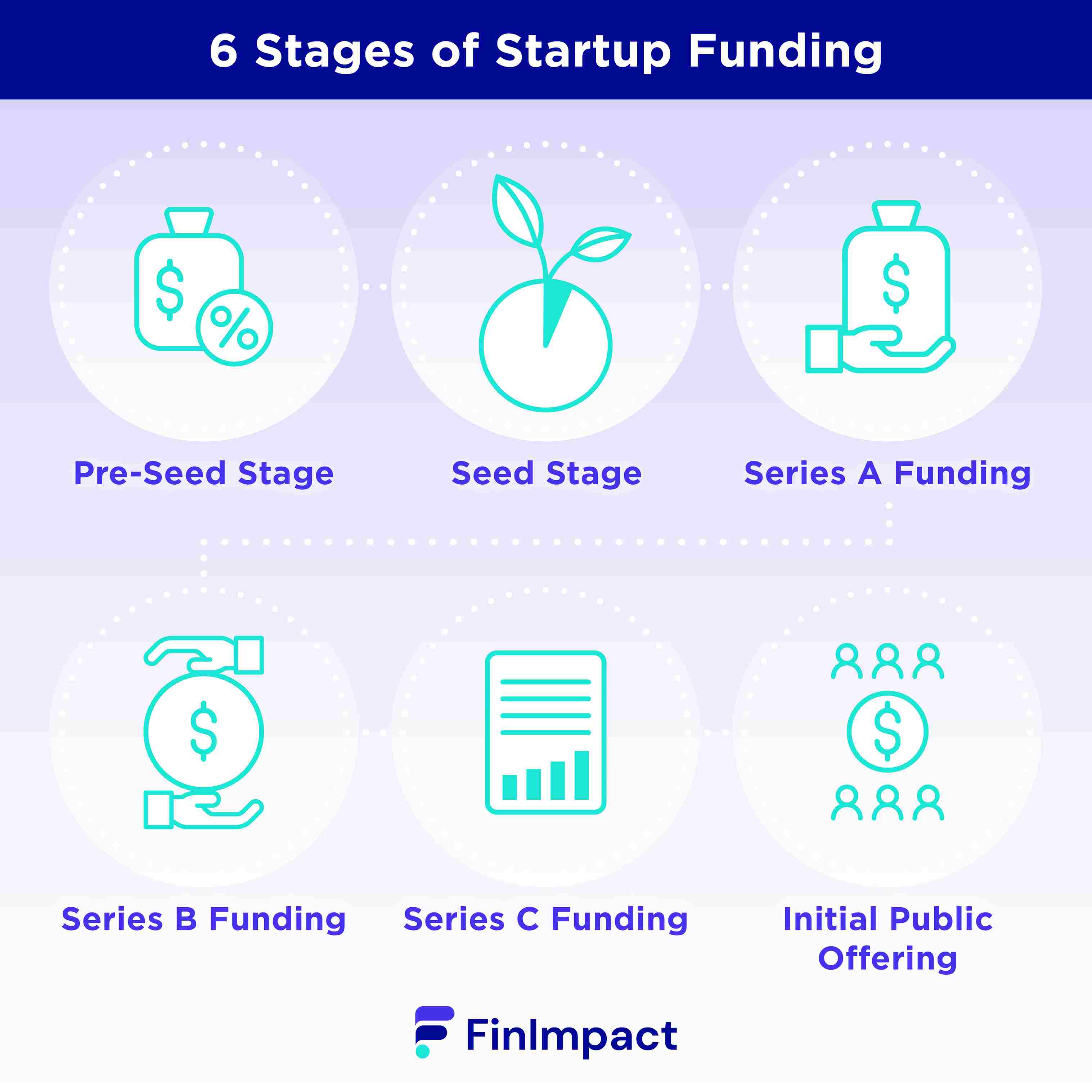

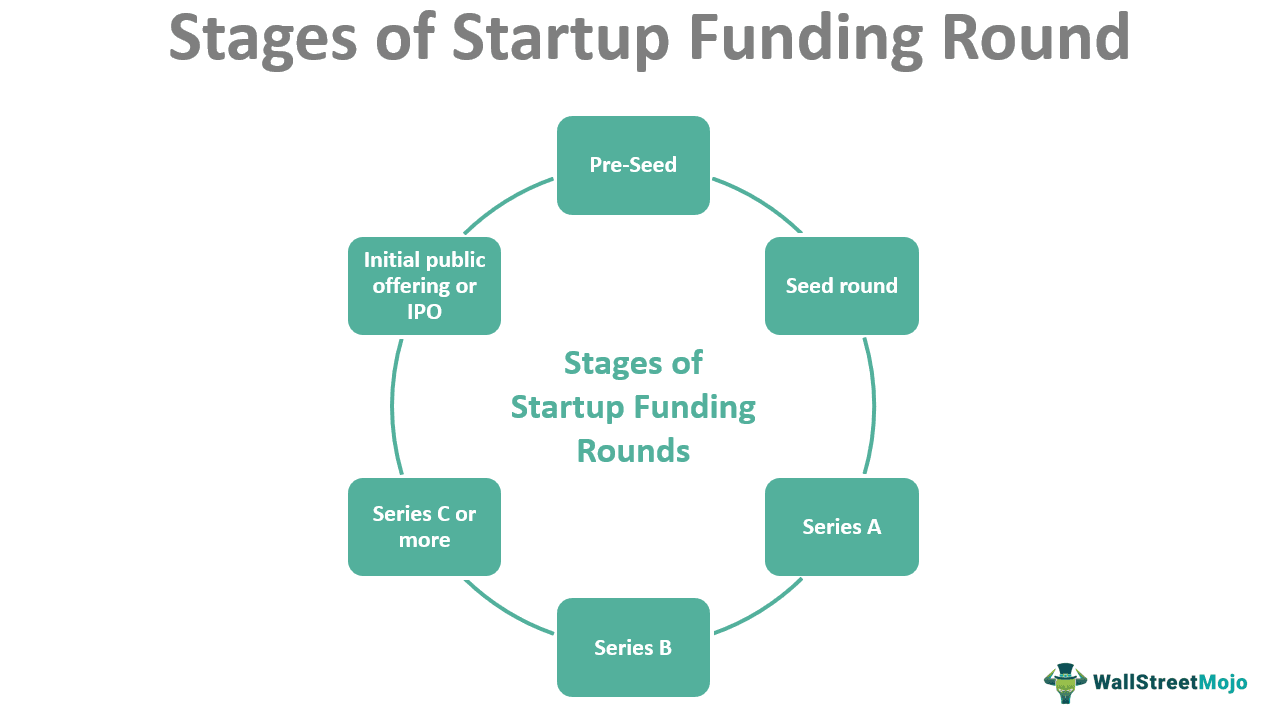

A Step By Step Illustration Of Startup Funding Stages Alcor Fund Equity: seed investors typically get between 15% 35% of equity. valuations: typical seed round valuations in 2024 land between $1m to $15m. runway: seed capital should last 12 24 months on average, depending on your burn rate. average seed funding amount: over the past decade, seed checks have increased significantly. If we calculate that scale, then the startup funding stages will be like…. pre seeding round: $0 to $50,000 seeding round: $50,000 to $3 million series a funding: $3 million to $6 million series b funding: $10 million to $30 million series c funding: $30 million to $50 million series d funding: $50 million and above. 3. series a funding. series a funding is the first significant round of venture capital financing for a business. it is one of the most critical stages of funding for startups and involves selling between 10% and 30% of the company’s equity. series a funding rounds usually rely on selling preferred stock to venture capital and private equity. Pre seed stage. seed stage. early stage (series a and b) late stage (series c) exit stage. get started with stripe. startups receive a massive amount of funding, globally. while venture funding—the largest source of capital for startups—declined in 2023, the second quarter of 2023 still saw around $60.5 billion in global funding.

Startup Funding Stages 6 Steps To Success 3. series a funding. series a funding is the first significant round of venture capital financing for a business. it is one of the most critical stages of funding for startups and involves selling between 10% and 30% of the company’s equity. series a funding rounds usually rely on selling preferred stock to