Show Your Customer The Three Payoff Options

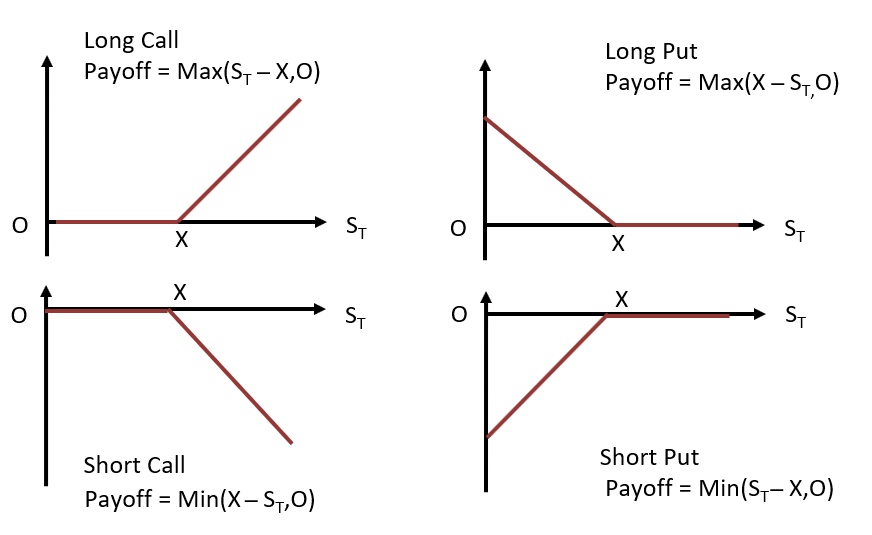

Options Trading For Beginners What It Is Types Common Terms And Automotive sales training, car sales training, selling cars, automotive sales people, automotive selling tips, steve richards, used car sales, new car sales,. The payoff to the put buyer: pt = max(0,x –st) = max(0,$26–$29) = 0 p t = m a x (0, x – s t) = m a x (0, $ 26 – $ 29) = 0. when the option has a positive payoff, it is said to be in the money. in the example above, the call option is in the money. the put option is out of the money because x –st x – s t is less than 0.

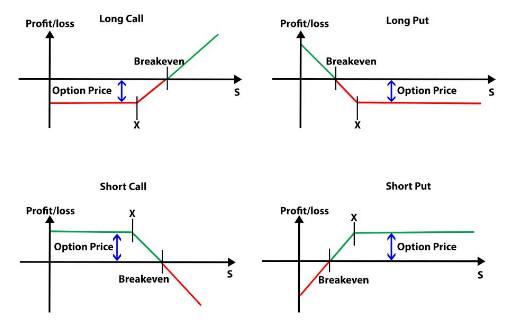

Options Payoffs And Profits Calculations For Cfaв And Frmв Exams The payoff line at the same point on this chart is the premium, or price, of the option. (this isn't always the case though regarding the premium for the option and the payoff p&l line. for certain combinations it can be either the premium or max profit loss.) this example was calculated when the option has 30 days until expiration and is worth. A payoff graph will show the option position’s total profit or loss (y axis) depending on the underlying price (x axis). here is an example: what we are looking at here is the payoff graph for a long call option strategy. in this example the trader has bought a 20 strike call for $2 per contract (or $200 for a standard option contract. Cryptocurrency. rewards or points. 1. credit and debit cards. nutrition brand huel accepts a variety of card types. credit and debit cards are one the most common payment methods, especially for online stores. credit card companies, including visa, mastercard, american express, and discover, extend credit to purchasers. Cf at expiration = $3.85 per share. cf at expiration = $3.85 x 1 contract x 100 shares per contract = $385. initial cost is of course the same under all scenarios. therefore the formula for long put option payoff is: p l per share = max ( strike price – underlying price , 0 ) – initial option price. p l = ( max ( strike price – underlying.

Comments are closed.