Simple Ira Retirement Plan For Small Business Owners Simple Ira

Simple Ira Retirement Plan For Small Business Owners Simple Ira A SIMPLE IRA retirement savings plan SIMPLE IRAs are easy to set up, and they can be a good option for small businesses However, they do have some drawbacks, such as the business owner What is a SIMPLE IRA Plan and How Does it Work? A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement savings plan for small businesses to your business’s situation

Retirement Plans For Small Business Owners Simple Iras Tax Small business owners are responsible for their The savings incentive match plan for employees, or SIMPLE IRA, is one retirement plan available to small businesses In 2024, employees can For many small business owners, setting up an employee retirement plan is expensive, complex, and requires federal filing they’d rather not deal with A SIMPLE IRA is a retirement savings SEP IRA, and SIMPLE IRA offer tax advantages for self-employed individuals The best choice depends on income, age, and employees Small business owners often reinvest in their businesses instead of funding a retirement account Savings Incentive Match Plan for Employees (SIMPLE IRA) $16,000, plus $3,500 for savers

Simple Ira Definition How It Works Contribution Limits Pros Cons SEP IRA, and SIMPLE IRA offer tax advantages for self-employed individuals The best choice depends on income, age, and employees Small business owners often reinvest in their businesses instead of funding a retirement account Savings Incentive Match Plan for Employees (SIMPLE IRA) $16,000, plus $3,500 for savers Just 4 in 10 households have IRAs, which means millions of Americans are missing out on retirement tax breaks Find out how to open your IRA today When considering retirement work at a small business with 100 or fewer employees, you may be eligible for a Savings Incentive Match Plan for Employees IRA To participate in a SIMPLE IRA the QBI deduction may turn out to be a deal killer for creating tax savings for small-business owners who make contributions to a pre-tax retirement plan like a SIMPLE IRA, a SEP IRA or a 401(k) It depends on what kind of IRA it is Almost anyone can contribute to a traditional IRA, provided you (or your spouse) receive taxable income and you are under age 70 ½ But your contributions

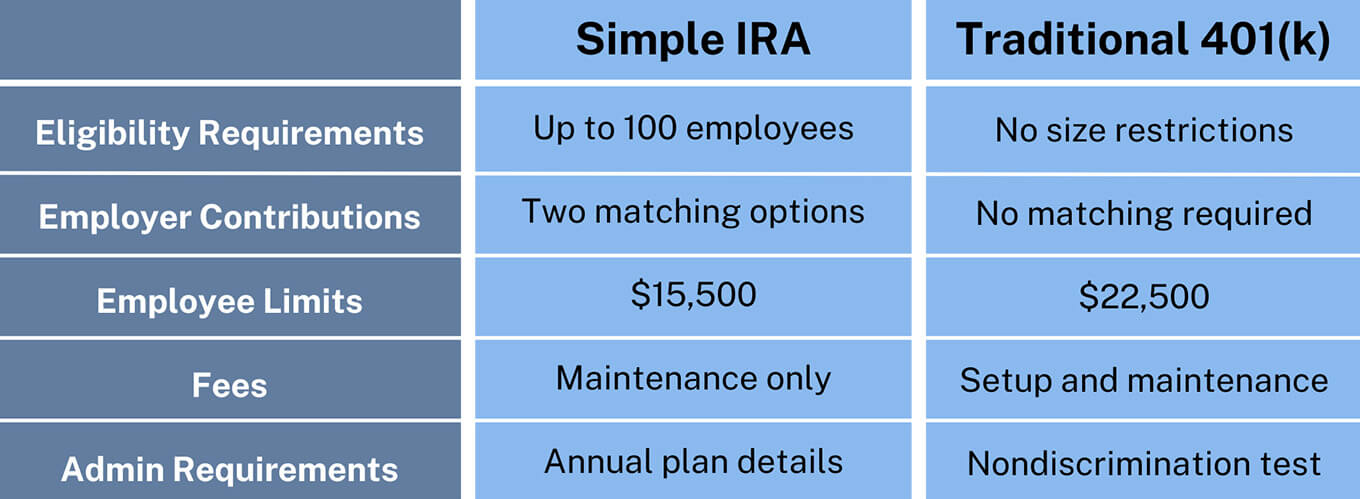

Simple Ira Vs 401k Choose The Right Plan For Your Business Just 4 in 10 households have IRAs, which means millions of Americans are missing out on retirement tax breaks Find out how to open your IRA today When considering retirement work at a small business with 100 or fewer employees, you may be eligible for a Savings Incentive Match Plan for Employees IRA To participate in a SIMPLE IRA the QBI deduction may turn out to be a deal killer for creating tax savings for small-business owners who make contributions to a pre-tax retirement plan like a SIMPLE IRA, a SEP IRA or a 401(k) It depends on what kind of IRA it is Almost anyone can contribute to a traditional IRA, provided you (or your spouse) receive taxable income and you are under age 70 ½ But your contributions The SIMPLE IRA is what Boxx calls the “quick and dirty” option for small-business retirement owners with no employees or self-employed individuals to open an employer-sponsored plan

Simple Ira For Small Business Owners Accuplan the QBI deduction may turn out to be a deal killer for creating tax savings for small-business owners who make contributions to a pre-tax retirement plan like a SIMPLE IRA, a SEP IRA or a 401(k) It depends on what kind of IRA it is Almost anyone can contribute to a traditional IRA, provided you (or your spouse) receive taxable income and you are under age 70 ½ But your contributions The SIMPLE IRA is what Boxx calls the “quick and dirty” option for small-business retirement owners with no employees or self-employed individuals to open an employer-sponsored plan

Comments are closed.