venture capital and private equity. Pre seed stage. seed stage. early stage (series a and b) late stage (series c) exit stage. get started with stripe. startups receive a massive amount of funding, globally. while venture funding—the largest source of capital for startups—declined in 2023, the second quarter of 2023 still saw around $60.5 billion in global funding. There are multiple stages of startup funding: seed, series a, series b, series c, and so forth. startups should be conscientious about the funding rounds that they will go through, which are generally based on the current maturity and development of the company. here’s an overview of the major startup stages. as of 2023. Understanding these startup funding stages is essential for entrepreneurs seeking capital and investors looking to support promising startups. each stage comes with its unique challenges, opportunities, and funding sources. the importance of startup funding stages. startup funding stages play a pivotal role in the success and growth of new.

6 Important Stages Of Startup Funding There are multiple stages of startup funding: seed, series a, series b, series c, and so forth. startups should be conscientious about the funding rounds that they will go through, which are generally based on the current maturity and development of the company. here’s an overview of the major startup stages. as of 2023. Understanding these startup funding stages is essential for entrepreneurs seeking capital and investors looking to support promising startups. each stage comes with its unique challenges, opportunities, and funding sources. the importance of startup funding stages. startup funding stages play a pivotal role in the success and growth of new.

Funding Rounds Meaning Startups Process Types Example

Comments are closed.